The king of cryptocurrencies, Bitcoin, has started its expected decline and rapidly lost $28,800. For most investors, this is not surprising. The downward break of the price, which has been trapped in a narrow range, was already seen as highly likely, and the Fed Minutes supported this view.

Why are Cryptocurrencies Falling?

When we shared the Fed Minutes with you as breaking news yesterday at 9:00 p.m., we mentioned that these details could cause further declines. Some members say that tighter measures are necessary in light of current data. The current interest rates may not be sufficient for inflation to rise back to 3.8% as predicted.

The previously discussed 6% interest rate target, which reflects the predictions of many major financial institutions, may become a reality. Wage increases, low unemployment, and rising fuel prices indicate that the period of rapid decline in inflation has turned into a slow rise.

So, what will the Fed do? Even if a rate hike is skipped at the September meeting, they will take further tightening steps if this process continues. The credit crunch did not contribute to the expected tightening to the extent expected, and on the other hand, this situation is not very encouraging for the risk markets.

Bitcoin and Altcoins Commentary

Bitcoin price reached its lowest level today at $28,342. We mentioned that the last critical support level was at $28,300 and the possibility of losing it was increasing with each passing day. On the other hand, the situation is not very promising for altcoins. Most altcoins experienced even greater losses along with the decline of BTC.

While the Fed expresses the “uncertainty” about the effects of the current monetary tightening, Bitcoin and altcoin investors are pushing the king of cryptocurrencies towards support levels. Popular analyst Crypto Tony said the following about the recent move:

“Bitcoin has lost $28,800, so I will feed my short positions as long as it stays below $28,800.”

A significant portion of market analysts expect the decline in BTC to continue towards $27,500 and $26,000. This means that double-digit gains could continue for altcoins.

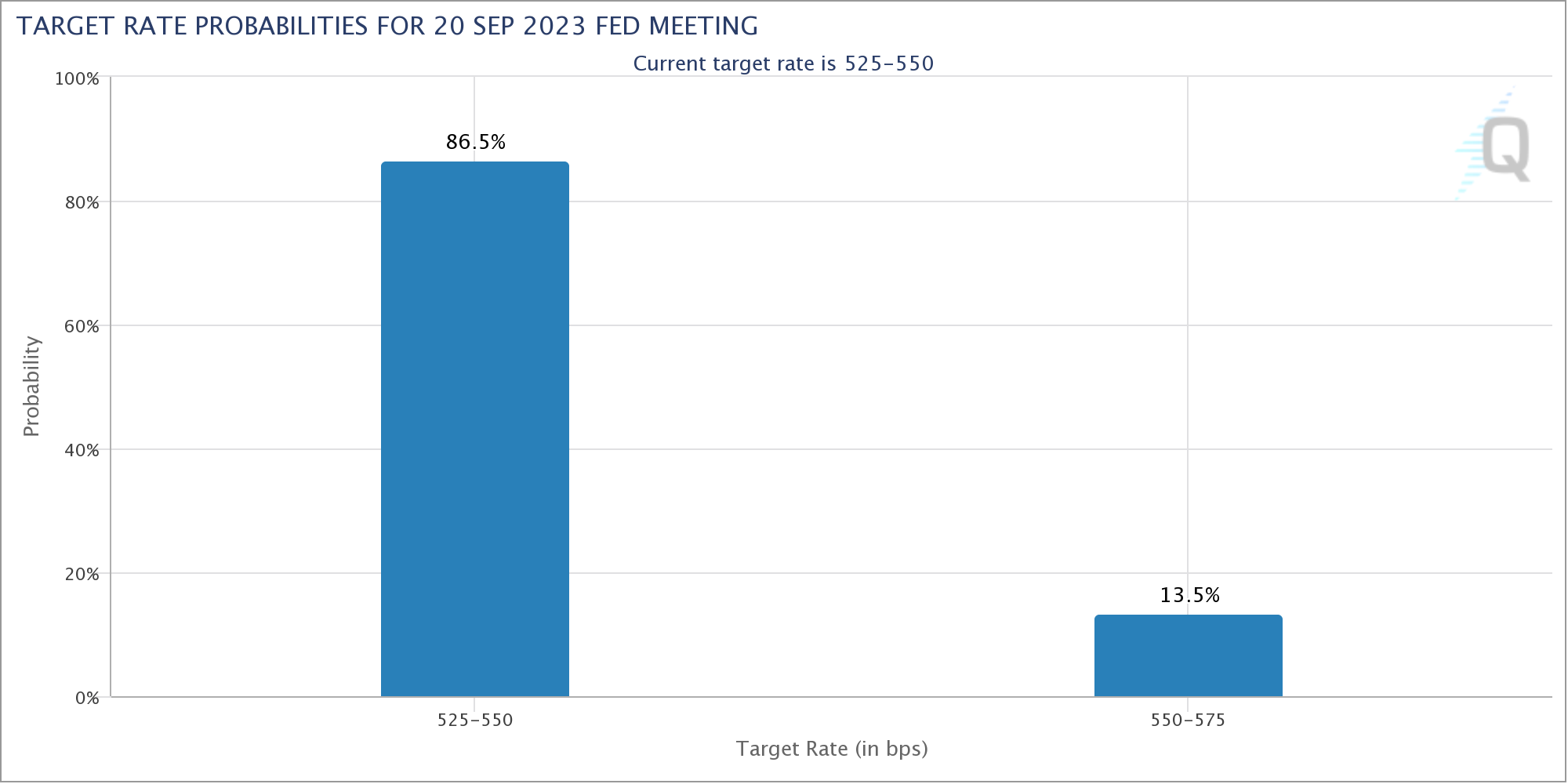

According to CME Group’s FedWatch tool, the probability of the Fed keeping the current interest rate unchanged remained close to 90% after the release of the minutes. Caleb Franzen, Senior Analyst at Cubic Analytics, said in a recent forecast that the thing exhibiting “stickiness” is not inflation but rather disinflation.

“Disinflation + stronger earnings + stronger economic data + approaching the end of the interest rate hiking cycle have been a perfect recipe for market returns and the development of an uptrend. Although these conditions may change in the future, I do not see any evidence that they have changed yet.”

Türkçe

Türkçe Español

Español