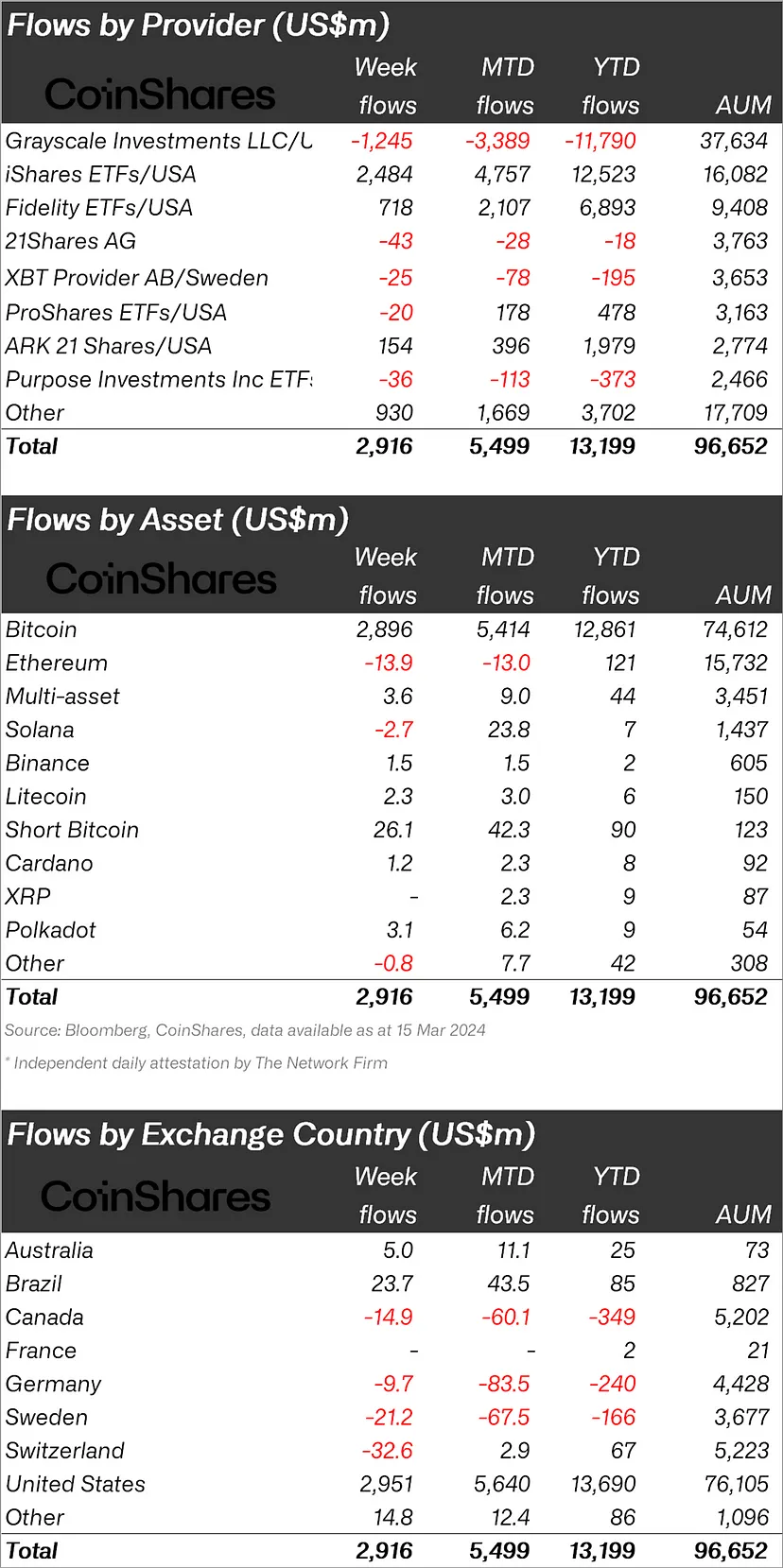

Crypto asset investment products have reached a new peak, surpassing the records set in recent weeks. Last week, they recorded a record weekly inflow of over $2.7 billion, reaching $2.9 billion. This week’s inflows have increased the year-to-date total to $13.2 billion, already surpassing the entire 2021 inflow of $10.6 billion.

Transaction Volumes Focus on Bitcoin

Transaction volumes maintained their record levels from the previous week, reaching $43 billion, which constituted 47% of the total global Bitcoin volume. However, following a price correction over the weekend, the total value of global ETPs fell to $97 billion.

Regionally, the United States saw inflows of $2.95 billion, while other regions experienced smaller outflows. Nevertheless, countries like Canada, Germany, Sweden, and Switzerland observed a total outflow of $78 million last week.

Bitcoin alone accounted for $2.86 billion of inflows last week, representing 97% of all inflows since the beginning of the year. Additionally, short-focused Bitcoin transactions saw the largest inflow of the year for the fifth consecutive week, totaling $26 million.

Ethereum, Solana, Polygon, and Others

Altcoins such as Ethereum, Solana, and Polygon experienced outflows of $14 million, $2.7 million, and $6.8 million, respectively, last week. On the other hand, inflows were noticeable for Litecoin and Cardano. Blockchain-focused stocks, after six weeks of outflows, recorded an inflow of $19 million.

The dynamic activity in the digital asset markets continues to attract investor attention and is expected to keep growing in the future.

Türkçe

Türkçe Español

Español