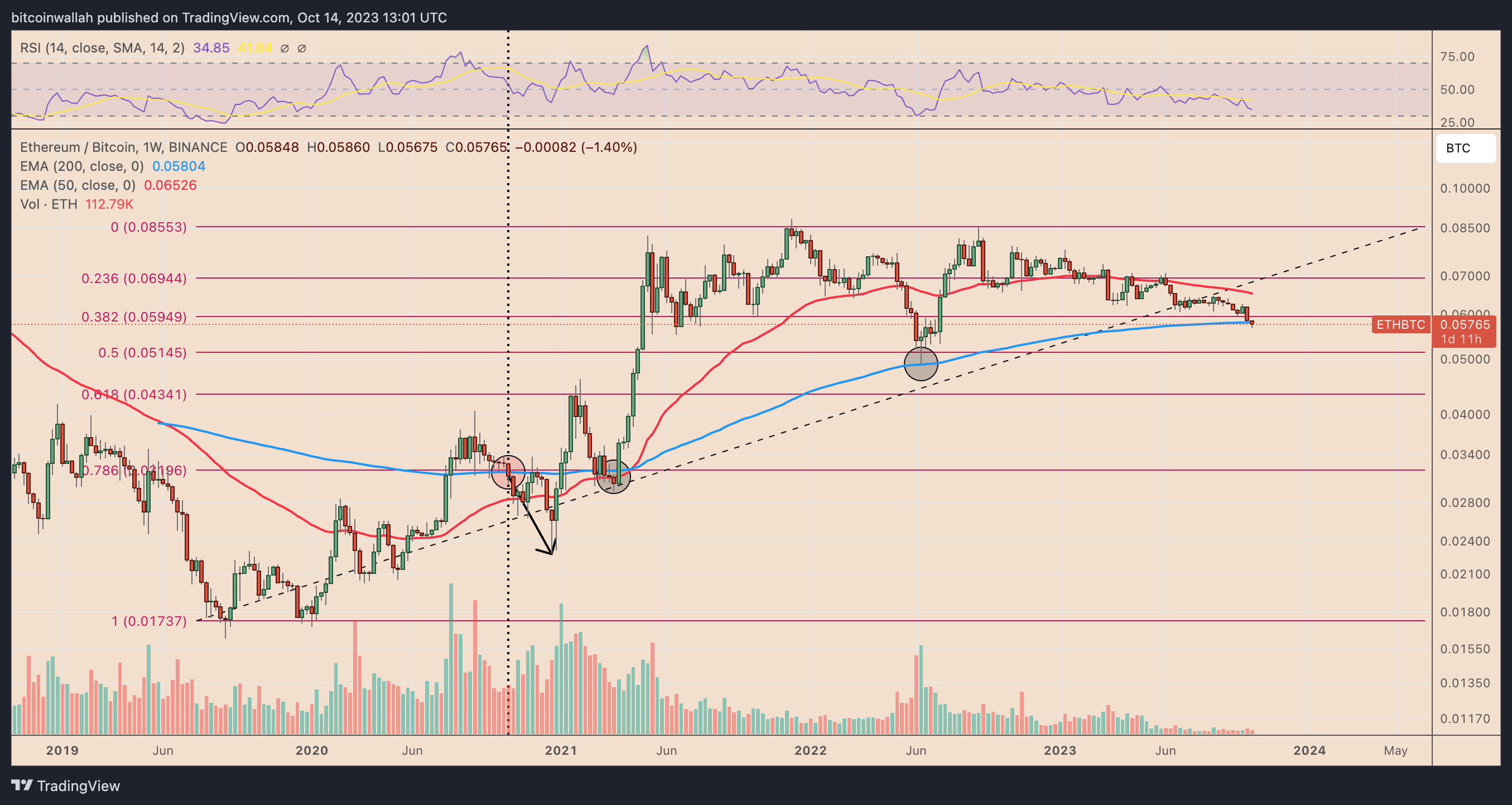

The decline in the cryptocurrency market continues under the leadership of Bitcoin. However, the depreciation of Bitcoin is causing serious risks for altcoins. Recently, a significant drop has occurred in Ethereum. The altcoin king reached its lowest level in 15 months against Bitcoin. This situation indicates the lowest level for Ethereum since its transition to proof-of-stake (PoS) with the ecosystem update.

Critical Resistance Breakout Occurred

With the decline in the ETH/BTC pair, the level of 0.056 BTC was reached this week. In addition, the pair going below the 200-week exponential moving average (200-week EMA / blue level) near 0.058 BTC further increased downward risks.

The 200-week EMA level is a reliable support level for investors following the ETH/BTC chart historically. For example, after testing this support in July 2022, there was a 75% increase within only three months. However, in October 2020, the loss of the same support led to a decrease of over 25% in the pair.

