Since the first day of April, the sentiment in the cryptocurrency market has been nothing but fear. During this period, it was observed that many currencies, including Bitcoin, experienced a decline of over 5%, and many are currently facing extreme overselling, which could be a signal to “buy the dip”.

Cryptocurrencies and the RSI Indicator

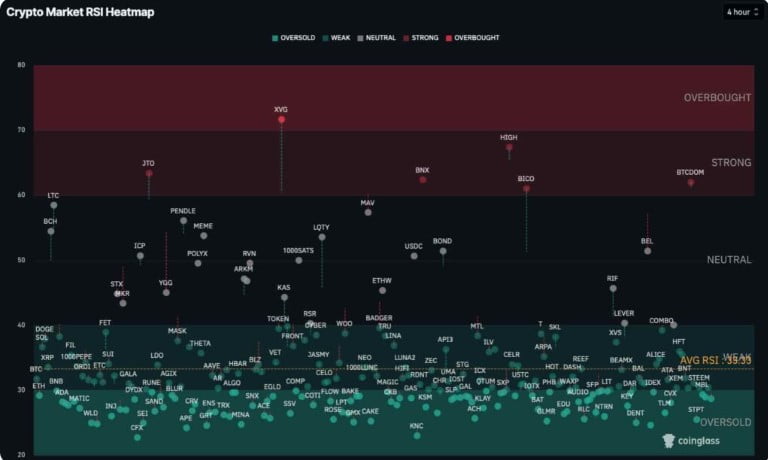

With a surprising turn of events, the outlook for cryptocurrencies shifted from a clear rise to a decline within a few days. According to data provided by CoinGlass, the overall Relative Strength Index (RSI) once again demonstrated this with a 4-hour average of 35.33 RSI.

Currently, many cryptocurrencies are positioned between weak and extreme oversold conditions in the 4-hour momentum outlook, which could lead to two possible scenarios:

Firstly, this could indicate a reversal of the general trend and bring a dominance of decline moving forward. However, the recent drop could also present buying opportunities for medium and long-term investments, which cautious investors might interpret as a buying signal.

Will Near Protocol (NEAR) Rise?

Amidst these developments, one of the cryptocurrencies fitting the description is Near Protocol (NEAR). NEAR was reflecting one of the most promising buying signals according to this technical indicator.

Despite its solid fundamentals and strong growth projected for 2024, NEAR lost 6.21% of its value in this downturn and is trading at $6.30. The token currently has a 4-hour RSI of 31.35, while it shows a daily RSI of 47.46.

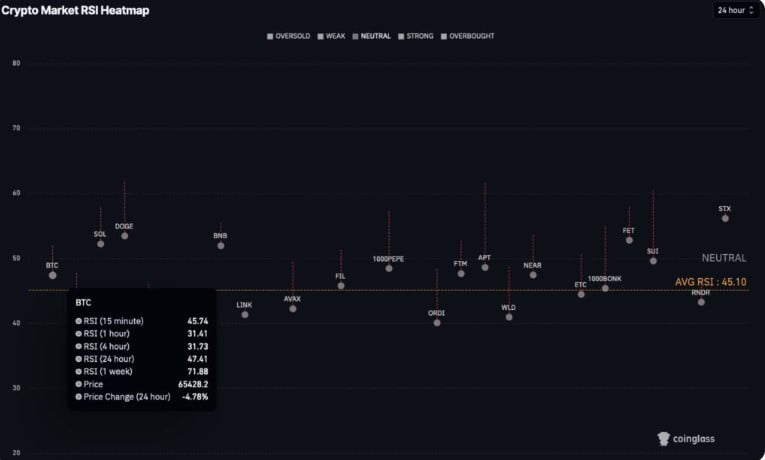

NEAR’s RSI level is above the daily average of 45.10, which indicates the crypto market’s average.

Is Bitcoin Overly Sold?

Bitcoin (BTC) is also exhibiting a similar outlook to Near Protocol and reflected a strong potential sell signal in the current downturn. The leading cryptocurrency displayed a 4-hour and daily Relative Strength Index of 31.73 and 47.41, respectively.

Bitcoin retreated to $64,428 after losing 6.78% of its price in the last 24 hours but later recovered slightly and rose above the $65,700 level.

On the other hand, the RSI condition indicating overselling may not always work as accurate data. Understanding this extreme weakness indicator is crucial for investors who want to make purchases based on the signal.

Türkçe

Türkçe Español

Español