The cryptocurrency market has been under selling pressure over the past few weeks, with Bitcoin (BTC) and several top-tier altcoins experiencing a downturn. Developments in the macro sphere and the ongoing uncertainties related to the U.S. debt ceiling crisis seem to be fuelling the selling pressure on cryptocurrencies. However, the data indicates that it might be time to buy, especially for altcoins and Bitcoin.

Investors Should Buy FUD, Not the Dip

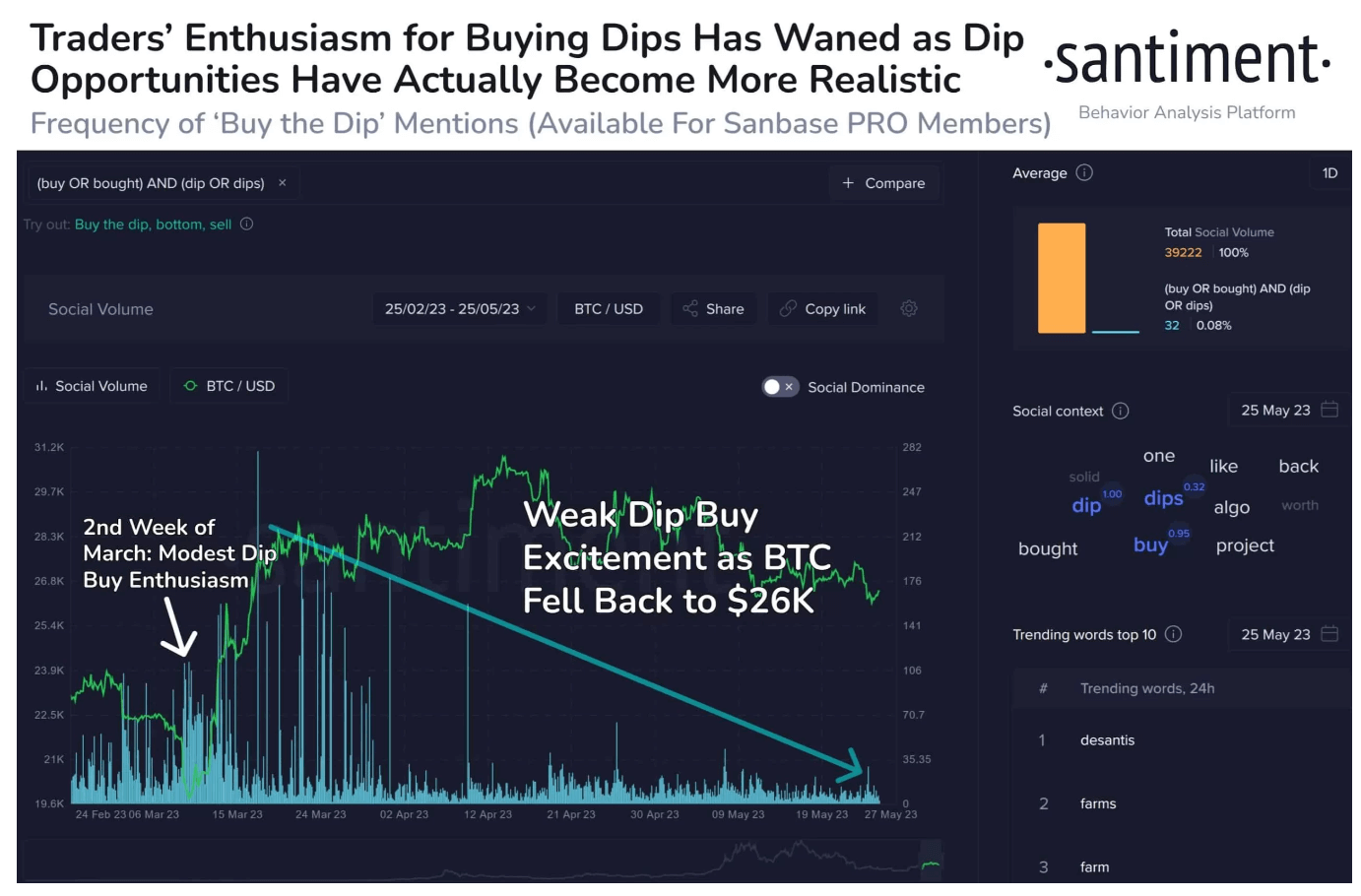

On-chain data provider Santiment reported that as dip opportunities become more realistic, investors’ enthusiasm for buying the dip has waned. In its recent announcement, Santiment stated, “We face a common paradox where investors buy short-term, minor price dips in cryptocurrencies but are afraid to purchase larger, longer-term ones. Phrases like ‘buy the dip’ or ‘I bought the dip’ are no longer in use. Historically, it has always been beneficial to capitalize on such FUD.”

