Digital asset management company CoinShares has released its 142nd weekly report, which shows the movements in crypto funds. The report indicates that there was a total outflow of $20.9 million from crypto funds last week and investors shifted their focus to altcoins other than the altcoin king, Ethereum (ETH).

Significant Decrease in Trading Volume in Crypto Funds

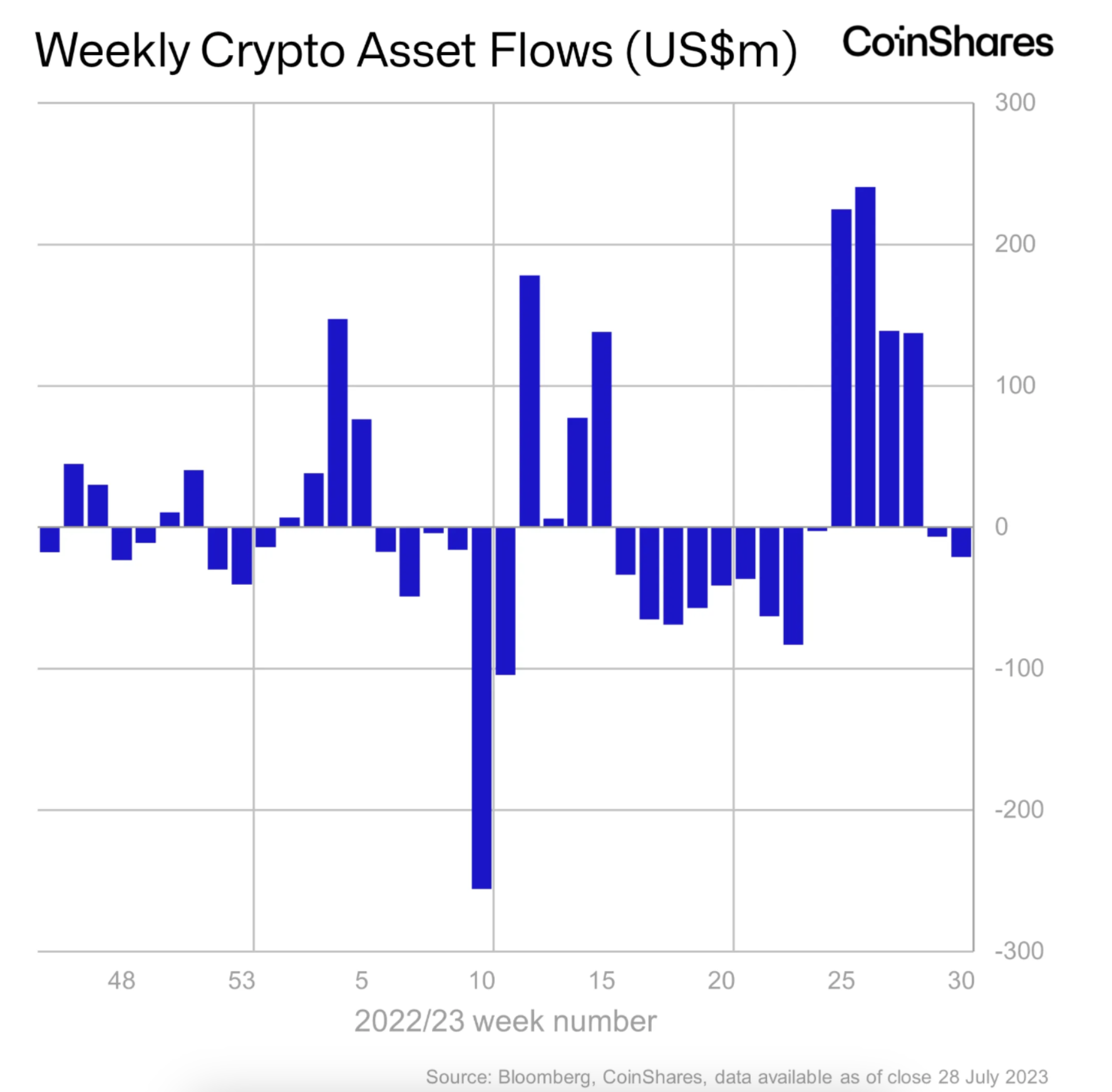

According to CoinShares’ latest weekly report, there was a total outflow of $20.9 million from crypto funds last week. Compared to the weekly average trading volume of $1.5 billion in crypto funds so far this year, the trading volume was significantly low at $915 million last week. This decline also affected the overall Bitcoin market, as the trading volume on reliable crypto exchanges, which has an average of $52 billion throughout the year, dropped to $16 billion.

The largest outflow from crypto funds came from North America. While there was a total outflow of $22.4 million from both the US and Canada, there was an inflow of $5 million from Germany, and outflows of $3.2 million and $2.6 million from Switzerland and Sweden, respectively.

The report also stated that there was slightly less than $500 million in inflows to crypto funds in the first half of the year.

93% of the outflows came from long Bitcoin funds, while there was a total outflow of $3.1 million from short Bitcoin funds for the 14th consecutive week. This indicates that investors have been profitable in recent weeks and the overall sentiment towards the largest cryptocurrency remains supportive.

Investors Are Focusing on Altcoins Other Than Ethereum

Furthermore, the report shows that investors are turning their attention to altcoins other than ETH. Last week, there was a total inflow of $3 million to altcoins, and a total inflow of $19 million in the past 8 weeks.

The data reveals that Cardano (ADA), Solana (SOL), and XRP were the altcoins that received the largest inflows, with $0.64 million, $0.6 million, and $0.5 million, respectively.