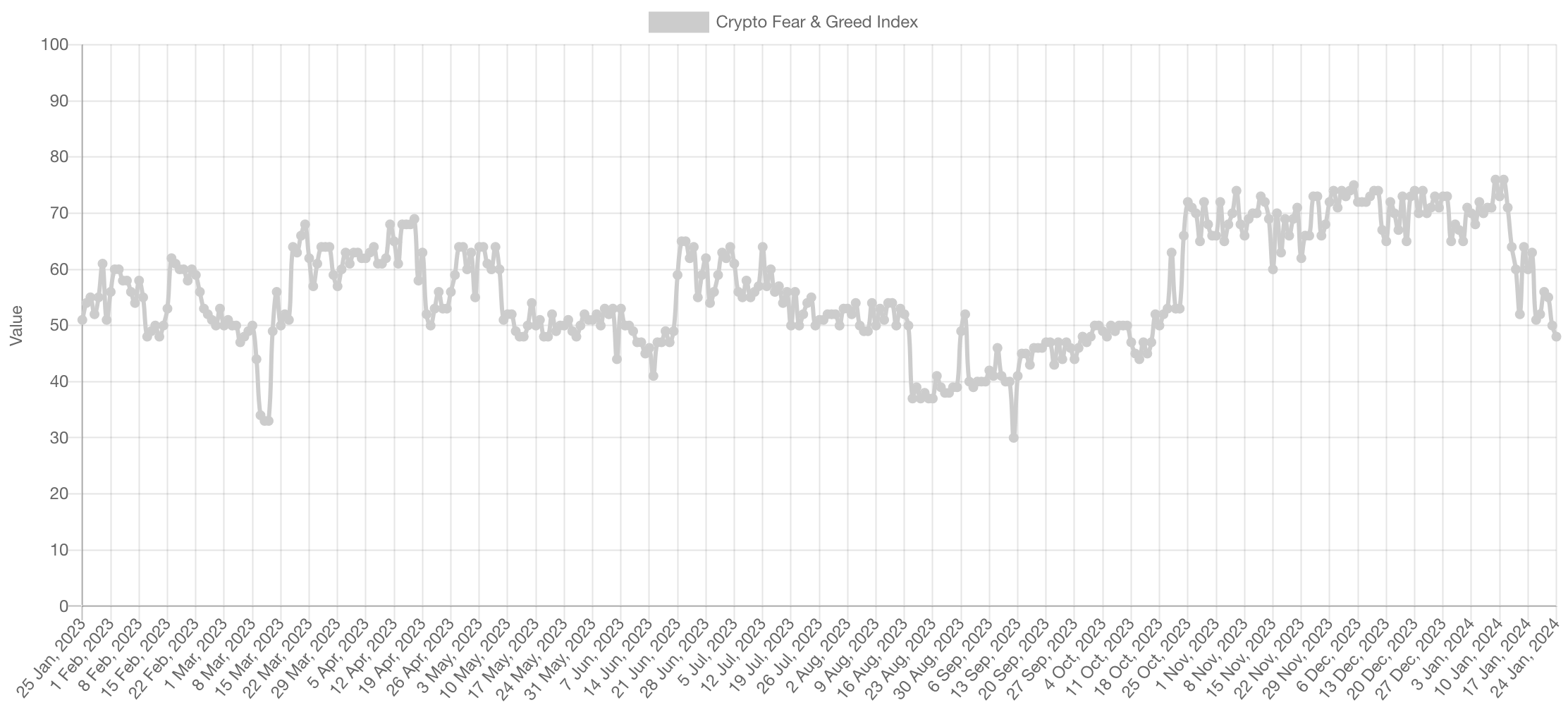

Significant developments continue to unfold in the cryptocurrency market. Accordingly, the price of Bitcoin continues to fall after the approval of spot exchange-traded fund (ETF) applications in the United States, while the Crypto Fear and Greed Index has reached its lowest level in 100 days. On January 24, the index fell to 48 points, settling into the Neutral sentiment range.

Lowest Level in 100 Days

The Crypto Fear and Greed Index experienced a two-point drop compared to the previous day and a 15-point drop compared to the same day last week, placing it in the Greed sentiment range. This situation indicates the lowest point in 100 days for the index, which scored 47 points on October 16, 2023, while Bitcoin was trading just above the $28,500 level.

The Index collects data daily from six fundamental market performance indicators to score the sentiment of the crypto market. These basic data points include 25% volatility, 25% market momentum and volume, 15% social media, 15% surveys, 10% Bitcoin dominance, and 10% trends.

Developments in the cryptocurrency market and the intensity of the agenda directly affect the Crypto Fear and Greed Index, providing many investors with direct clues about the market.

ETF Process and Fear Index

Bitcoin, reached its two-year high of approximately $47,000 on January 8, days before the approval of multiple spot Bitcoin ETF applications in the US, and since the approval of the new ETF product listings, the price has fallen below the $40,000 level.

In particular, Grayscale Bitcoin Trust (GBTC), experienced an outflow of over $2 billion since its conversion into an ETF product, causing days of net outflows from 10 spot Bitcoin ETF products. The Index shows that market sentiment has been in the Greed zone since the end of October, due to optimism about spot ETF approvals.

The Index reached 76 points on January 1, the day after the approval of several Bitcoin funds, and achieved its highest score since November 11, 2021, when Bitcoin surpassed its all-time high of $69,000, reaching 77 points.

Türkçe

Türkçe Español

Español