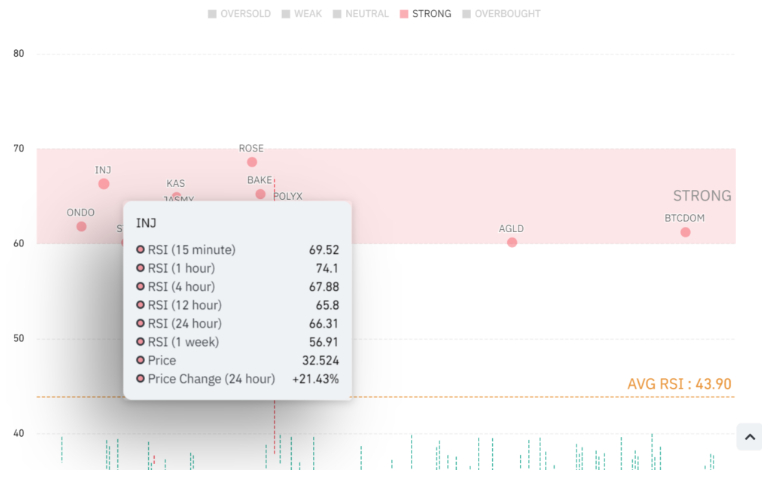

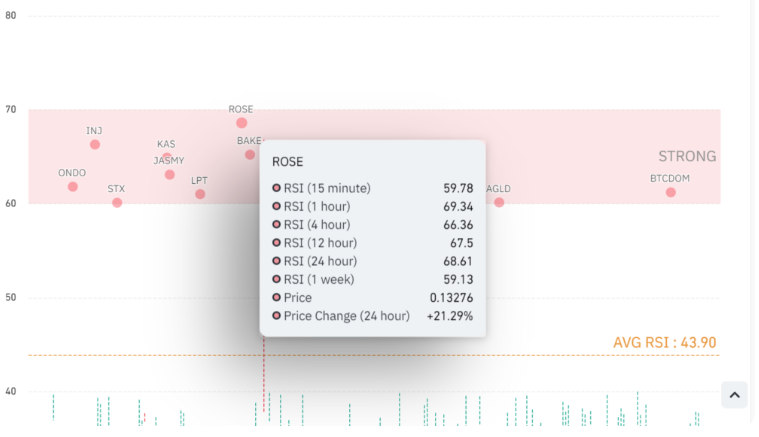

The cryptocurrency market showed signs of recovery after the positive Consumer Price Index (CPI) data. Meanwhile, two cryptocurrencies caught investors’ attention today. The Relative Strength Index (RSI) heatmap from CoinGlass on June 12 reflected significant data. The average RSI value of the market remained near neutral-50, indicating whether cryptocurrencies might move up or down. As of the time of writing, the average daily RSI value was 43.90, reflecting the latest market outlook. So, which two cryptocurrencies stood out?

Injective (INJ) Comments

Injective (INJ) will be the first cryptocurrency we examine. The recent performance and technical indicators of INJ clearly show buy signals. The 24-hour RSI value of INJ is 66.31, supported by a notable 21.43% price increase. This indicates a significant buying pressure for INJ, which may continue the upward trend.

When the time frame is narrowed, especially between 15 minutes and 12 hours, the RSI value remains above 60. This shows that investors clearly evaluate INJ. As of the time of writing, INJ trades at $31 after a rise of over 17%. The market cap surpassed $2.8 billion, while the 24-hour trading volume exceeded $326 million, indicating a 33% increase.

Oasis (ROSE) Latest Status

On the other hand, looking at Oasis (ROSE), the 24-hour RSI value is 68.61, with a 9% price increase showing a clear performance during BTC’s decline. ROSE also shows a stable RSI over different time frames, reflecting the existing buying pressure. Despite BTC’s decline, this situation indicates market confidence.

The weekly RSI value of ROSE is 59.13, indicating a positive outlook and highlighting ROSE’s growth potential. As of the time of writing, ROSE was trading at $0.13.

Despite all the data, it’s important to remember that RSI alone cannot be a buy-sell indicator. Events like today’s CPI data and interest rate decisions can always have significant impacts on the market.

Türkçe

Türkçe Español

Español