Crypto investors seem to have weathered the storm of inflation data without significant losses for now. However, losses for Bitcoin (BTC), which continues to remain under support, could deepen after the daily close. Tomorrow is a big day and DCG is stuck in the present. Here are the latest developments and expectations you need to know.

Important Developments in Cryptocurrencies

Tomorrow is the SEC’s last day to appeal the GBTC decision, a matter that has already been emphasized all week. Since all members of the committee support Grayscale, it is not expected that the SEC’s appeal will yield much. In fact, their argument is not enough to reject spot ETFs, as they had approved futures ETFs two years ago.

The rejection of spot Bitcoin ETFs, based on speculative price, created a contradiction since the futures ETFs traded at the same price. If no appeal is made tomorrow, and if the crypto community becomes overly optimistic, we may see a market recovery in anticipation of ETF approval.

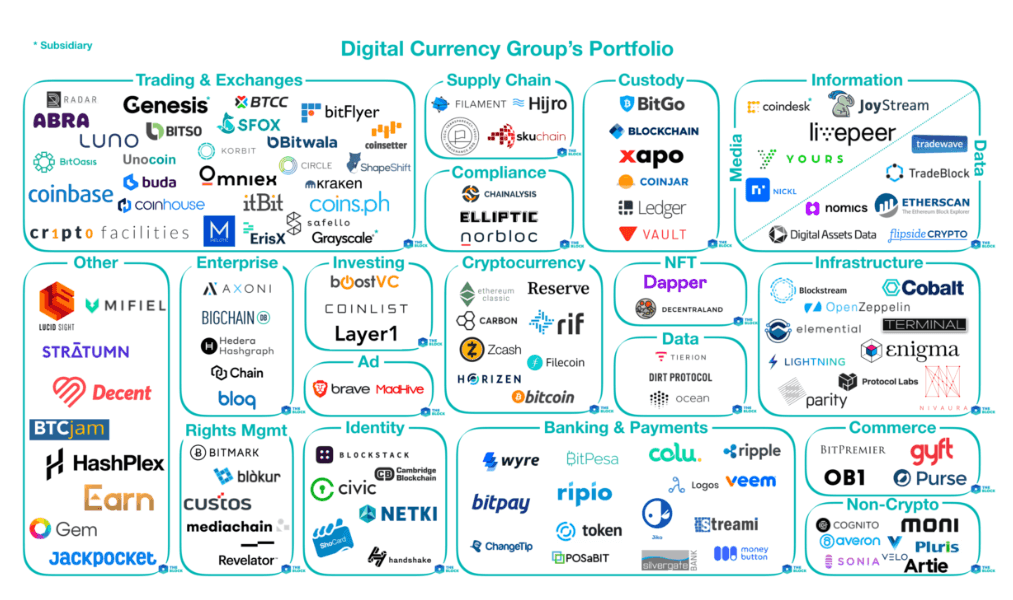

If the SEC appeals, there will be one more evaluation with all members, and considering the letter from the Senate to approve the ETFs, the regulatory institution will likely suffer another defeat. The conversion of GBTC to Spot Bitcoin ETF is a critical situation for the parent company DCG. The largest group of cryptocurrency companies, DGC, is in a difficult position due to Genesis, which we will discuss in detail shortly. The possibility of overcoming the current situation will be determined by the approval of the ETF, which will increase Grayscale supported earnings.

Genesis Halts Withdrawals

Genesis Global Trading (GGC) was forced to pay $175 million to FTX, leading to the suspension of withdrawals. The court decision has made things even more difficult for the struggling company.

The decision made by the United States Bankruptcy Court for the Southern District of New York on October 11 also puts the parent company DCG in a difficult situation. If the GBTC conversion is not approved, the company, which has structured debts worth millions of dollars for 10 years, may face an even more challenging situation.

So how did Genesis, the largest crypto lending institution, end up in this situation? Mainly due to bad loans. The company, which worked with adrenaline junkies like SBF and Zhu Su, could not recover its loans. As a result, it could not repay the money it borrowed from its partners like Gemini for the Earn service.

When you go to a bank, your credit score is checked before a loan is granted. However, when companies borrow money, detailed examinations are not always conducted depending on the amount. This is even more flexible in the crypto world. This week, Caroline Ellison, the former CEO of Alameda Research, revealed how they applied for credit from Genesis using fake financial statements.

Ellison testified that Genesis prepared seven different financial statements before a meeting with the co-chair of trading and lending in which Bankman-Fried gave instructions. This tactic aimed to conceal the massive debts in Alameda Research’s financial statements and the approximately $10 billion it had stolen from customers.