After a tough start to the week, cryptocurrencies are rebounding as Bitcoin  $90,533 touches $94,000 again. Despite this optimistic surge, Bitcoin is yet to close above $94,000 in the short term, making it difficult to assert a definitive upward trend. Today, we explore the 8 major developments from the last 24 hours and examine 3 significant charts influencing the crypto market.

$90,533 touches $94,000 again. Despite this optimistic surge, Bitcoin is yet to close above $94,000 in the short term, making it difficult to assert a definitive upward trend. Today, we explore the 8 major developments from the last 24 hours and examine 3 significant charts influencing the crypto market.

Major Crypto Developments

Recently, PNC Bank announced permission for eligible customers to trade Bitcoin via Coinbase. The day was eventful in the news sphere; despite disappointing JOLTS data, Bitcoin rose, leading many investors to worry this might be a false breakout. Their concerns are justified, considering the market’s similar behavior repeatedly over the past two months.

To summarize the 8 major developments:

- Trump approved the sale of Nvidia’s H200 chips to China, with similar concessions expected for AMD and Intel. In exchange, the US will claim 25% of the revenue. Meanwhile, China plans to impose an embargo to encourage domestic production, as Blackwell remains excluded from the deal.

- BlackRock filed for a Staked ETH ETF. This is their second ETH ETF following ETHA, offering investors yield from staking in addition to potential ETH price appreciation.

- Circle received the ADGM Money Services Provider license.

- Executives from Bank of America, Wells Fargo, and Citi are meeting US senators on Thursday to discuss crypto regulation.

- Standard Chartered expects the Fed to cut interest rates by 25 basis points on Wednesday, echoing BofA’s similar predictions. However, future rate cut expectations are downgraded for 2026.

- US gas prices fell to $2.95, the lowest in four years, with Trump praising the benefit on inflation and creating room for rate cuts in a recent Politico interview.

- The SEC announced a Financial Oversight and Privacy roundtable on December 15, featuring participants like Zcash, StarkWare, Aleo, and ACLU. Regulation respecting privacy needs could significantly boost privacy altcoins.

- Hyperliquid Strategies Inc. announced a $30 million buyback program.

