Cryptocurrency world’s last two years of incidents necessitate a rethinking of dangerous trends in the industry. Emin Gün Sirer’s recent statements carry a critical warning. In particular, the SBF scandal brings to light many issues that should be questioned before assuming the innocence of crypto projects and their leaders.

Emin Gün Sirer Points to a Dangerous Situation

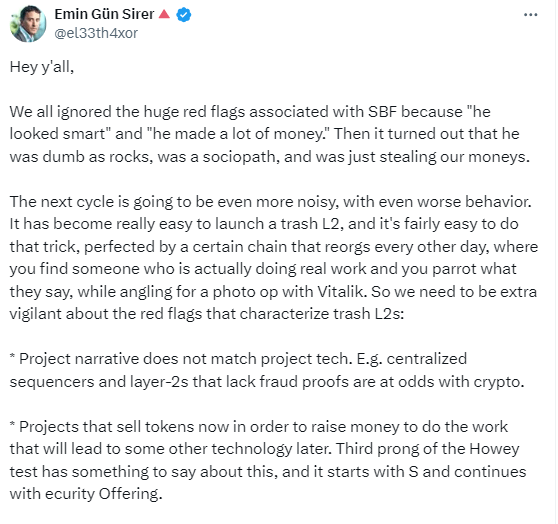

SBF was seen as one of the popular figures in the crypto world. However, as Emin Gün Sirer emphasizes, appearances can be deceiving. SBF’s true intentions and activities point to numerous dangers that worry the crypto community.

Firstly, Emin Gün Sirer points out the mismatch between project narratives and their technologies. Centralized sequencers and the lack of fraud proofs in Layer-2s contradict crypto ideals. Are such projects truly operational, or are they merely selling hot air?

Moreover, it’s concerning that projects currently selling tokens may be operating to gather funds for a switch to another technology in the future. Such practices could be contrary to legal regulations and put investors at serious risk.

The issue of founders dumping their personal tokens before a launch is also critical. According to Sirer, it’s important for team members’ holdings to be locked and managed transparently. Otherwise, investor trust could be undermined, and crypto projects could lose their reputation.

Token value depression and manipulation are also worrying. Some actors may serve their own interests by playing games with low-value tokens and borrowing against them. Such manipulations could threaten market integrity. Lastly, founders complaining about personal pleasures could be an ethical discussion point. This could also indicate a lack of seriousness in project management.

Ways to Prevent Such Corruption

According to Emin Gün Sirer, there’s a simple test to cut through the noise and identify what’s truly important. Recently, scalability and performance issues were among the prominent problems in the crypto world. Sirer notes that platforms like Avalanche and Solana have emerged to address these issues. However, Sirer emphasizes that these solutions should focus on a broader scope of usability rather than just specific use cases.

Sirer questions whether crypto projects truly bring a game-changing approach to addressing prominent issues. For a project to be truly significant, its owners need to be in a unique position to solve these problems and clearly demonstrate this.

However, with Sirer’s warning, many projects in the crypto world can easily emerge that could be considered trash. Sirer points out that a new group of people is lining up to fill the void left by prominent figure Sam Bankman-Fried (SBF), which could affect developments in the industry.

Türkçe

Türkçe Español

Español