The cryptocurrency market is undergoing a period of fluctuation as investors grapple with conflicting forces. Renewed concerns about stagflation in the US—a scenario where high inflation combines with stagnant economic growth—are exerting downward pressure on prices. However, potential compensatory factors, including liquidity injections from the US government and the launch of Bitcoin ETFs in Hong Kong, offer a glimmer of hope.

Crypto Prices Drop Amid Stagflation Fears

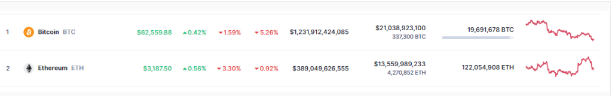

While Bitcoin, the market’s undisputed leader, continues to trade at $62,959 as of this writing, this represents a 1.5% decrease over the last 24 hours. Ethereum (ETH) and other major cryptocurrencies also appear to be following this trend. The price drop highlights increasing concerns in the US about a potential stagflation environment.

Historically, stagflation can be considered a “nightmare scenario” as it forces investors to make tough choices. High inflation erodes the value of cash assets, while a stagnant economic structure reduces risk-taking behavior. Cryptocurrencies, generally considered a risky asset class, could face losses in such conditions.

US Economic Data and Uncertainties

Recent economic data from the US seems to support this situation. The GDP report for the first quarter reflects a slower growth rate compared to the previous quarter, dropping from 3.4% to just 1.6%. Meanwhile, the upcoming Personal Consumption Expenditures (PCE) price index, a key inflation measure for the Federal Reserve, had a concerning outlook.

Prices in the first quarter of 2024 saw a significant rise to 3.4% after a 1.8% increase in the last quarter of 2023. The slowdown in economic growth combined with ongoing inflation may reflect the Fed’s reluctance to lower interest rates as previously indicated.

Stagflation and Crypto

In the US, despite all the negative outlook, all may not be lost for cryptocurrencies. The US government’s financial strategy, utilizing the Treasury General Account (TGA) and Reverse Repo Program (RRP), could facilitate an influx of over one trillion dollars in liquidity into the financial structure.

This potential cash flow in the market could contribute to risk assets, including cryptocurrencies. On the other hand, the much-anticipated trading date of Bitcoin exchange-traded funds (ETFs) in Hong Kong on April 30th also seems to create optimism. These ETFs, particularly in the Asian region, could enable investors to return to the crypto market.

However, the pressure on Chinese investors wanting to invest in these ETFs could also reduce the overall impact.

Türkçe

Türkçe Español

Español