A significant portion of crypto investors, aware of an impending major event, have been selling for some time. The direction is uncertain, but a price stuck in a range for long tends to break eventually. Why did an on-chain analyst issue a time bomb warning for crypto? BTC is at $57,100, and altcoins are relatively calm compared to last week.

Time Bomb Warning in Crypto

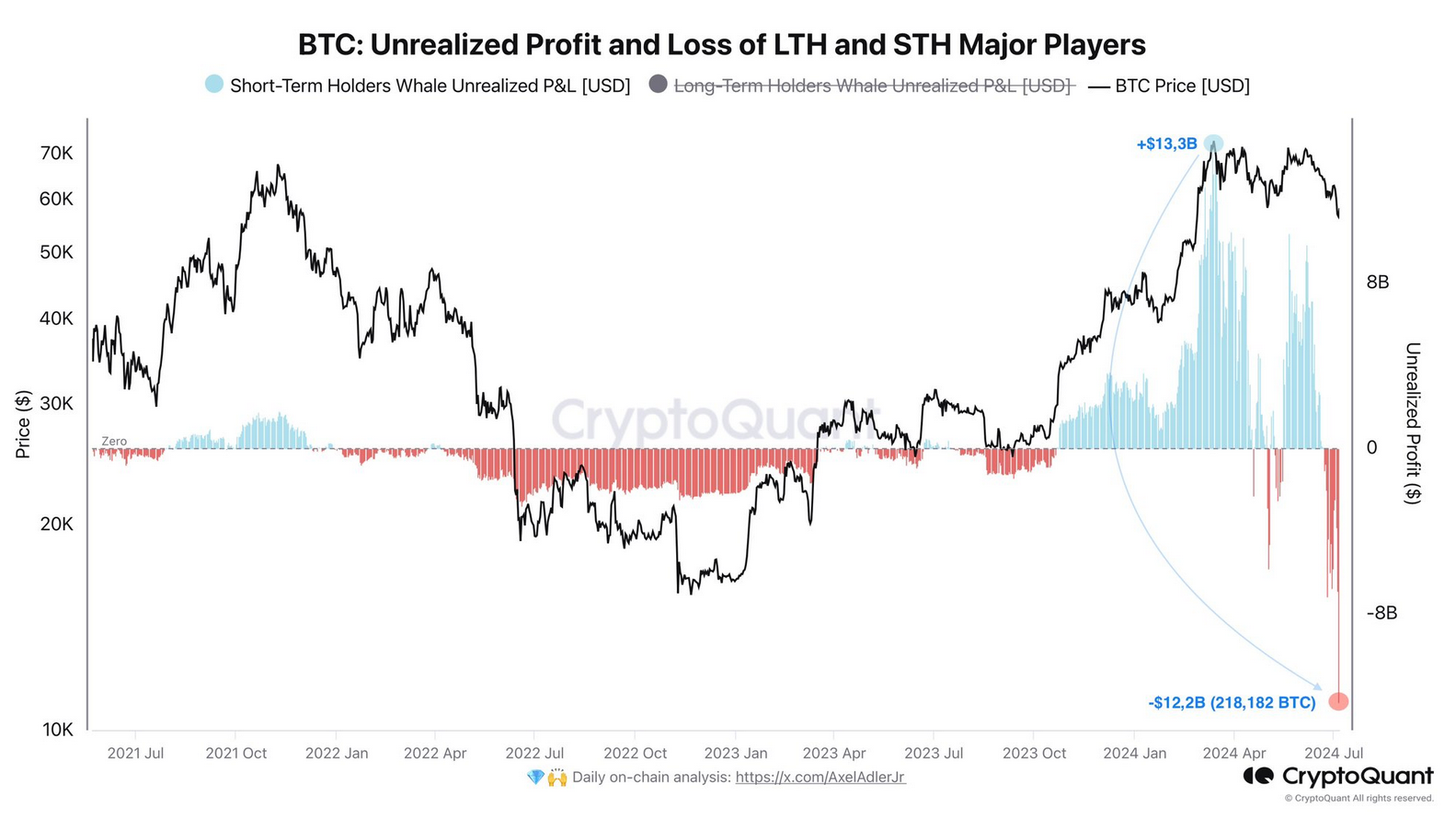

Popular on-chain analyst Axel Adler Jr, who publishes his evaluations on CryptoQuant, focuses on unrealized profit and loss analysis. Based on his observations, he issued a time bomb warning. In his latest assessment, he wrote:

“There is slight panic in the market due to small-scale sales of MTGOX and government assets, but no one is talking about the unrealized losses of STH whales, which equal 218,000 BTC. If they lose their nerve, I have no idea what will happen to the market.”

So, what does STH whales mean? This term is used for large short-term investors who make significant purchases. ETF issuers’ reserves are also included in this, and investors familiar with traditional markets hold the taps of a total reserve of $50 billion in the ETF channel.

