There are many popular crypto analysts worldwide, and their predictions are followed by hundreds of thousands of investors. One of the world-renowned crypto experts is known by the username EfloudTheSurfer. The expert, who rarely shares market evaluations through their X account, did not miss this recent drop.

Crypto Analyst’s Latest Bitcoin Analysis

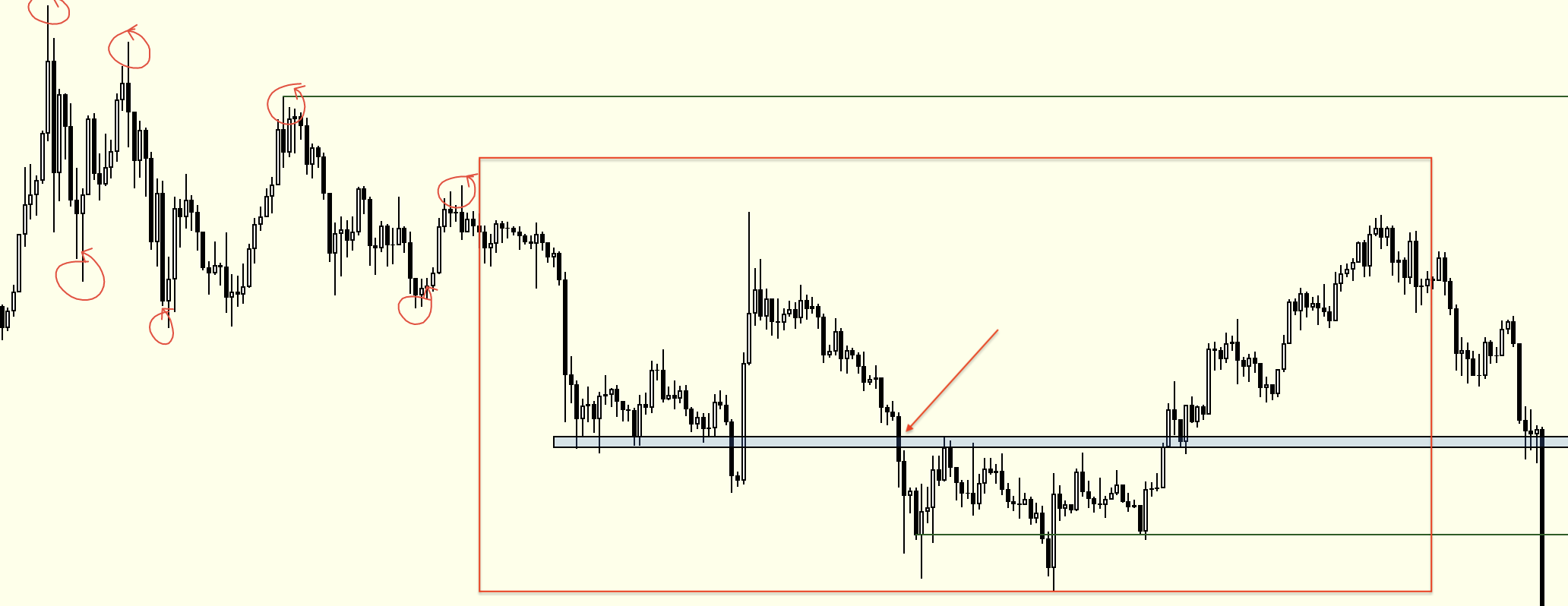

At the time of writing, the BTC price stands at $26,300, and the influx of Bitcoin (BTC) to exchanges throughout the day has paid off for the bears. Despite Grayscale’s victory, investors who saw the short-term rally as an opportunity for profit-taking sent the price back to where it started. So, what will happen next? EfloudTheSurfer recently shared the following graph regarding the recent drop and said;

“The price has reached its daily imbalance, which is actually an indicator of weakness. If the price fails to rise above the blue lines again, I will follow a structure similar to the fractal you see in the second graph.”

The second graph is shown below;

“Although it does not resemble the fractal by 100%, I believe similar content is being built based on Fundamental Analysis and Price Action. I think we could be in the red arrowed position in the second graph right now (IF the daily imbalance does not work).”

The Current State of Crypto

The court decision that came on Tuesday was better than expected. In fact, we witnessed a decision that put the SEC in a tight spot in terms of details. While the regulatory agency approved Futures ETF, it couldn’t explain why it didn’t approve Spot ETF. Gensler and his team claimed that this contradiction was due to the volatility of BTC’s price and the risks of fraud. However, since both the futures and spot ETFs are indexed to the same BTC price, they couldn’t prove otherwise.

Now, at this stage, the SEC will need to find different excuses for rejecting ETFs. Since the new excuses should not contradict the approval of futures ETFs, the task becomes extremely challenging. In the short term, sellers’ motivation comes from their belief that ETF approval will not happen this year. Moreover, they predict that macro data to be announced in the coming hours will shake the market. On the other hand, the lack of return of buyers and the failure of BTC’s price to stay above $28,000 supported this price drop.

In conclusion, although the downturn continues in the short term, as we approach 2024, investors may enter the halving mode. Moreover, there is a potential coincidence of the expiration of ETF approvals in March with the start of interest rate cuts in the second quarter.