The crypto market has experienced a sharp sell-off in the last 24 hours, with the global crypto market value falling from $2.57 trillion to $2.29 trillion, a drop of more than 2%. Bitcoin (BTC) and Ethereum (ETH) prices saw a 15% decline within a five-hour period, while other altcoins such as Solana (SOL), BNB, XRP, and Cardano (ADA) also drew attention with their value losses. Amid the meme coin frenzy, Dogecoin (DOGE) and Shiba Inu (SHIB) prices also suffered drops of over 10%.

Bitcoin Miners Initiate Sell-Off

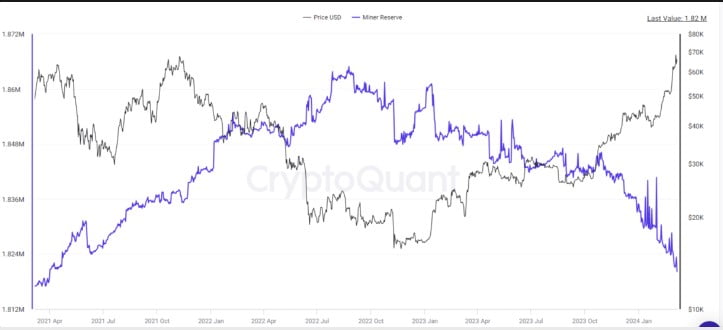

The sharp sell-offs in Bitcoin occurred shortly after BTC’s price surpassed its all-time high (ATH) level of $69,200. Onchain data from CryptoQuant regarding Miner Reserve and Miner to Exchange transfers indicated that a significant amount of BTC was moved to exchanges.

As a result of these transactions, the Bitcoin price fell approximately 15% from its peak level of around $69,200 to $59,323 in the last 24 hours. The reserve held by BTC miners also decreased to 1.82 million, returning to its 2021 level.

Moreover, it was observed that 1,000 BTC, which had not been moved since the Satoshi era and was worth $69 million, was transferred to Coinbase. These notable transactions were conducted by accounts associated with Bitcoin mining. As the Bitcoin halving approaches, the selling pressure from miners is steadily increasing.

Bitcoin miner sell-offs are also being accompanied by whales, and according to data disclosed by Whale Alert, large amounts of BTC, ETH, XRP, DOGE, SHIB, LTC, MATIC, and other altcoins have been transferred from wallets to crypto exchanges. Whales and market makers have been notable for securing significant profits during the recent rallies.

Liquidations Surpass $1 Billion

A general decline in the crypto market has also been noteworthy. Following BTC’s price reaching a new ATH, liquidations resulted in a loss of over $200 billion in market value.

Data provided by Coinglass revealed that the approximate value of these liquidations was $1.10 billion, with more than 297,000 investors being liquidated in the last 24 hours. The largest single transaction liquidation of XBTUSD, valued at $9 million, occurred on the crypto exchange BitMEX.

Approximately $820 million worth of long positions and $235 million worth of short positions were liquidated, with Bitcoin and Ethereum leading the list with over $309 million and $185 million in liquidations, respectively.

Macro Factors Affecting Bitcoin

On the other hand, Fed officials in the United States seem to be adopting a cautious approach regarding interest rate cuts, indicating that the first rate cut may be postponed to the second half of the year.

Fed Chairman Jerome Powell’s testimony to the House and Senate committees is expected to provide investors with clearer ideas as mixed inflation data continues to emerge.

CME FedWatch Tool suggests that a rate cut in June is within the realm of possibility following recent economic data. However, according to Wall Street, the first rate cut is projected to occur between July and September.

Türkçe

Türkçe Español

Español