Cryptocurrency Market is gearing up for a critical week shaped by various macroeconomic factors and market trends. These include the anticipated approval of the spot Ethereum ETF by the U.S. Securities and Exchange Commission (SEC) and various economic indicators.

Events This Week Could Trigger a Rally in the Crypto Market

According to experts, the cryptocurrency market is preparing for a potential rally with the expectation of several positive announcements. One significant factor is the U.S. 2nd quarter GDP growth, expected to rise from 1.4% to 1.9%. Economic conditions generally affect investor sentiment in the crypto market, and this economic improvement is expected to have an upward impact on the crypto market.

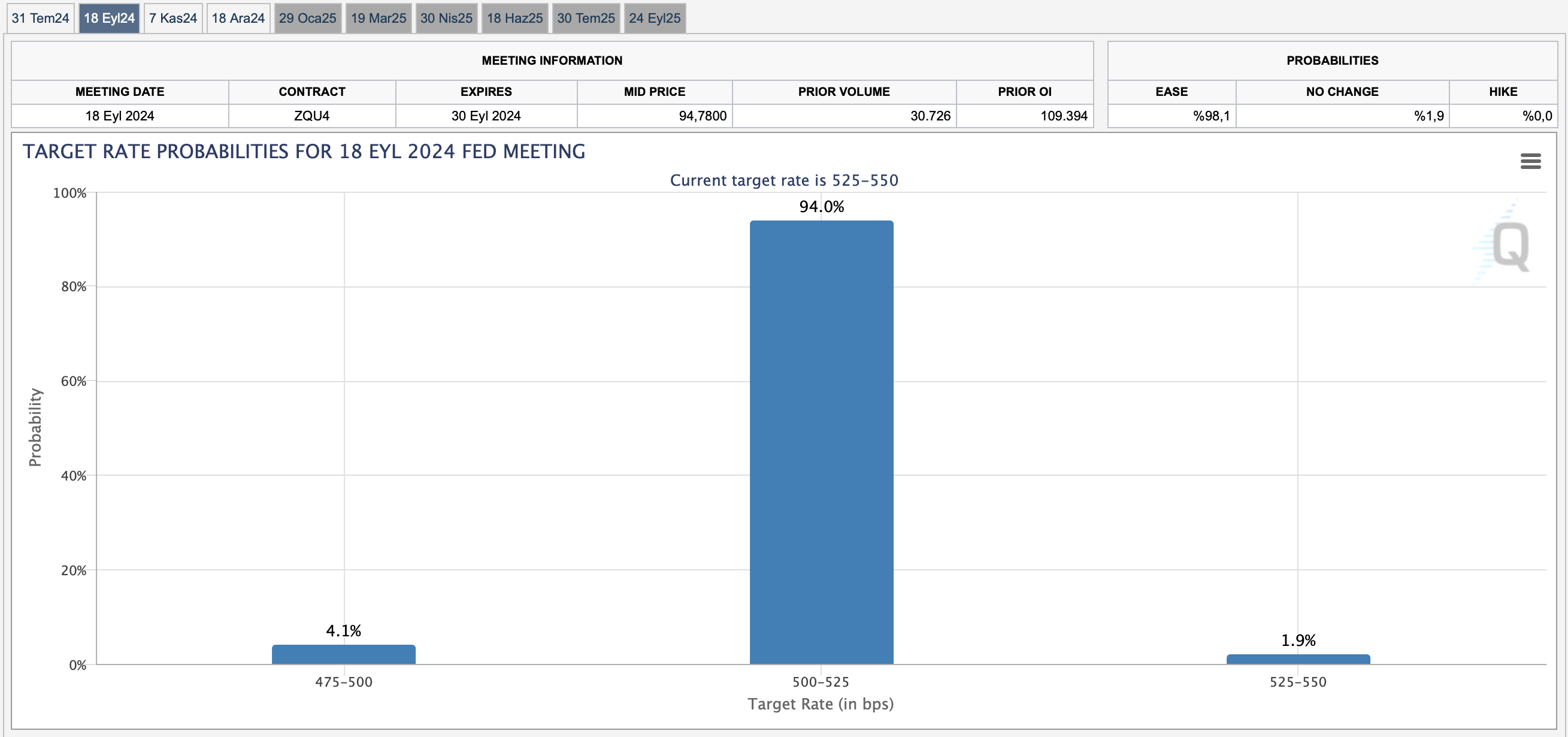

The upcoming GDP data will be critical in aiding the central bank’s potential policy rate change decisions. Current predictions from the CME FedWatch Tool indicate a rate cut in September. However, the actual GDP data will likely play a decisive role in the Fed’s actions and affect broader financial markets, including cryptocurrencies. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Another important economic indicator to watch this week is the U.S. PCE inflation data. Investors will closely monitor these figures to gauge the Fed’s stance on rate hikes. While recent cooling in U.S. CPI data suggests a dovish approach, higher-than-expected PCE data could indicate potential rate hikes, exerting negative pressure on the crypto market.

Moreover, the Bitcoin Conference happening this week is expected to significantly impact the crypto world. U.S. presidential candidate Donald Trump is expected to speak at the event, with speculations that he might make a significant announcement regarding Bitcoin as a reserve asset for the U.S. Such an announcement could act as a catalyst, potentially boosting Bitcoin’s price and positively affecting the overall crypto market.

One of the most important events this week is the final approval of spot Ethereum ETFs by the U.S. SEC. Experts believe that at least one spot Ethereum ETF could start trading on July 23, 2024, potentially fueling a rally in the crypto market. This approval would mark a significant milestone reflecting increased institutional interest and confidence in ETH, thereby boosting market sentiment.

Optimistic but Cautious Outlook for Bitcoin and Altcoins

Overall, the market outlook remains optimistic, with multiple factors coming together to potentially boost Bitcoin and altcoins. However, given the inherent high volatility of the crypto market, investors are advised to exercise due diligence before making investment decisions. The convergence of economic data releases and significant market events this week makes it crucial for investors to stay informed and cautious.

This week promises hope for Bitcoin and altcoins due to both macroeconomic indicators and significant events, but as always, the unpredictable nature of the market necessitates careful evaluation and strategic investment planning.

Türkçe

Türkçe Español

Español