The closing of September ended at $26,692, and the price increased by about 4% in the past month. Now, according to historical data, October, which looks promising, has begun. Volumes have been weak for about 5 months, and macro developments have not been in favor of cryptocurrencies. So what’s next?

Important Developments of the Week for Crypto Currencies

Crypto markets continue to have unpleasant days in the midst of a 5-month volumeless period. The nickname “Uptober” among crypto investors is due to the historical performance of October, but historical data alone does not mean anything. While September is historically a bearish month, the monthly candle closed green in the middle of the bear market. So we may also encounter an “OctoBear”.

So what developments will be of interest to crypto investors in the next 7 days?

October 2, Monday

- China Official Holiday (Throughout the Week)

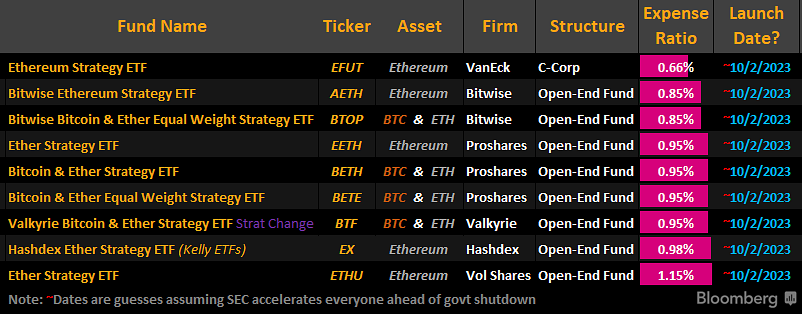

- 9 Futures ETF to Start Trading (ETH, BTC+ETH Equal Weight ETFs)

- 16:45 US Manufacturing PMI (Expectation: 48.9 Previous: 47.9)

- 17:00 US ISM PMI (Expectation: 47.8 Previous: 47.6)

- 18:00 Fed/Harker

- 20:00 Fed/Barr

- 20:30 Fed/Williams

October 3, Tuesday

- 02:30 Fed/Mester Speech

- 17:00 US JOLTS (Expectation: 8.883M Previous: 8.827M)

- SUI Public Sale (16.25 Million $)

- DYDX Public Sale (4.25 Million $)

October 4, Wednesday

- 15:15 US ADP Non-Farm Employment Change (Expectation: 155K Previous: 177K)

- 16:45 US Services PMI (Expectation: 50.2 Previous: 50.5)

October 5, Thursday

- 15:30 US Initial Jobless Claims (Previous: 204K)

- 16:00 Fed/Mester Speech

- 19:00 Fed/Daly

- 19:15 Fed/Barr

- ETHMilan Event

October 6, Friday

- 15:30 US Average Hourly Earnings (Expectation: 0.3% Previous: 0.2%)

- US Non-Farm Payrolls (Expectation: 163K Previous: 187K)

- US Unemployment Rate (Expectation: 3.7% Previous: 3.8%)

Crypto Currency Comments

Important PMI data that will provide signals about the current state of the US economy will be published on Monday. Fed members will make statements about the current state of the economy. China will have a holiday throughout the week, and the 9 futures crypto ETF will likely start trading on Monday.

Friday is the most important day of the week, and wage growth should slow down. The employment sector continues to remain strong, and overly strong data will be in favor of cryptocurrencies.

Türkçe

Türkçe Español

Español