After losing the 200-week EMA level as support, the ETH/BTC pair focuses on similar selling risks in 2023. In a possible scenario, the next downward target is seen near the 0.5 Fib line around 0.051 BTC in 2023 with a decrease of approximately 9.5% from the current price level.

Alternatively, if the ETH price recovers the 200-week EMA level as support, it may rebound towards the 50-week EMA level (red level) near 0.065 BTC.

What to Expect in Bitcoin and Ethereum?

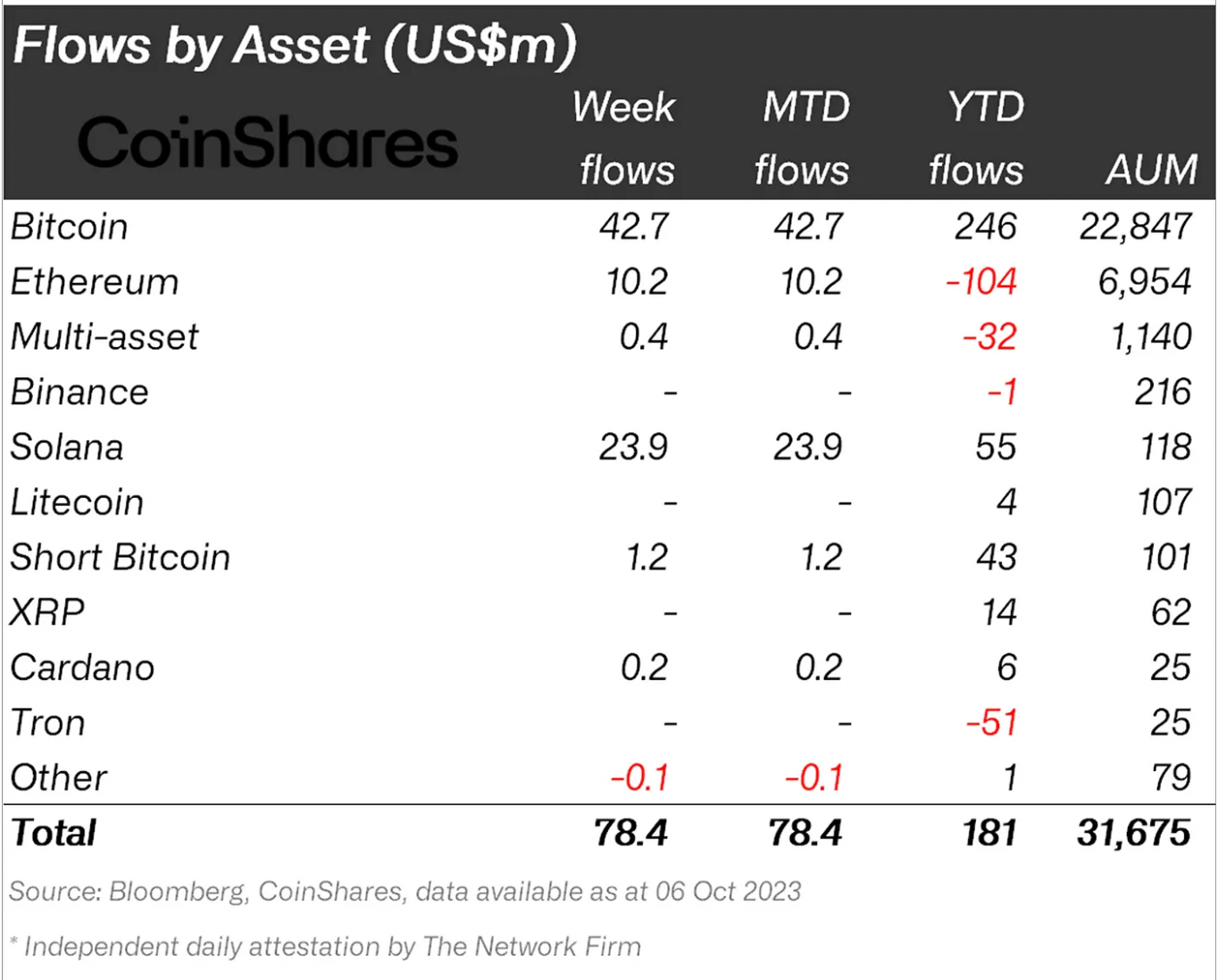

The devaluation of Ethereum against Bitcoin also reflects on institutional capital flow data. According to the data analysis platform CoinShares, as of October 6, there has been a $246 million influx in Bitcoin-specific investment funds since the beginning of the year. In the same period, Ethereum funds lost $104 million in value.

The inconsistency here is most likely due to increasing rumors about a potential Bitcoin exchange-traded fund (ETF) expected to be approved in the United States.

Analysts argue that the launch of a spot Bitcoin ETF would attract $600 billion. Additionally, Bitcoin is expected to gain value compared to the altcoin market after the fourth halving event expected to occur on April 24, 2024.