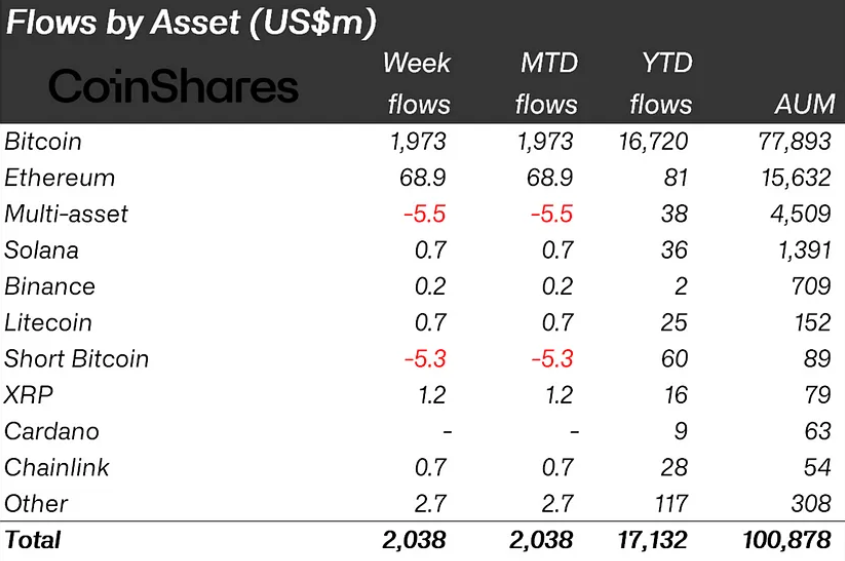

Crypto-based investment products saw a significant inflow of $2 billion in the first week of June. This inflow contributed to a five-week total inflow reaching $4.3 billion. This week also saw a significant increase in the trading volumes of exchange-traded products (ETPs), with the figure reaching $12.8 billion, a 55% increase from the previous week.

Bitcoin Becomes the King of Inflows

Bitcoin was the main focus of these inflows with $1.97 billion. This overshadowed other cryptocurrencies, showing continued strong interest and investment in Bitcoin. Ethereum also had a notable week, achieving its highest inflow since March with $69 million, likely linked to the unexpected decision by the U.S. Securities and Exchange Commission (SEC) to allow spot Ethereum ETFs.

The recent inflows marked a deviation from the outflow trend observed among established market players and were broadly distributed among different providers. This shift in sentiment could be attributed to weaker-than-expected macroeconomic data in the United States. This situation has recently led to increased expectations of interest rate cuts in monetary policy. The positive market sentiment resulted in total assets under management (AuM) surpassing the $100 billion mark for the first time since March.

Regional Situation and Altcoins

Regionally, the United States dominated the market with $1.98 billion in inflows just last week. Notably, the first day of the week recorded the third-largest daily inflow on record. The iShares Bitcoin ETF emerged as a significant player, surpassing Grayscale with $21 billion in total assets under management.

While Bitcoin continued to attract most investments, short-based Bitcoin products saw outflows of $5.3 million for the third consecutive week. This indicated increased confidence among investors in Bitcoin’s potential for growth.

In addition to Bitcoin and Ethereum, altcoins like Fantom and XRP also saw some activity with inflows of $1.4 million and $1.2 million, respectively. Although these figures are modest compared to Bitcoin and Ethereum, they indicate a diverse interest in various cryptocurrencies.

Türkçe

Türkçe Español

Español