Noted crypto analyst Benjamin Cowen has issued an unconventional warning for the cryptocurrency market during its bull phase, suggesting that Ethereum (ETH) could experience a sharp decline. Cowen believes that ETH is poised to retest its long-term trend indicator prior to initiating a new bull market run.

Cowen Projects a Target of $875 for ETH in the Most Likely Scenario

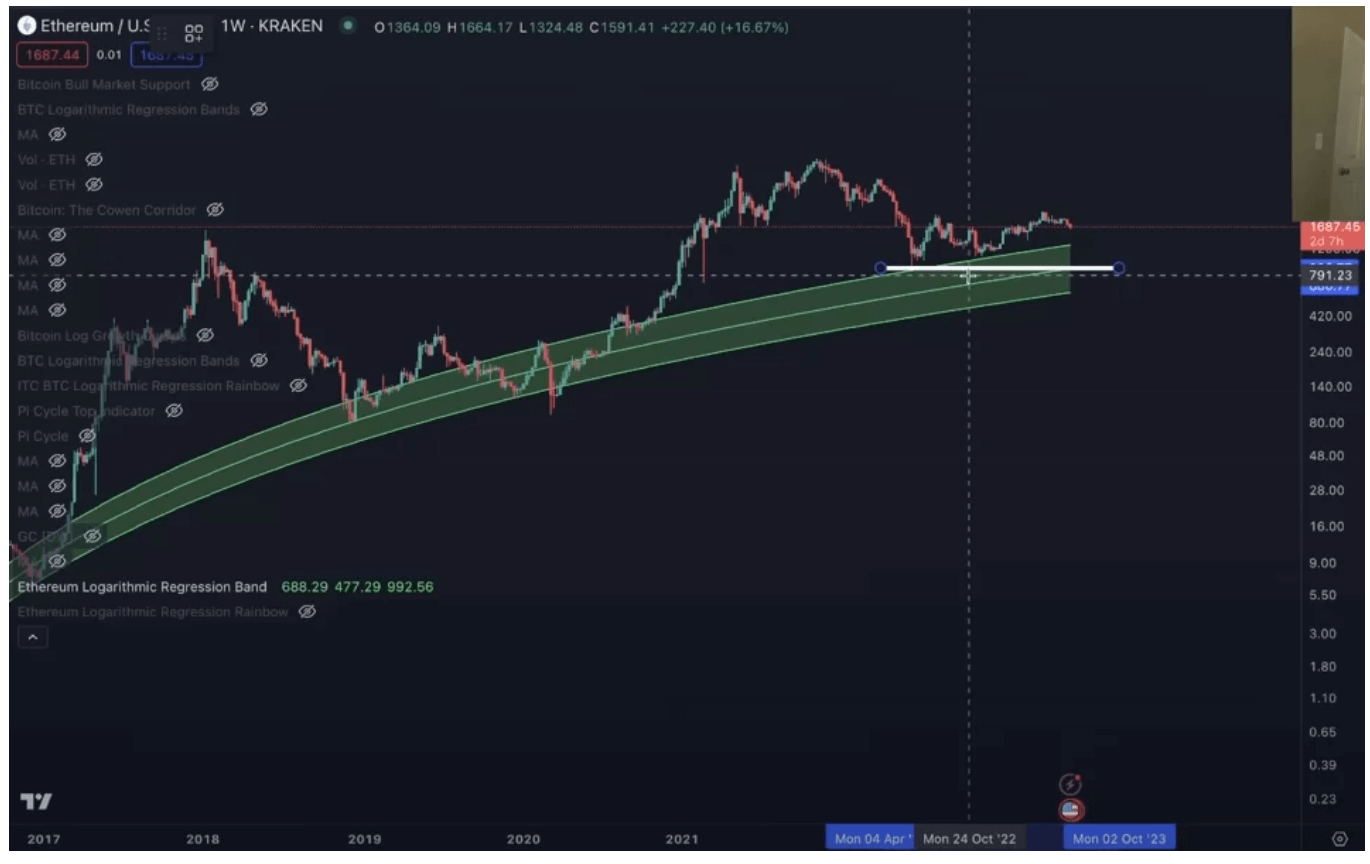

In a recent strategy session, famed crypto analyst Benjamin Cowen highlighted that since 2017, Ethereum has followed its fair value logarithmic regression band, which has served as a support. Cowen asserts that the logarithmic regression band is designed to track the fair value of an asset, using non-bubble data.

Under a positive scenario, Cowen proposes that Ethereum could retest the upper boundary of its trend indicator. This retest coincides with the lowest point of ETH’s bear market, around the $875 mark. Cowen explained:

What’s interesting is that the fair value of Ethereum, based on the fit to its non-bubble data, is $875, and the previous low was $880. So they’re actually the same. If Ethereum reverts to its previous low, it means it’s returning to where it belongs. We discussed this a year ago, saying ‘Look guys, I think we’re either going to drop to the regression band, or move sideways until we catch up to it.’ If it drops now, and reverts to where we called home in the past, this would essentially be revisiting the previous low.

Final Target of $400 for Ethereum in the Worst-case Scenario

In the worst-case scenario, Cowen adds that ETH could trade briefly below the logarithmic regression trend line, similar to the events of March 2020. He added, “This doesn’t mean it won’t fall below that level. As you can see, we went entirely below the regression band in March 2020 and dropped approximately 34% below the band during that collapse. If a similar drop happens again, that is, if we go 34% below this level, that would correspond to an Ethereum price of around $400, which is why I had previously thrown out this number as a potential outcome in a worst-case scenario.”

At the time of this article’s preparation, ETH is trading at approximately $1,813, which is about 78% above the $400 level that the analyst marked as the worst-case scenario.