Crypto assets have introduced new challenges to traditional methods used to conceal the origins of illicit funds, with blockchain technology at the heart of this challenge, making every transaction visible to the public. Despite this transparency, criminals continue to creatively disguise the trail of their funds and aim to convert their illicitly obtained cryptocurrencies into fiat money without detection.

Significant Report from Chainalysis

Chainalysis’s “2024 Crypto Crime Money Laundering Report” emphasizes a notable shift in the tactics used by these individuals and reflects broader changes in the crypto financial crime landscape. This analysis not only underscores the criminals’ ability to adapt to technological advancements but also points to the ongoing battle between these illegal actors and regulatory efforts to prevent money laundering in the digital age.

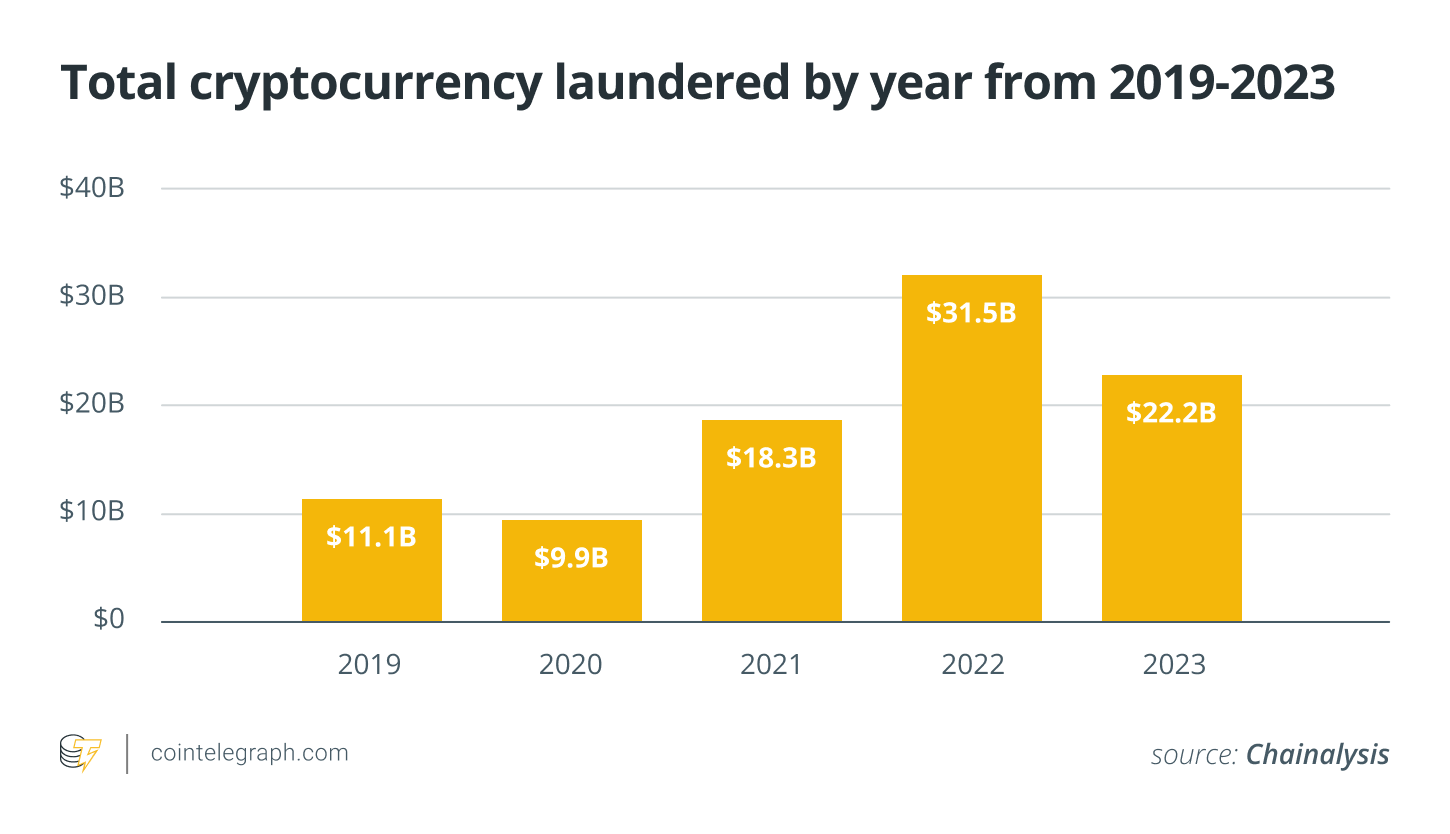

Chainalysis’s updated data reveals a significant change in crypto transactions linked to illegal activities in 2023. Illegal addresses transferred $22.2 billion in cryptocurrency to various services; this figure represents a notable decrease from the $31.5 billion in 2022. This reduction, which exceeds the overall transaction volume’s 14.9% decrease, indicates that factors beyond mere transactional slowdowns are playing a role in the decline of crypto money laundering.

