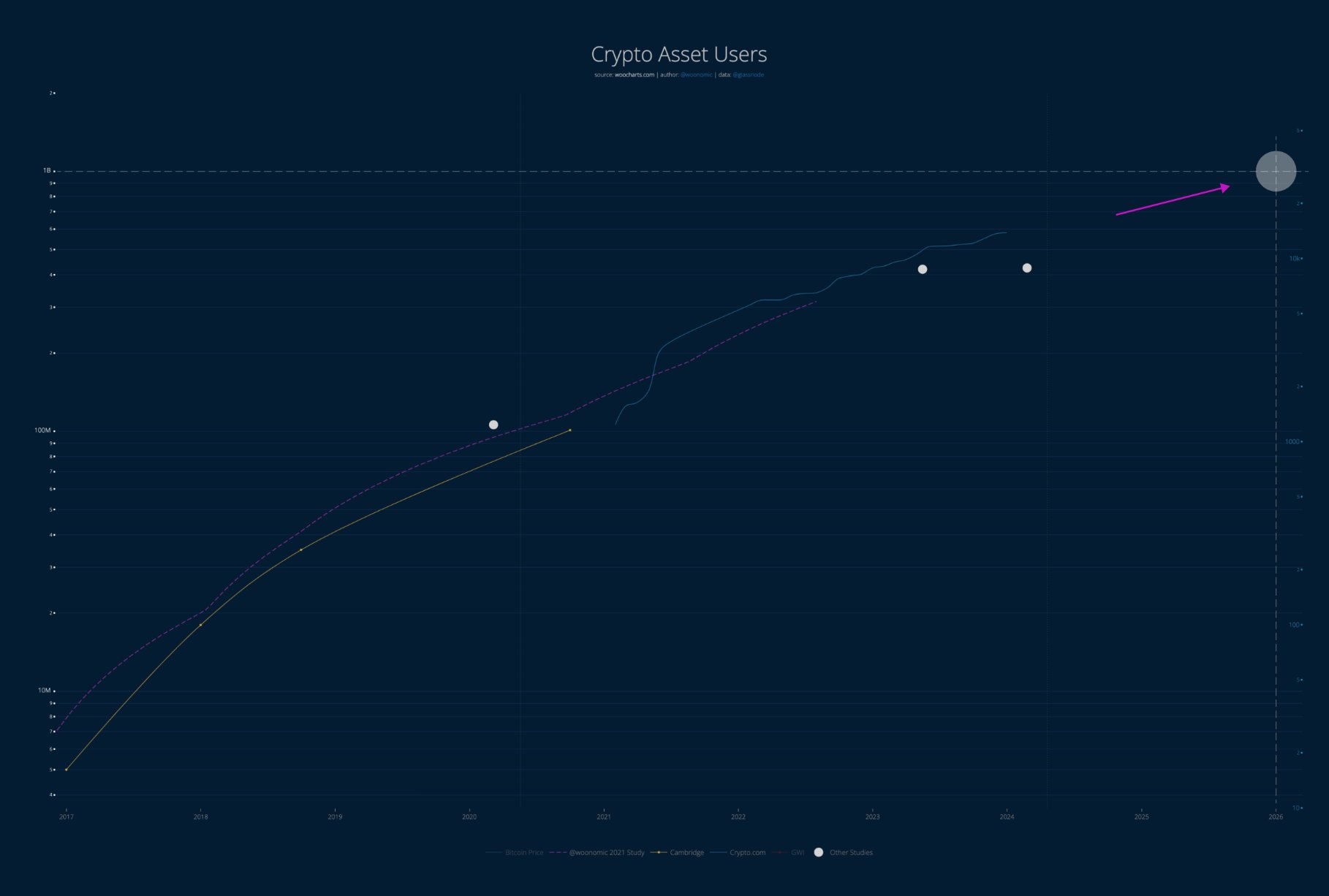

Bitcoin analyst Willy Woo believes the cryptocurrency sector could reach its first billion users by the end of 2025. Woo made a notable post on April 29 on X, sharing data from an independent study with his followers. According to the famous figure, 65% of one billion crypto users could own Bitcoin.

Famous Analyst Predicts One Billion Users

Bitcoin ESG Forecast‘s investor and author Daniel Batten considers Woo’s chart the first comprehensive model aimed at mapping all current crypto asset users and predicting the first billion adopters. Batten responded to Woo on X with the following statement:

“An incredible chart. The first view we have of when we might cross the one billion threshold with full traceability.”

The chart defines crypto users as unique individuals who have completed Know Your Customer (KYC) verification and have previously transacted on the blockchain. Reaching the first billion crypto users has long been touted as a significant milestone in mainstream cryptocurrency adoption. Mainstream adopters could bring a new influx of capital, crucial for the appreciation of crypto asset prices.

Key Details on the Subject

According to a report published by the Crypto com team in January 2024, the number of cryptocurrency owners increased by 34% in 2023, reaching 580 million. Bitcoin owners increased by 33% from 222 million in January to 296 million in December 2023, making up 51% of global crypto owners.

The report states that developments around Bitcoin exchange-traded funds were a major factor behind user growth. However, the current 580 million users need a 72% increase to reach the first billion, which seems unlikely given last year’s growth rate.

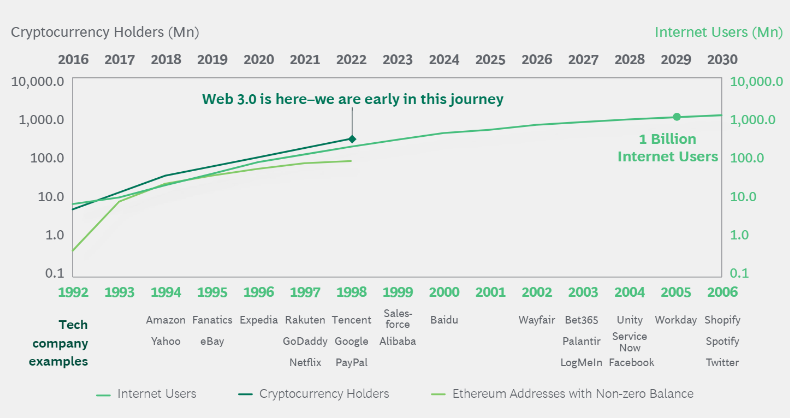

The world’s largest management consulting firm, Boston Consulting Group, in a joint report with Bitget and Foresight Ventures dated 2022, predicts reaching the first billion crypto users by 2030. The report compares the current crypto adoption rate to the internet’s adoption curve, using current cryptocurrency owners and Ethereum addresses with non-zero balances.

According to BCG, crypto adoption is still low, and there is plenty of room to grow. The consulting giant estimates that only 0.3% of individual wealth is invested in cryptocurrencies, compared to 25% in global stocks.

Türkçe

Türkçe Español

Español