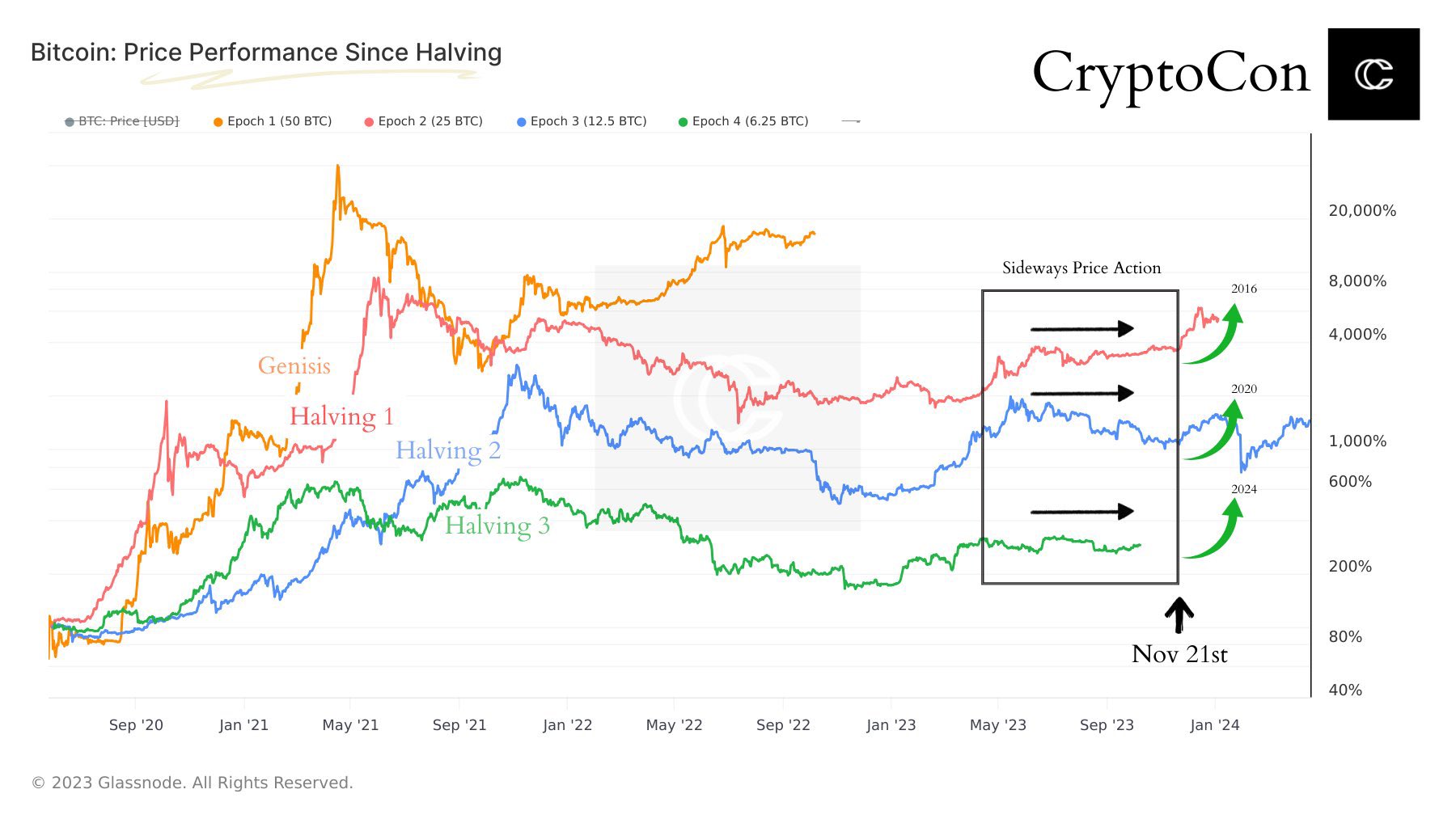

Crypto analysts highly value past price movements and believe that these patterns tend to repeat. The reason behind this is psychological, just like in technical analysis. The more investors follow the same pattern and take positions, the higher the probability of these patterns repeating in the future.

Crypto Predictions for November

Crypto market analysts seem hopeful for November after a prolonged period of sideways movement. Although it may sound amusing considering the expectations for October, historical patterns cannot always be violated. Moreover, October has so far helped support the crucial BTC level of 27,200.

Crypto analyst Miles Deutscher referred to a chart from CryptoCon on October 10, pointing out the resemblance of the current chart to previous cycles. If we are to witness a repetition, we may expect an early rise in cryptocurrencies similar to November before the halving.

“This chart represents the typical sideways price movement that occurred between Q2 and Q4 in previous halving years.”

He also added that November 21 historically marks an important pivot point for Bitcoin‘s price, as it starts to rise towards the next block reward halving.

Historical Data for Cryptocurrencies

The price of Bitcoin initiated a compelling sideways movement accompanied by declining volumes in March. In fact, we have witnessed BTC trading in a narrow range for two quarters. In mid-2015, the price of BTC started to rise around November after remaining sideways for six months. Similarly, in 2019, the markets spent a significant portion of the year in a sideways trend before the year-end rally.

Crypto expert known as Mags also made a similar observation, stating that the current BTC value is approximately 60% below the all-time high level planned for the halving, similar to 2015 and 2019.

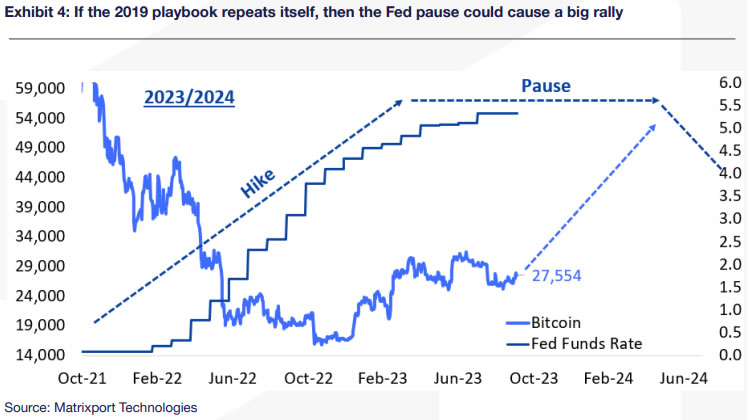

Another analyst, Galaxy Trading, believes that a new bottom may be observed around November 10-15, followed by an upward trend. Markus Thielen, the research director at Matrixport, stated in a recent report that the price of Bitcoin could rise until 2024, although for different reasons.

“The most critical macroeconomic factor at the moment seems to resemble the situation in 2019, when the Fed stopped raising interest rates, leading to a significant increase in Bitcoin prices.”

However, under current circumstances, it seems unlikely that the Fed will lower interest rates, which would be a surprising move.

Türkçe

Türkçe Español

Español