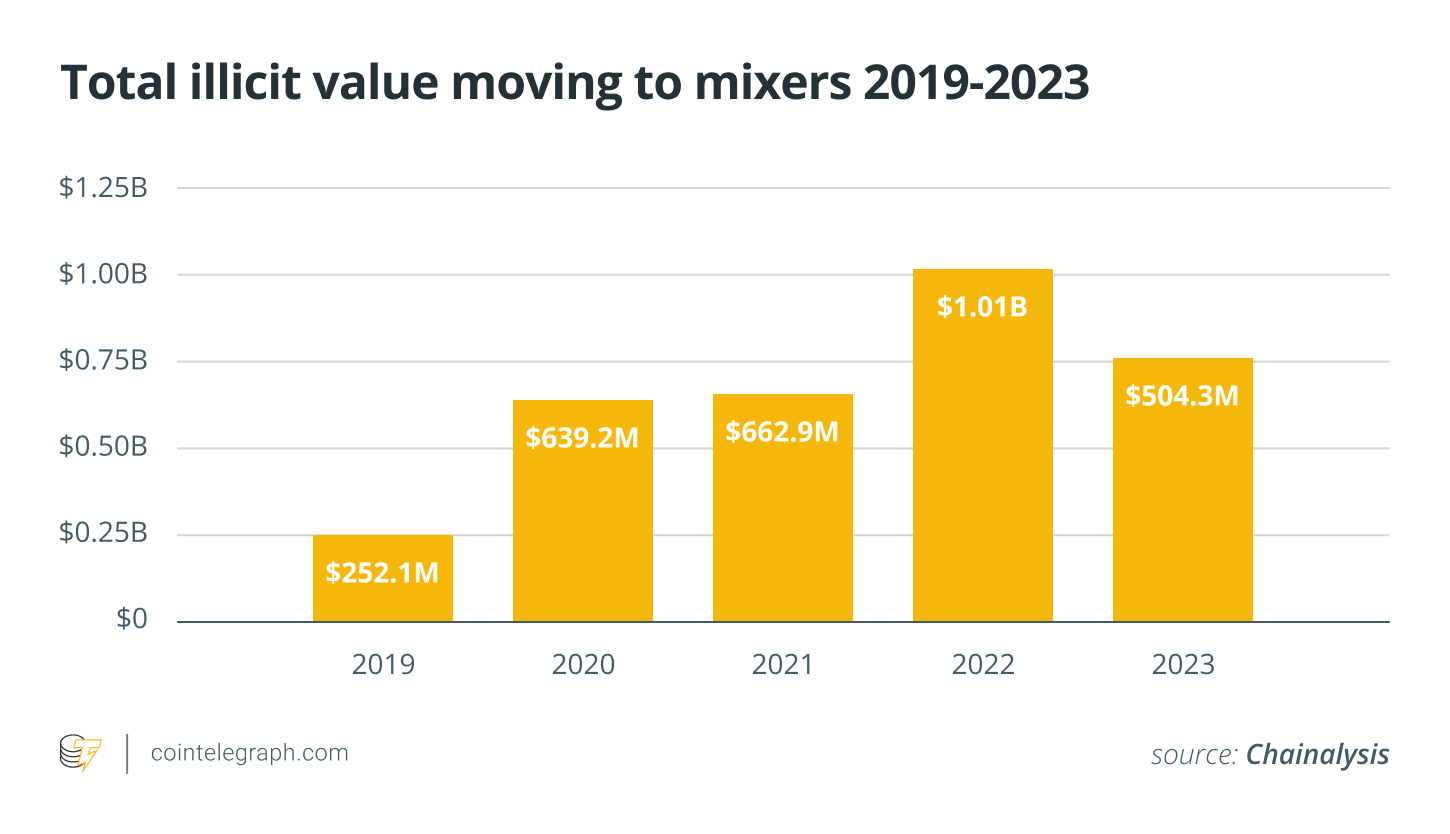

The decline in crypto money laundering can be linked to several factors, including significant impact from the aggressive pressure by US authorities on crypto mixers. These services, known for blending illegal funds to obscure their origins, continue to face increasing prosecutions, significantly reducing their activities in the laundering ecosystem.

Notable Developments in Crypto Mixer Protocols

The shutdown of Tornado Cash on August 8, 2022, marked a turning point for the crypto mixer industry and foreshadowed further actions like the shutdown of Sinbad by US authorities on November 29, 2023. These pressures significantly affected crypto launderers who relied on mixers to hide the origins of illegal funds. The Chainalysis report shows a sharp decline in funds sent from illegal addresses to mixers, dropping from $1.0 billion in 2022 to $504.3 million in 2023.

