Bitcoin (BTC)  $103,435, Ethereum (ETH)

$103,435, Ethereum (ETH)  $2,523, and the broader cryptocurrency market continue to exhibit high volatility as they respond to macroeconomic developments. Recently, two significant pieces of data were released from the United States, following the Consumer Price Index (CPI) figures that fueled market rises. Today, the focus shifted to the Producer Price Index (PPI) and Claims for Unemployment Insurance, both of which have just been disclosed.

$2,523, and the broader cryptocurrency market continue to exhibit high volatility as they respond to macroeconomic developments. Recently, two significant pieces of data were released from the United States, following the Consumer Price Index (CPI) figures that fueled market rises. Today, the focus shifted to the Producer Price Index (PPI) and Claims for Unemployment Insurance, both of which have just been disclosed.

PPI Data Surprises Analysts

According to the U.S. Bureau of Labor Statistics, the month-to-month PPI data for August recorded a rise of 0.2%, exceeding the anticipated increase of 0.1%. Year-on-year, the PPI was revealed to be at 1.7%, slightly below the expected 1.8%.

The core PPI, which excludes food and energy costs, showed a month-to-month increase of 0.3% and a year-on-year increase of 2.4%, surpassing expectations of 0.2% and 2.5%, respectively.

Unemployment Claims Exceed Predictions

On another front, the Unemployment Claims data, a crucial indicator for assessing the U.S. labor market, also surprised analysts by exceeding expectations. While analysts anticipated 227,000 new claims, the actual figure reported was 230,000.

Additionally, the Continuing Unemployment Insurance Claims were recorded at 1.85 million, matching the predicted figure of 1.85 million.

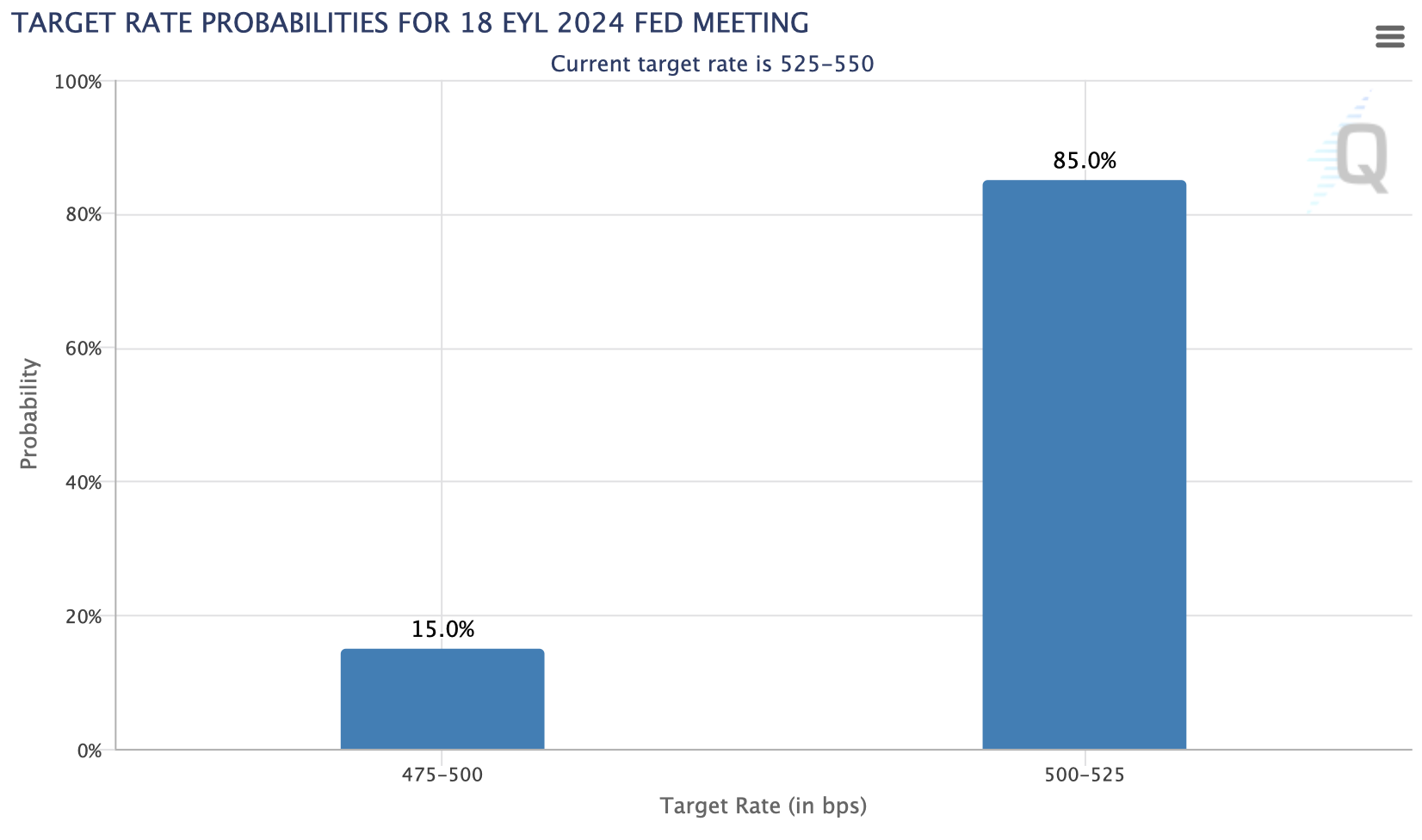

Following the release of this data, expectations for a Federal Reserve interest rate cut remained unchanged. According to the CME FedWatch tool, the likelihood of a 25 basis point cut on September 18 stands at 85%, with a 15% chance for a 50 basis point reduction. The market is anticipated to continue adjusting these probabilities as it digests the details of the data.

In response to the data, BTC initially reacted negatively, with the largest cryptocurrency trading at $57,945 at the time of writing.

Türkçe

Türkçe Español

Español