Like every Sunday, today we are addressing events in the coming days that concern crypto investors. Macro-economic developments, key unlocks, network updates, and much more significantly affect prices. Indeed, we all experienced the aftermath of the latest inflation data a few days ago. So, what developments will occur in the coming days?

Significant Developments in Cryptocurrencies

Bitcoin’s price stands at $51,600 as this article is being prepared, but declining volumes favor sellers. BTC could not turn the $51,800 resistance into support, and profit-taking continues in rallies. While some altcoins have broken through resistances, the situation is not very promising. So, what developments will we see in the coming days that will positively or negatively affect the price?

Monday, February 19

- US Markets Closed

Tuesday, February 20

- Binance Delist (ANT, MULTI, VAI, and XMR)

- Starknet (STRK) Listing

- DYDX Unlock ($1.82 Million)

Wednesday, February 21

- 16:00 Fed/Bostic

- 21:00 Fed/Bowman

- 22:00 Federal Reserve Meeting Minutes

Thursday, February 22

- 14:00 Central Bank of the Republic of Turkey Interest Rate Decision (Expectation: Steady Previous: 45%)

- 16:30 US Unemployment Claims (Expectation: 217K Previous: 212K)

- 17:45 US Manufacturing PMI (Expectation: 50.1 Previous: 50.7)

- 17:45 US Services PMI (Expectation: 52 Previous: 52.5)

- AVAX Unlock ($382 Million)

- ID Unlock ($11.1 Million)

Friday, February 23

- 01:00 Fed/Cook and Kashkari

- 03:35 Fed/Waller

- IMX Unlock ($3.87 Million)

What to Watch For?

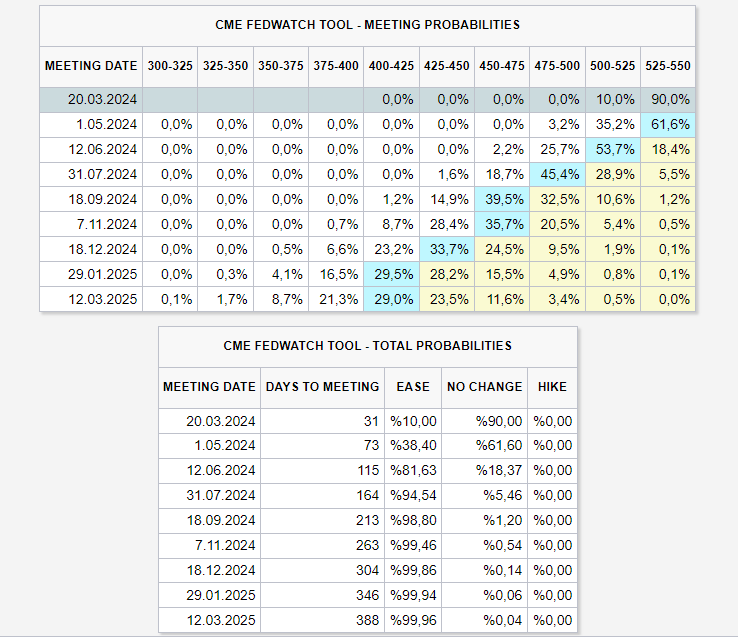

The most crucial development of the week will be the Federal Reserve Minutes to be announced on Wednesday at 22:00 EET, where signals regarding interest rate cuts for 2024 will be sought. Fed minutes can cause significant movements during such pivotal times. For now, markets expect more than the 75bp cut forecasted by the Fed, and any clear messages that counter this expectation could trigger short-term declines. Most likely, messages supporting a 75bp cut will be present, so pay attention to the minutes.

AVAX is making another significant unlock. Although the price is over $40 as this article is prepared, the $382 million unlock should be taken seriously. Privacy-focused altcoins are saying goodbye to the Binance exchange; this has already been priced in, but volatility could increase in both directions on the day of delisting. Investors chasing speculative trades in futures may want to turn this into an opportunity.

Türkçe

Türkçe Español

Español