Crypto investment products have reached a total of $1.2 billion in inflows for the third consecutive week. This positive trend is believed to have been triggered by new options approvals for investment products in the United States. Additionally, Ethereum (ETH)  $3,094 investment products broke a five-week streak of declines, indicating a notable recovery. However, the mixed performance of altcoins has left investors confused.

$3,094 investment products broke a five-week streak of declines, indicating a notable recovery. However, the mixed performance of altcoins has left investors confused.

Interest in Crypto Investments Grows in the US and Switzerland

Over the past three weeks, inflows into crypto investment products have hit $1.2 billion. The primary reason for this increase is attributed to anticipated dovish monetary policy in the US and the strengthening price movements in that direction. Furthermore, the approval of certain options for US-based crypto investment products appears to have boosted investor confidence. Meanwhile, total assets under management (AuM) rose by 6.2% last week, while trading volume decreased by 3.1%.

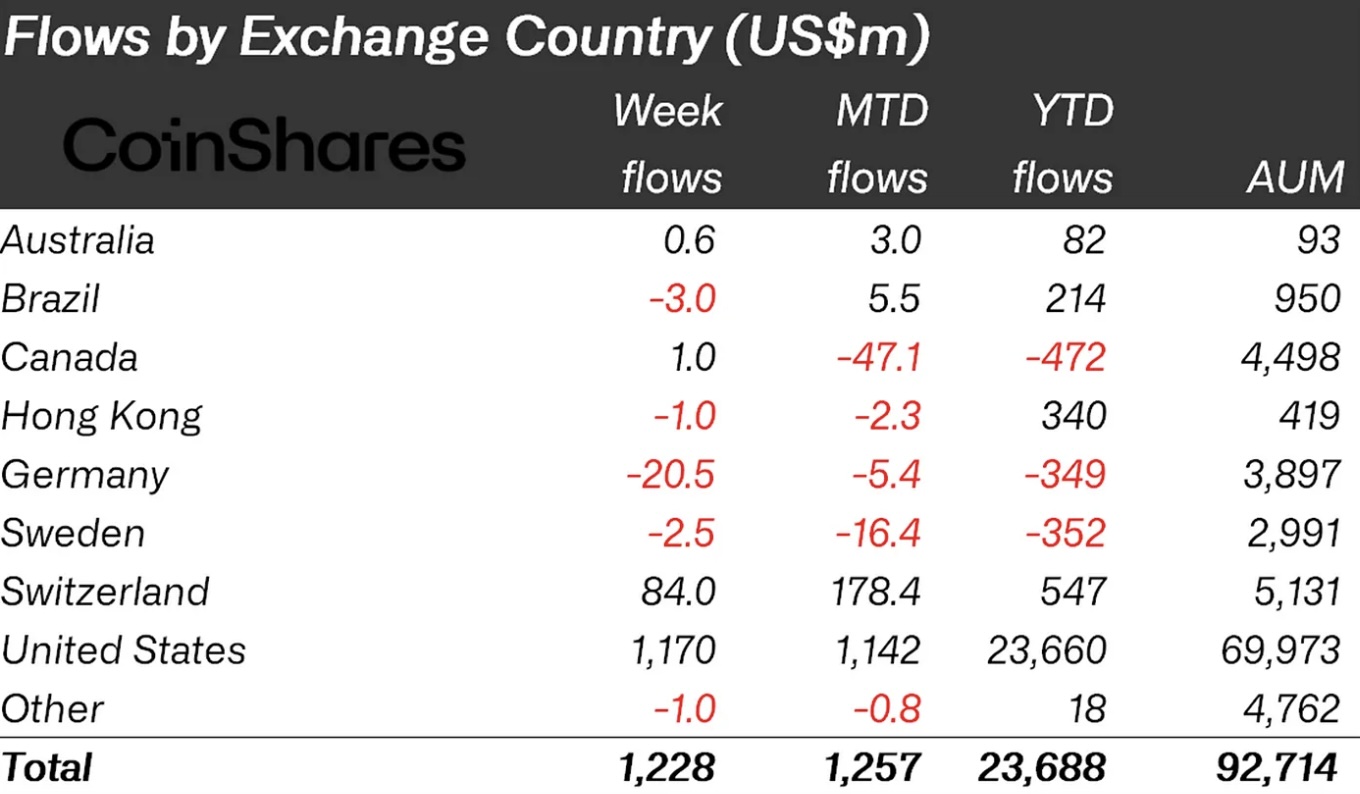

Regionally, the US has seen the largest inflows at $1.2 billion, followed by Switzerland with $84 million, marking the highest levels since mid-2022. Conversely, Germany and Brazil experienced outflows of $21 million and $3 million, respectively.

Bitcoin and Ethereum Recover While Altcoins Show Mixed Results

Inflows into Bitcoin (BTC)  $91,081 investment products reached $1 billion, with short-position products also experiencing an inflow of $8.8 million. Simultaneously, Ethereum ended its five-week decline with a positive signal, recording an inflow of $87 million, marking significant activity for the first time since early August.

$91,081 investment products reached $1 billion, with short-position products also experiencing an inflow of $8.8 million. Simultaneously, Ethereum ended its five-week decline with a positive signal, recording an inflow of $87 million, marking significant activity for the first time since early August.

On the other hand, the altcoin market presents a mixed picture. Solana  $139 (SOL) saw the largest outflow at $4.8 million. Litecoin (LTC) and XRP performed better with inflows of $2 million and $800,000, respectively, while BNB (BNB) and Stacks (STX) faced outflows of $1.2 million and $900,000.

$139 (SOL) saw the largest outflow at $4.8 million. Litecoin (LTC) and XRP performed better with inflows of $2 million and $800,000, respectively, while BNB (BNB) and Stacks (STX) faced outflows of $1.2 million and $900,000.

Despite an overall positive atmosphere in the crypto market, the negative fluctuations in altcoins indicate that investors should exercise caution.