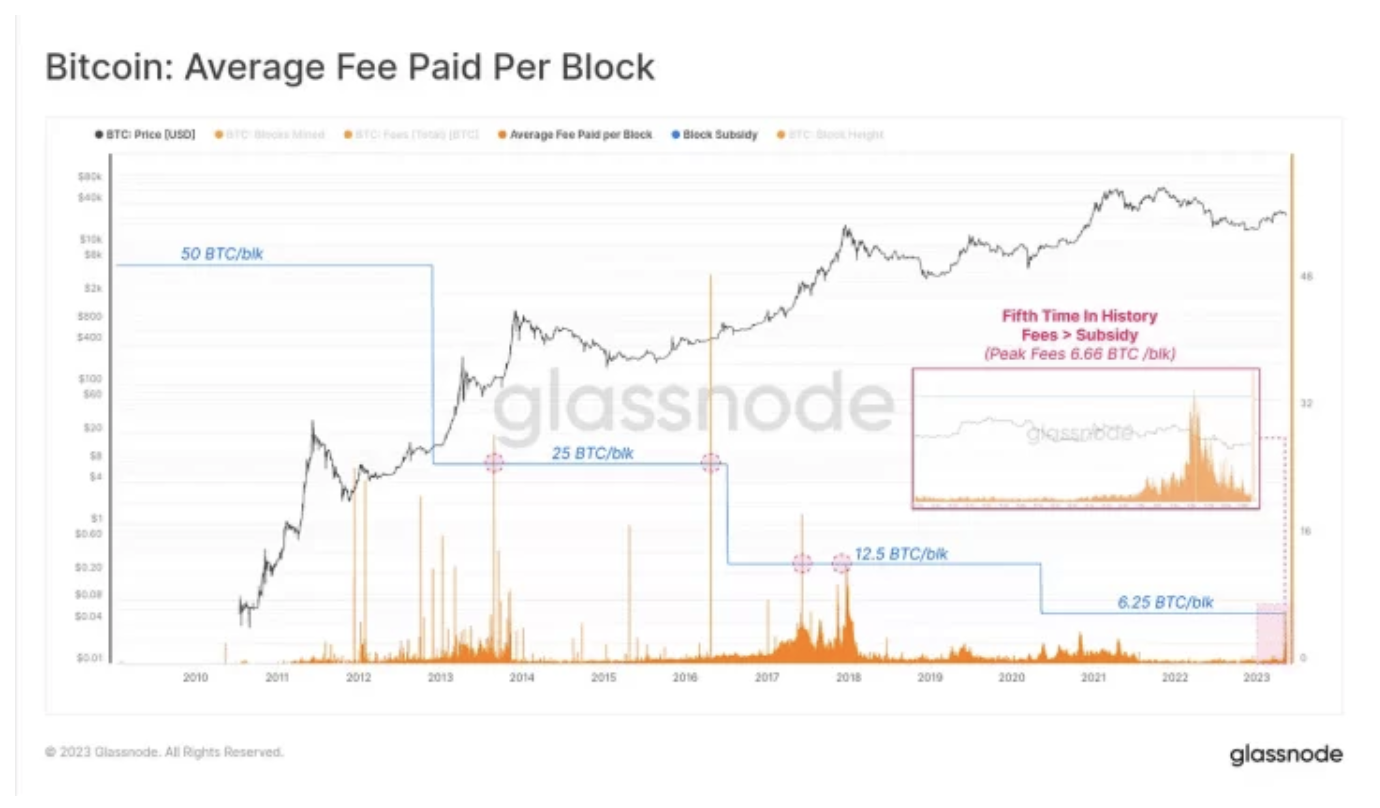

On the other hand, it is observed that Bitcoin miners have been increasing their assets since the first day of May. Data from the crypto data platform Glassnode indicates that miners increased their BTC balance by as much as 8,200 BTC after the collapse of the FTX exchange, and their total BTC assets are nearing 80,000 BTC. In addition, Bitcoin miners earned a total of 12.9 BTC per block as mining rewards throughout May. Only for the fifth time in history, the fee income of Bitcoin miners exceeded subsidies.

Flash Buy Signal Lit For Altcoins

As Bitcoin’s price continues to remain under selling pressure, it is observed that investors’ attention is shifting towards altcoins. In an evaluation of the situation, Santiment stated, “While the markets seem boring for investors, we continue to see restless addresses emptying their wallets and selling at a loss. Our MVRV model shows that the vast majority of altcoins are giving buy signals from the dip across the sector.”

Leading market experts, in addition to data, emphasize that it’s time to buy altcoins. Famous crypto analyst and EightGlobal founder Michael Van De Poppe tweeted a few days ago, saying, “It’s time to accumulate for altcoins. Just like a year before the previous halving, it’s time to buy now,” sharing a graph showing the dominance chart of altcoins in the market (excluding Bitcoin and Ethereum) and indicating that the altcoin market has now hit rock bottom.

Some altcoins, such as Litecoin (LTC), have already started to show strength. The LTC price has risen above $90 due to the bullish momentum caused by the upcoming block reward halving event following the recent pullback.

It is really good