Cryptocurrency markets are once again trying to stay afloat amid another upheaval. The reasons for the decline are numerous. The rise of the right in the European Union Parliament, France heading for early elections, macroeconomic issues, rising bond yields with the uncertainty of the Fed while the ECB cuts rates, and much more. So, how do market experts evaluate this decline?

Cryptocurrency Decline

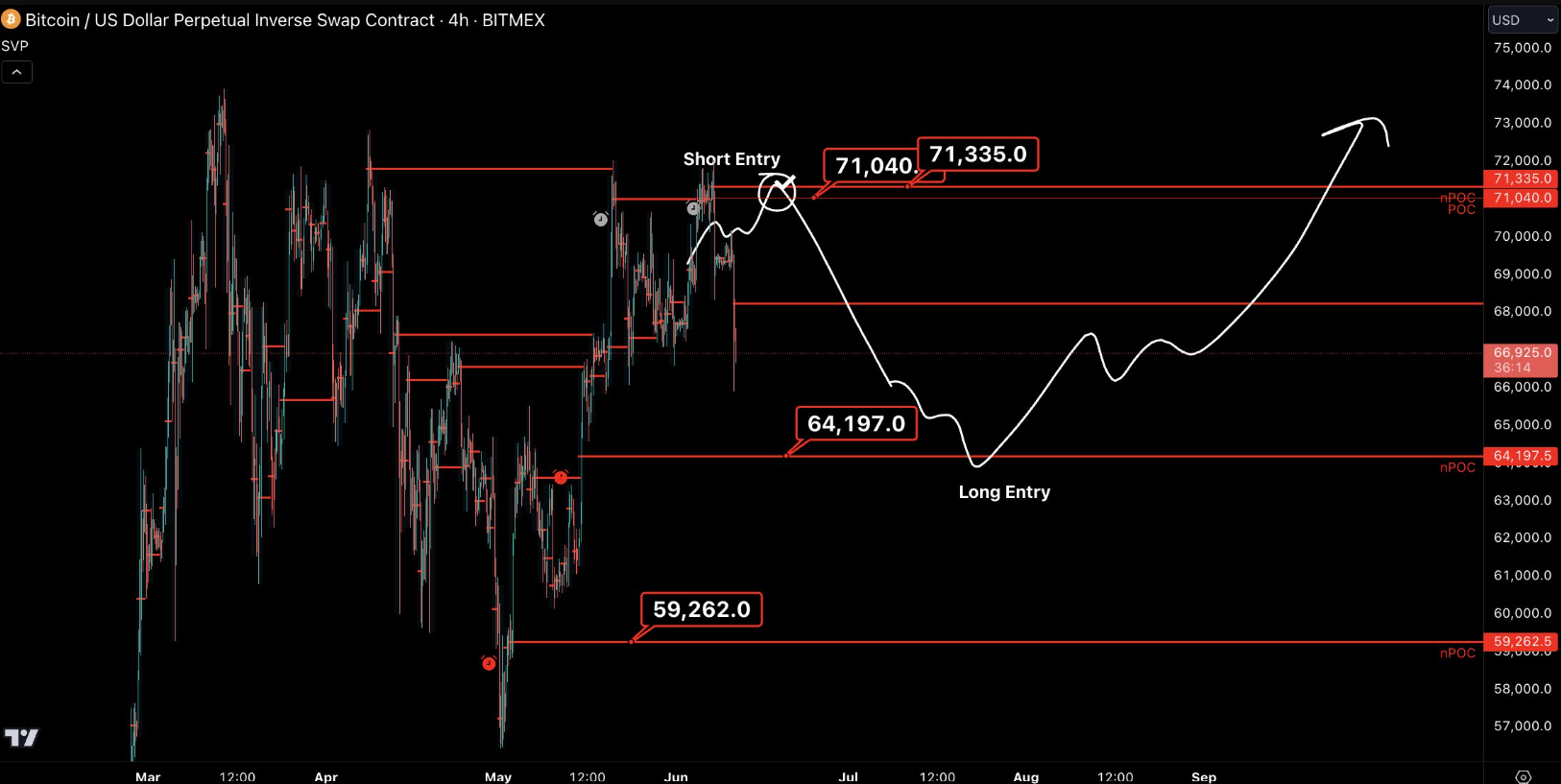

The price of Bitcoin (BTC) fell continuously for 24 hours to as low as $66,696. It then moved towards new lows and dropped to $66,000 on the Binance exchange. This was the expected basic scenario for Fed week, and by Friday, the accelerated sales were just beginning to be understood by new investors. This is how things work in crypto; investors here are much more active in early pricing.

In such a market that is open 24/7 and shows high volatility, there is honestly no other way. Popular crypto analyst Roman wrote the following;

“We are approaching support. If a reversal occurs, I will want to enter long positions.”

Another analyst, Castillo Trading, said similar things to Roman and wrote that he had been following the $67,000 support for buying opportunities for a long time. Especially in altcoins, BTC‘s decline here offers significant opportunities.

“We knew some decline in BTC was possible. Opening new longs above $70,000 would have been difficult. Now we have entered a period where I am more willing and comfortable to add.”

Analyst Comments

Popular crypto analyst Jelle could not understand why such declines disturb people while the uptrend continues. The BTC price, which has been below the all-time high for 15 weeks, had made similar moves in the past. Moreover, the current decline continued to $66,000. In November 2022, this figure was a dream for many investors, but now it is a disappointment for most. That’s crypto.

“15th week below all-time highs. This week we are returning to the key support level of $67,500 with a red start. It may be disturbing, but nothing has changed. Don’t be shaken.”

Scott Melker was also quite relaxed, just like Jelle;

“Today is a good drop, but it is only testing the support in the EQ range. It is still trading in the upper half of the range. It has been 3 months since the predictable breakdown that comes with this part of the cycle.”

The size of open positions for BTC in futures trading has decreased from $37.6 billion at the beginning of June to $35 billion.