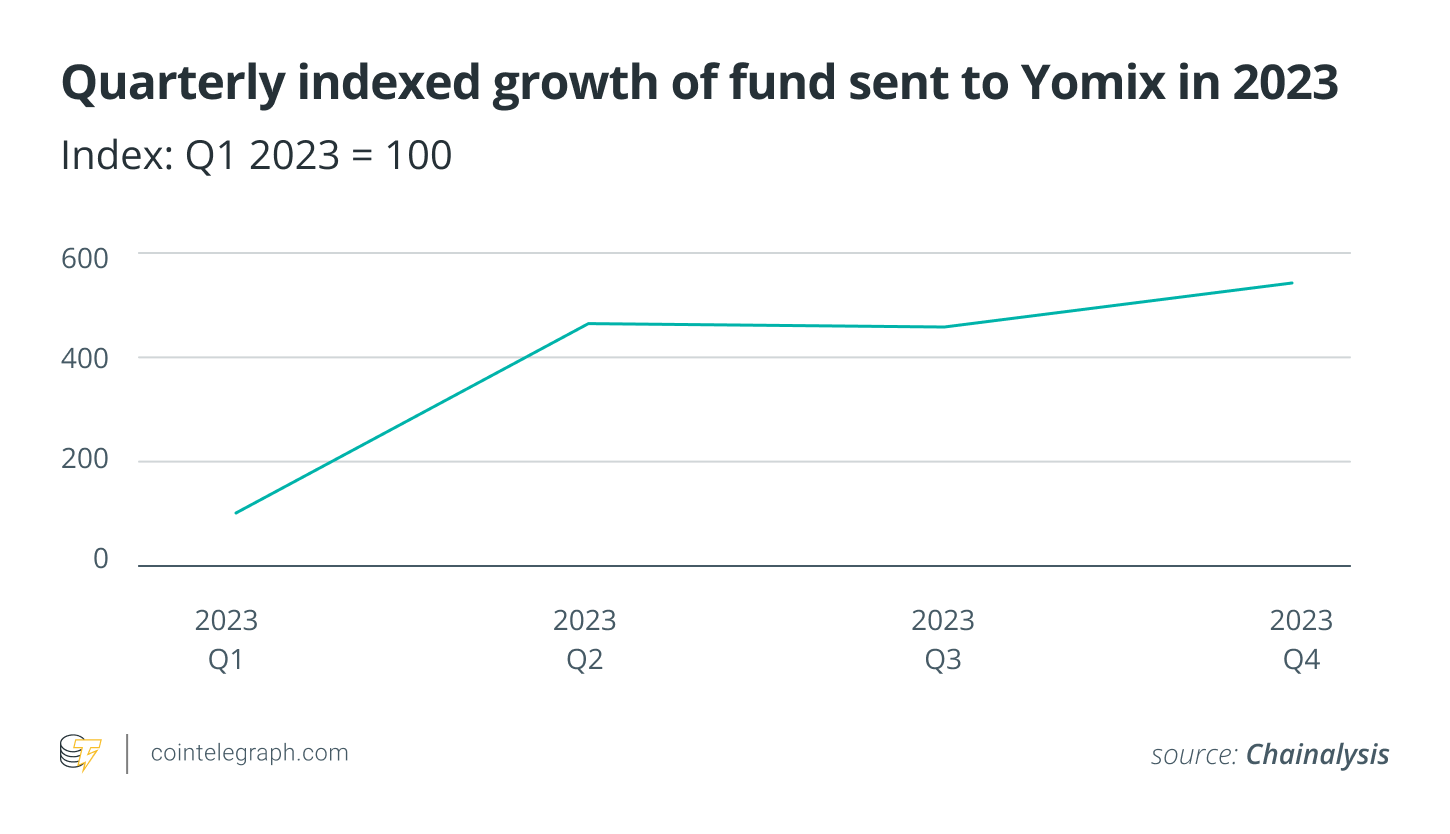

Despite US efforts to curb money laundering and the shutdown of Sinbad, the North Korean hacker group Lazarus Group has quickly adapted to these developments and continues to receive funds through YoMix since January 2024. YoMix’s activity increased fivefold throughout 2023, with approximately one-third of its inflows traceable to wallets connected to crypto hacks. This Chainalysis data underscores cybercriminals’ ongoing ability to adapt to regulatory pressures.

Despite the contraction in illegal services, Chainalysis points to a shift in the laundering landscape; an increasing portion of illicit crypto funds is now flowing into decentralized finance (DeFi) protocols. The report specifically highlights the increase in funds directed to gambling services and bridge protocols, indicating evolving strategies by those seeking to conceal the origins of illegal funds.

Türkçe

Türkçe Español

Español