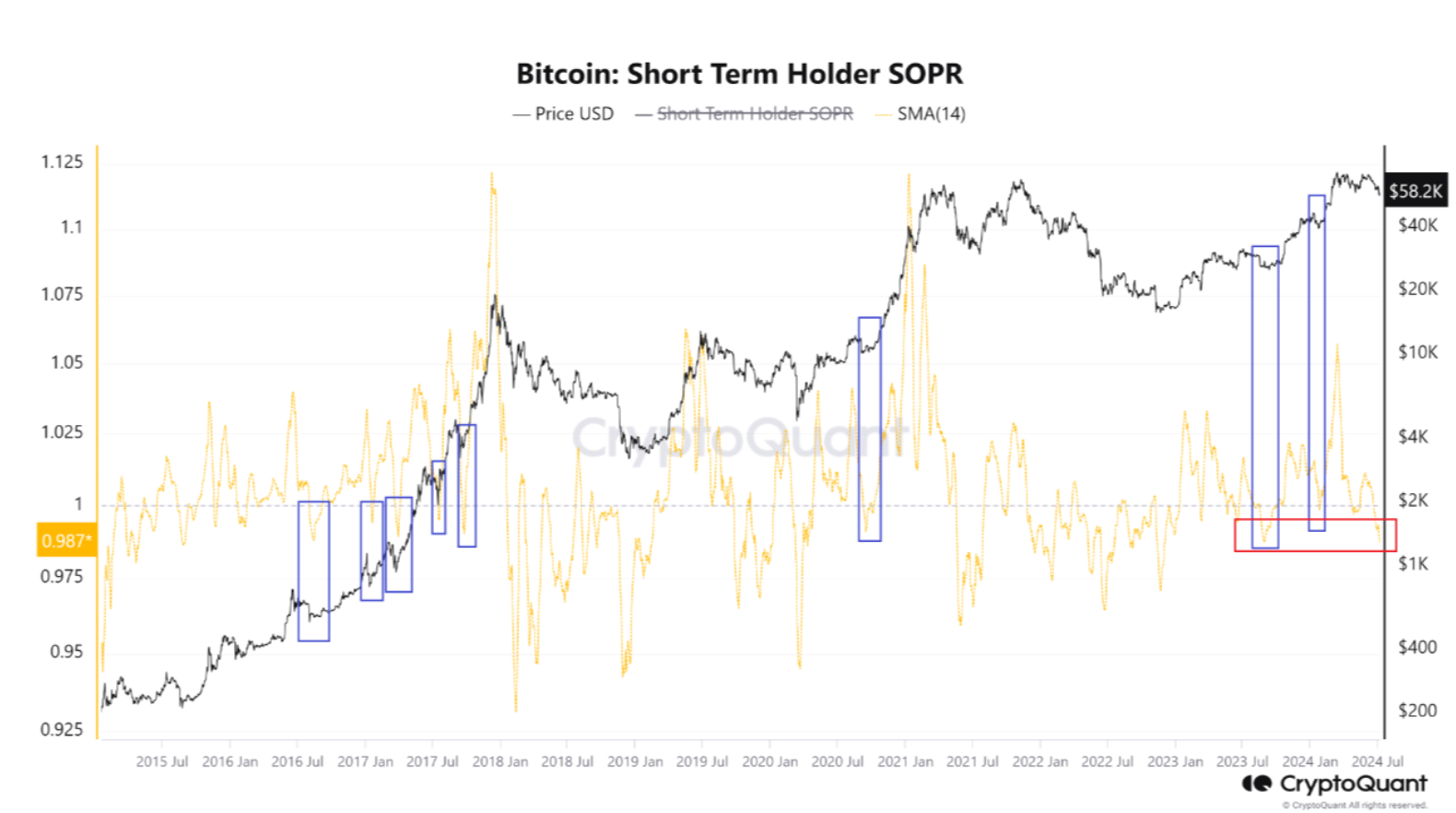

CryptoQuant expert Mignolet also pointed out the fundamental cost of $64,000 and said:

“If the current cycle is still in the bullish phase and the season is not over, short-term SOPR data shows the price is nearing the bottom. This pattern is very similar to the period in September last year.”

If so, the markets need to reverse quickly before the time bomb at the entrance explodes.

Busy Agenda in Crypto

Key data will be released this week. Besides PPI and CPI data, we will follow Fed Chairman Powell’s statements for two consecutive days. Continued decline in inflation is crucial and could be one of the most important events to motivate investors in risk markets soon.

The market interest rate forecast for July is stable according to FedWatch. However, the downward revision of the recent Non-Farm Payroll data reflects the employment relaxation desired by the Fed, leading to a scenario of two total 50bp cuts being priced in before the end of this year.