Crypto investors have started to feel the Uptober vibes as October comes to an end. Now, the parabolic rally expectation is high for November, and the $38,000 peak seems inevitable. So, what are the market experts predicting?

Will Bitcoin Rise?

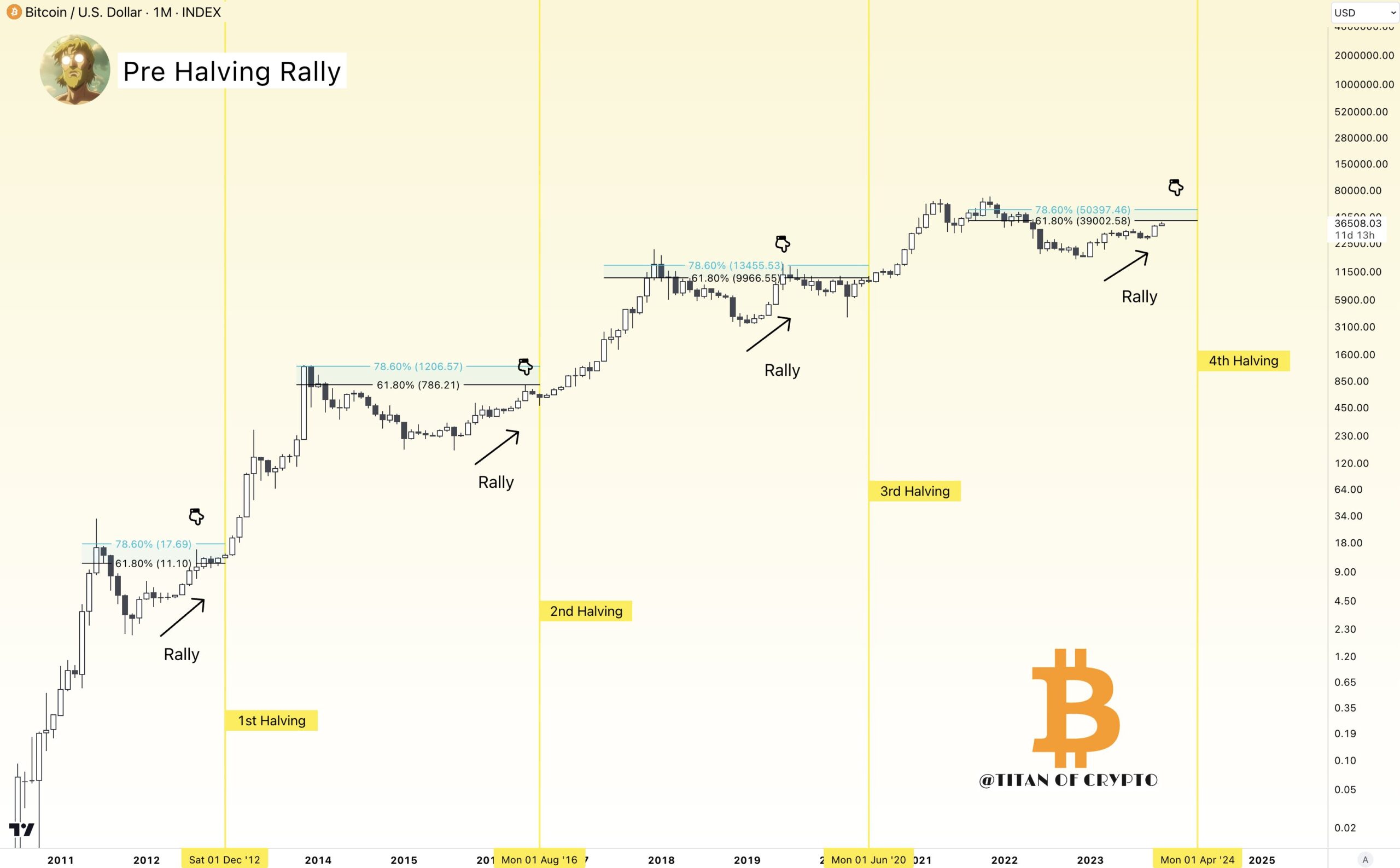

According to the popular crypto analyst, Titan of Crypto, the price of BTC is getting closer to its $50,000 target every day. The analyst is not concerned about the price retreat to an important Fib retracement level before the halving.

Bitcoin faces a strong resistance towards the $40,000 level. It struggled to break through this range in the past few days due to hasty profit-taking. It is a good selling point for investors who take advantage of the dips. Moreover, it presents a good cost point for those who bought during the 2021 bull market.

Will Crypto Currencies Continue to Rise?

In his recent evaluation, Titan of Crypto confidently stated that before the halving, $39,000 will turn into a support level. At the time of writing, the price of Bitcoin is at $36,500, not far from the mentioned level. The only problem is the volume stuck in the $50 billion range and the difficulty in attracting new investors.

“We are about to reach the target range of $39,000-$50,000 that I mentioned about a year ago before the halving. Be patient and see that patience is the key. There has always been a rally in BTC before the halving. These rallies reached their peak within the 61.8%-78.6% Fibonacci retracement area.”

Filbfilb, the co-founder of DecenTrader, believes that the price of BTC could reach $46,000 by the time of the halving. However, historically, it is forgotten that the real big rallies occur after the halving. Many analysts predict that new ATH levels of $130,000 and above can be seen until the end of 2025.

A few analysts predict that the ongoing crypto correction could become more difficult for BTC to reach a deeper low. The $30,900 level has been discussed as a dip for some time, and such a move could result in losses of over 50% for altcoins. Moreover, this situation would establish new ATL levels for rising altcoins below the market average.