After a period of high volume and increases in the crypto market since the early days of March, the past week has been relatively calmer and even saw some declines. Despite these declines, the levels of open interest in the market continue to indicate the highest levels of the year, and this process seems to pose a short selling risk for some cryptocurrencies.

Market Rise Alert

A short squeeze occurs when a significant number of traders with short positions are forced out through liquidation after the mentioned crypto asset visits a predetermined price region.

Speaking of this issue, the higher the market participants’ open interest in a cryptocurrency, the more likely a long or short squeeze is to occur. Looking at the data from CoinGlass on March 22, two cryptocurrencies were at the top of the list to be closely monitored.

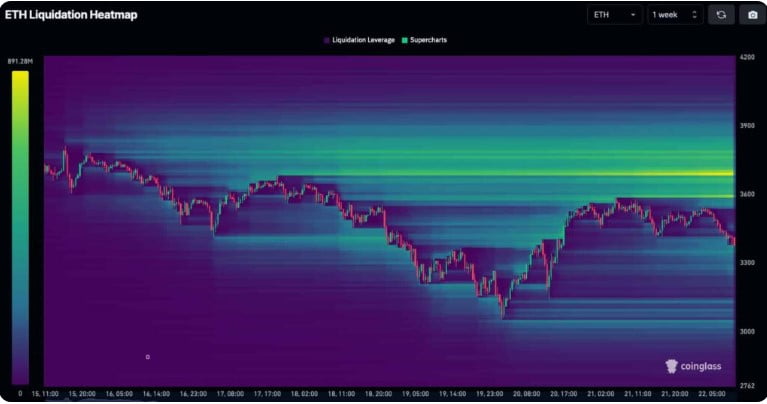

Ethereum (ETH) Insights

The first cryptocurrency to emerge from the Coinglass data was none other than Ethereum‘s (ETH). ETH has seen an increase in short positions in recent days, which has paved the way for the formation of significant liquidity pools in the upward direction.

A weekly timeframe analysis shows that a high liquidity has formed around the $3,700 price region, making it a target. On the other hand, a potential short squeeze could rapidly raise the price of ETH from $3,380 to $3,900, a 15% increase.

Especially, the open interest in Ethereum‘s derivative markets peaked on March 14 and continues to show a strong outlook. As of the time of writing, there are over $13 billion in open contracts in the market’s second-largest cryptocurrency.

While making these forecasts, it is necessary to consider recent events related to the Ethereum Foundation and the steps taken by the SEC regarding ETH. Negative developments regarding ETH could invalidate these expectations.

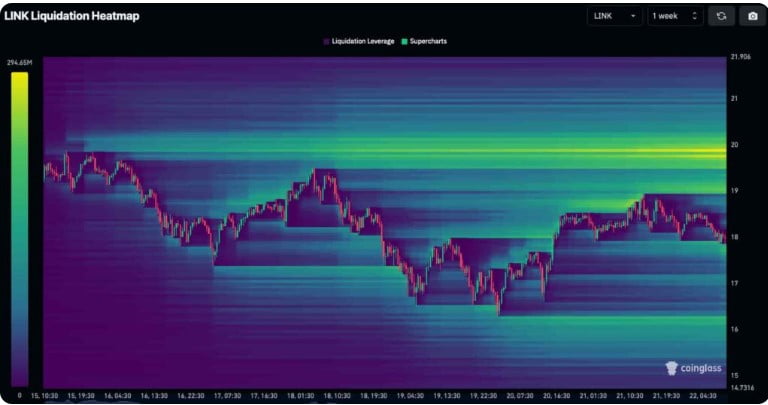

Will Chainlink (LINK) Rise?

On the other hand, Chainlink (LINK) continues to record volumes in the futures market. The price increases LINK has experienced towards the end of 2023 have not gone unnoticed by market observers, who are aware of the potential for volatility and liquidations.

Looking at Chainlink‘s heat map, it is worth mentioning the observed liquidation levels, as a potential short squeeze could push LINK above $20.

The mentioned level is where the largest liquidity pools for Chainlink have formed, and a 10% rise from the current price level could reach this region.

Despite all this emerging data, negative price movements in Bitcoin and news that could emerge in the market could also affect Ethereum and LINK and prevent the predictions from materializing.