Significant Cryptocurrency Charts

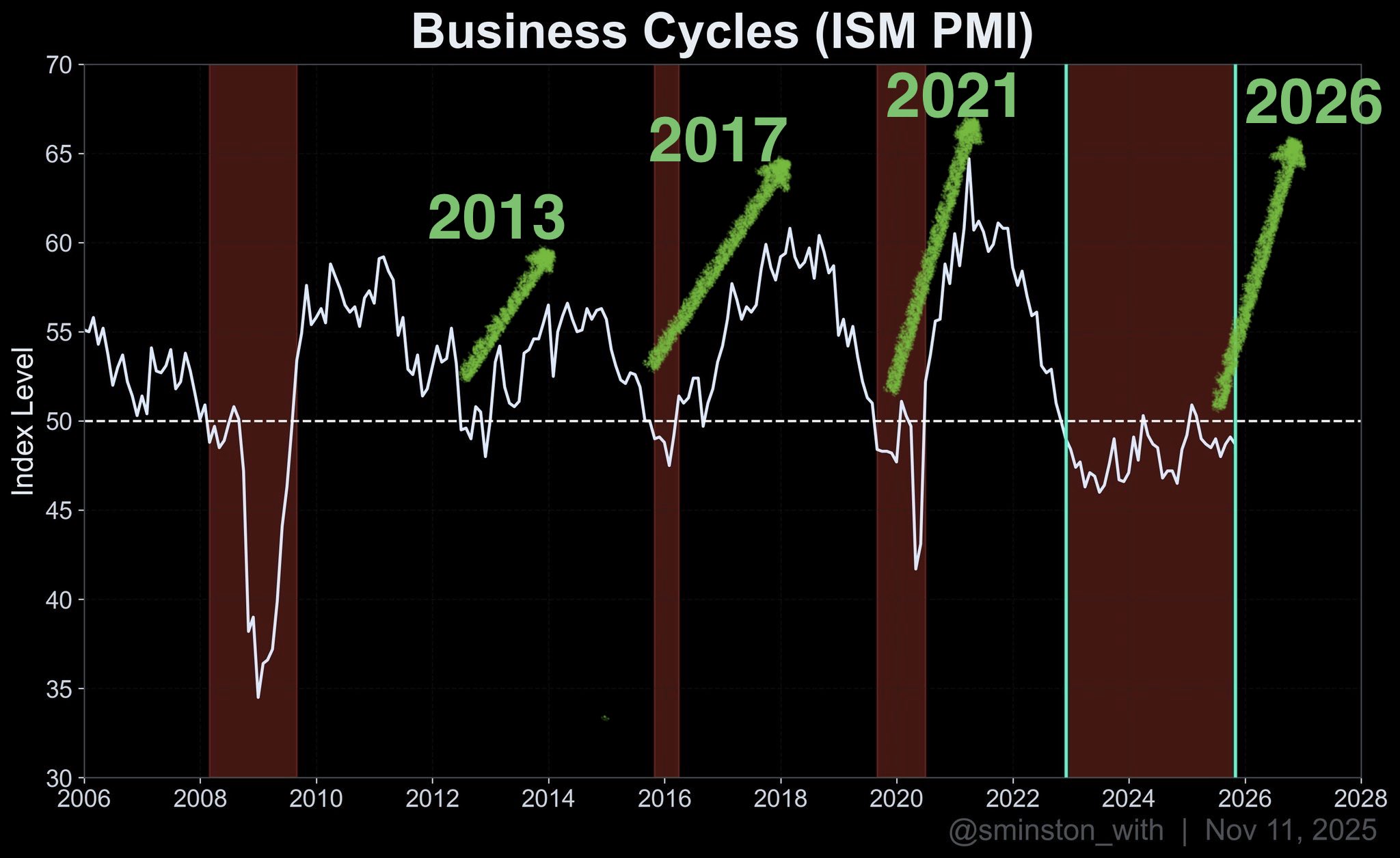

Some claim the four-year cycle narrative is obsolete. However, Quinten argues otherwise, emphasizing its continued alignment with business and liquidity cycles. Supported by a chart, he suggests we’re not nearing the peak. A crypto bear market amidst rate cuts seems unlikely, with even CZ discussing a super cycle by 2026.

Poppe shared a chart indicating increased risk appetite as Bitcoin closes above $92,000. If $92,000 holds as support on Fed’s decision evening, his scenario points towards $100,000.

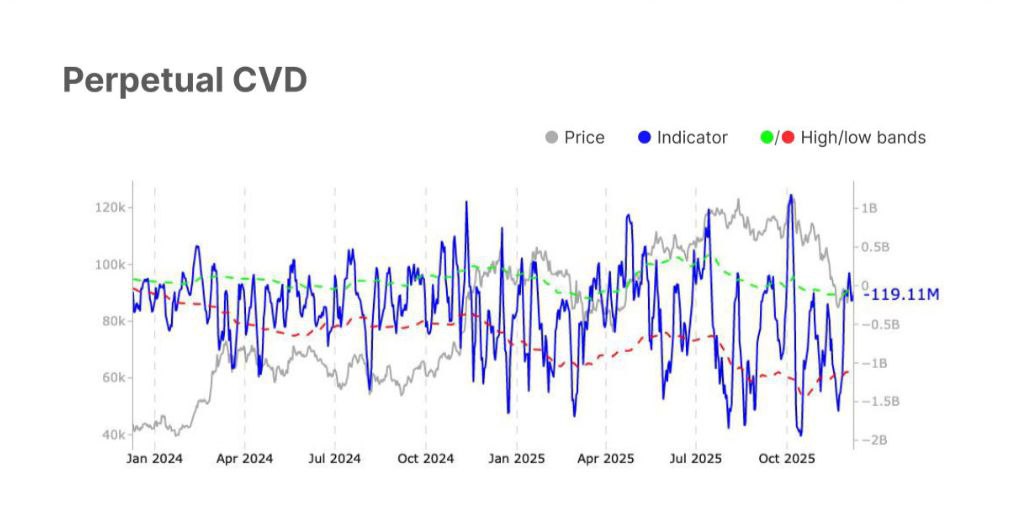

Kyle focuses on the Perpetual CVD change, indicating buyers’ resurgence. If sustained, this could signify an ongoing uptrend.

“-After dropping to -$139.3 million, it rebounded to +$119.1 million, indicating reduced selling pressure and buyers re-engaging. This suggests more of a balanced futures environment than a trend reversal. Constructive…but not yet a breakout signal.”