The cryptocurrency market witnessed one of the most significant declines in recent times as the leading cryptocurrency Bitcoin dropped to $25,400 during the week. Ethereum (ETH) also experienced a decrease of more than 10% in the past week, trading at around $1660. Short and long positions worth over $1 billion were liquidated during the week.

Striking Decline in the Crypto Market

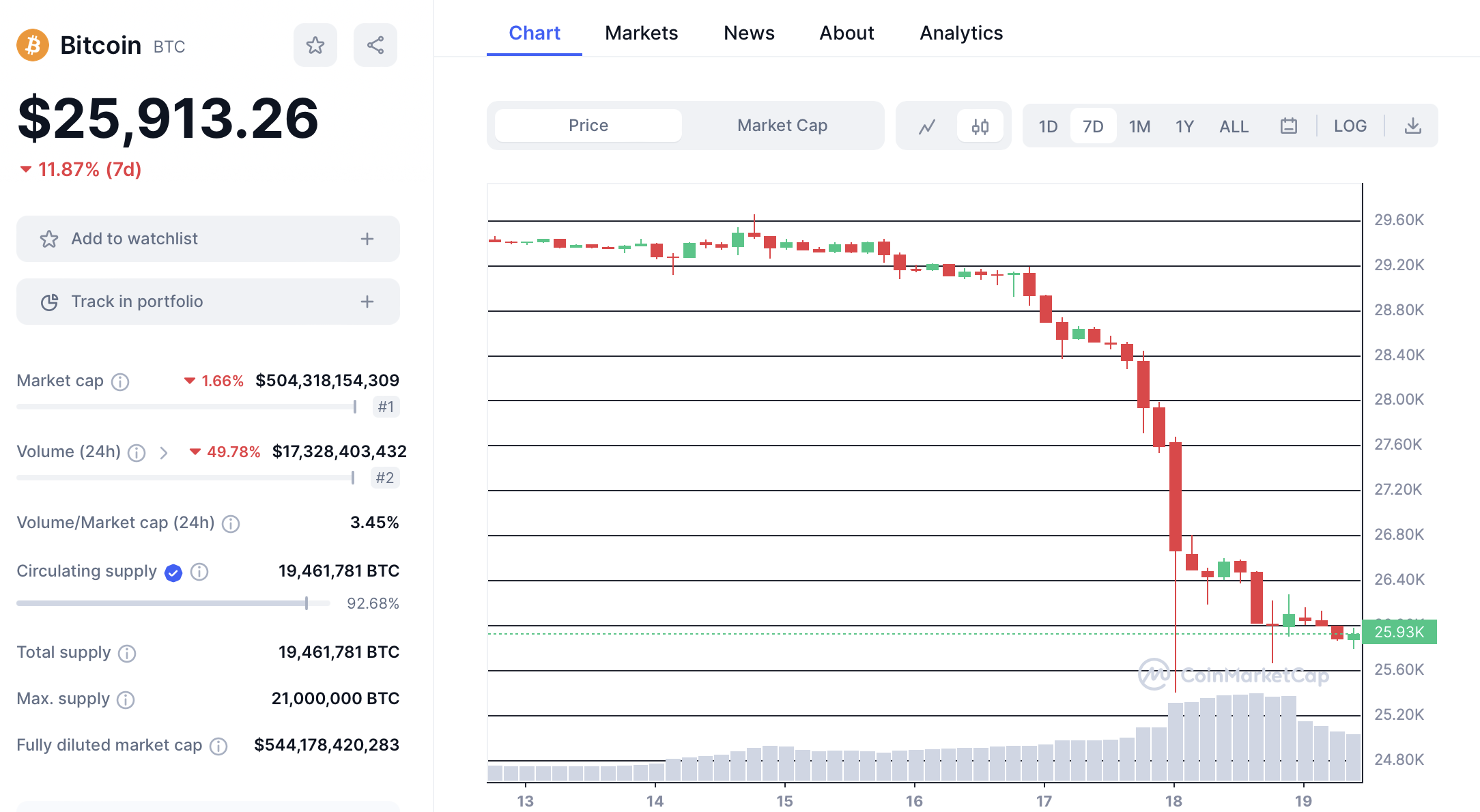

After weeks of low volatility, the cryptocurrency market regained momentum. The leading cryptocurrency Bitcoin (BTC), which had been consolidating between $29,000 and $30,000 for weeks, experienced a significant decline on Friday. The drop to $25,400 by Bitcoin triggered a strong downward trend in most altcoins in the cryptocurrency market.

Ethereum (ETH) started trading at $1660 after recording a loss of over 10% in the past week. XRP, which lost nearly 20% in the last week, dropped to $0.5 and became one of the cryptocurrencies with the highest percentage loss among high market cap cryptocurrencies. The total market value of the cryptocurrency ecosystem also dropped to $1.05 trillion according to CoinMarketCap (CMC) data.

Furthermore, after weeks of low volatility, the cryptocurrency market regained momentum, and market volatility increased significantly. According to Coinglass data, over $1 billion worth of short and long positions were liquidated throughout the week.

What’s Next for Bitcoin?

Crypto analyst Michael Van de Poppe drew attention to possible price levels that could play a critical role for BTC in the near future. The analyst suggested that for Bitcoin to gain momentum again, it needs to surpass the $29,700 level. He also claimed that if BTC falls below $29,000, it could experience further losses.

Meanwhile, crypto analysis platform Santiment evaluated the current state of the cryptocurrency market and shared updated data. Santiment highlighted the sharp decline in the total market value of the cryptocurrency market and suggested that current metrics indicate a historical opportunity zone.

However, despite Santiment’s claim that current metrics indicate a historical opportunity zone, Bloomberg Intelligence Macro Strategist Mike McGlone believed that the Federal Reserve (FED) will maintain its hawkish stance and continue its monetary tightening policy, warning of a possible downtrend. According to McGlone, a new selling pressure may occur in risky assets, including BTC, leading to further depreciation in the near term.