The major decline in the cryptocurrency world continues at full speed. Bitcoin price fluctuations have turned into a decline, with the price dropping to $61,000 during this period. Meanwhile, key figures in the market continue to comment on cryptocurrencies.

CEO’s Bitcoin Comment

According to the CEO of the well-known blockchain analysis firm CryptoQuant, leading Bitcoin (BTC) investors have started to make risk-averse moves following recent events.

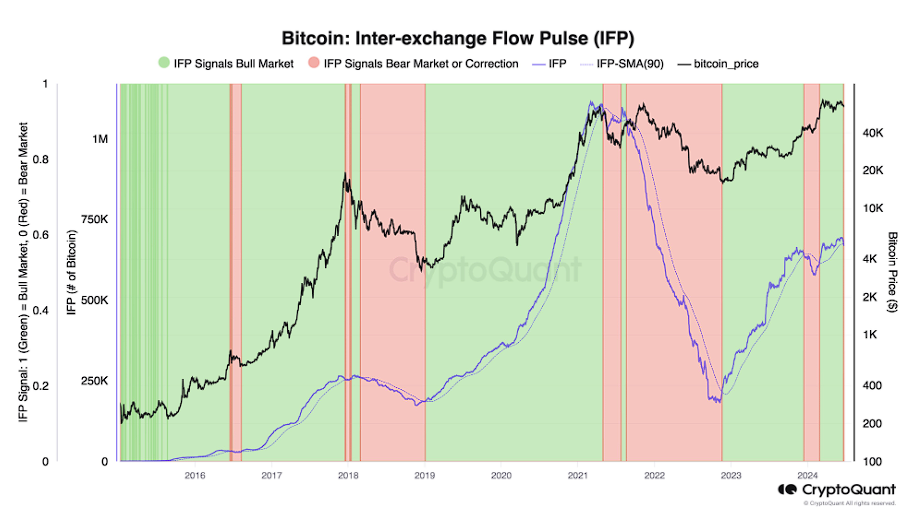

Ki Young Ju made significant statements to thousands of people via social media, indicating that data shows whales are currently in “risk-averse mode” according to the interexchange flow pulse (IFP) indicator, which tracks the flow of BTC between spot and derivative exchanges.

The famous figure mentioned that traders are transferring their existing assets to derivative exchanges and using these assets as collateral to take on more risk through leveraged positions.

According to Ju, the IFP indicator continues to remain below its 90-day moving average.

Bitcoin IFP indicator turned red. Whale traders on derivative exchanges are in risk-averse mode… IFP (Interexchange-Flow-Pulse)… tracks Bitcoin movements between spot and derivative exchanges, reflecting market sentiment. Increased flows from spot to derivative exchanges may indicate BTC is being sent as collateral for new/existing positions. Whales transferring BTC to derivatives usually indicate long positions, especially at cyclical market bottoms. The strategy targets Bitcoin exposure during IFP uptrends, where 90-day moving average crossings indicate market changes (green and red areas on the chart).

Bitcoin and Ethereum Prices

As of the time of writing, the price drop in BTC continued. BTC was trading at $60,200 after a 6.5% drop in the last 24 hours. Following this price, the market cap also fell below $1.2 trillion, dropping to $1.193 trillion.

The 24-hour trading volume indicated an increase due to the sales that occurred. After a 268% increase, the trading volume rose above $31 billion.

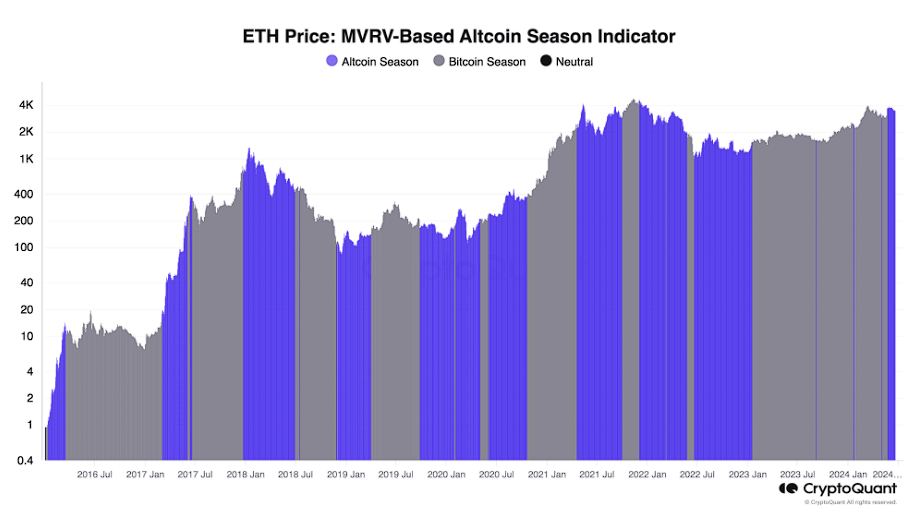

When examining Ethereum after Bitcoin, CryptoQuant data revealed that ETH’s Market Value – Realized Value (MVRV) indicator showed a faster rise compared to Bitcoin’s MVRV.

CryptoQuant made the following statement:

This indicates that the ETH market is heating up. Historically, when Ethereum rises, other altcoins tend to follow.

As of the time of writing, Ethereum was still finding buyers at $3.244 after a drop of over 6% during the day.

Türkçe

Türkçe Español

Español