Critical data for crypto investors is expected to come on Thursday, and the price of Bitcoin is preparing for increased volatility. Following the movement in the markets triggered by BlackRock’s Spot Bitcoin ETF application, sellers took control. However, at the time of writing, BTC was struggling to surpass the $30,000 level again. The price, which rose to $29,950 around 21:15, is hovering near $28,900.

Bitcoin and US Inflation Data

The S&P 500 index is trading just 6% below its all-time high reached in December 2021. Traditionally, such a situation would have been seen as a bullish sign for risky assets, including commodities and cryptocurrencies. However, this time the correlation between the BTC price and the stock market has broken.

Inflation has been seen as a positive factor that affects the price for Bitcoin and crypto investors, as indicated by the previous all-time highs of $65,000 and $69,000 reached in 2021 during the period of monetary expansion and increasing inflation. However, the current situation is different because as the US Federal Reserve (Fed) effectively reduces liquidity in the system, inflation is making a comeback. As a result, the impact of inflation on cryptocurrencies remains uncertain.

Fortinet (FTNT) with a 25.7% drop, Block Inc. (SQ) with a 20.5% drop, Paypal (PYPL) with a 15% drop, Shopify (SHOP) with a 14.8% drop, and Palo Alto Networks (PANW) with a 13.9% drop have dominated the past 7 days.

Economists predict that the Consumer Price Index (CPI) for July, which will be announced on August 10, will be around 3.3%, surpassing the previous month’s 3% figure and the Central Bank’s 2% target. Considering the unemployment rate, which approached the lowest level in 40 years at 3.5% in June, the process may not develop favorably for cryptocurrencies.

Bitcoin and Cryptocurrencies Analysis

Even assets traditionally considered safe, such as bonds, are losing their appeal due to the continued increase in US debt. It was reported that Bill Ackman, the investment king and hedge fund billionaire, made short sales on 30-year US Treasury bonds, expressing concerns about long-term inflation.

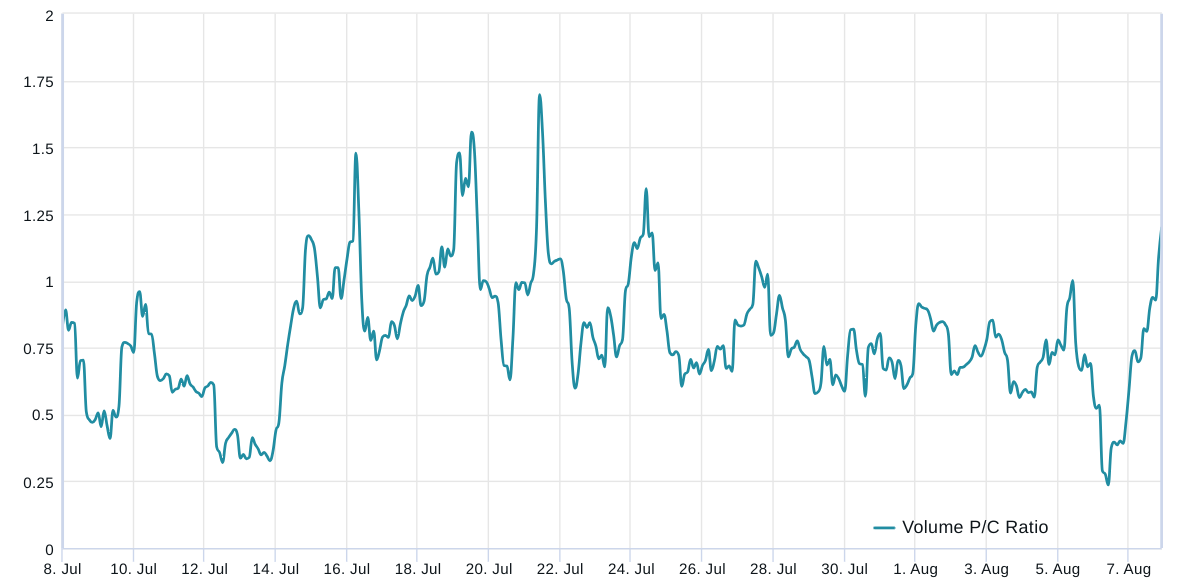

As a result, investors have started looking for alternative markets, and Bitcoin whales are focusing on futures trading instead of spot trading. Open positions saw an increase of $617 million during the recent BTC rally. The put-to-call ratio has been below 1 since July 24, indicating strong demand for call options. These data show investors’ optimism about potential price increases in Bitcoin.

Despite inflation and regulatory pressures being against cryptocurrencies, there is something that boosts optimism in futures trading. This could be due to an upcoming news release. It is noteworthy that qualified investors are increasing their positions in anticipation of a surprise ETF approval or another major development.