The crypto bull market is in full swing. Recently, Bitcoin surged to $68,000 but experienced a slight pullback. Nevertheless, investors worldwide continue to inject capital into the market, driving the impressive rally.

Current State of the Crypto Market

Amid these developments, the global crypto open interest reached an all-time high of $47.43 billion as of Sunday. According to data provided by Coinalyze, there are currently $44.56 billion worth of open trades in the derivatives market, which can consist of either long or short positions, thus creating a liquidity pool and increasing volatility.

Coinalyze reported a surge of over $3 billion in open positions within 24 hours, supporting Bitcoin‘s (BTC) rise from $61,000 to $68,000, aiming for its all-time high of $69,000.

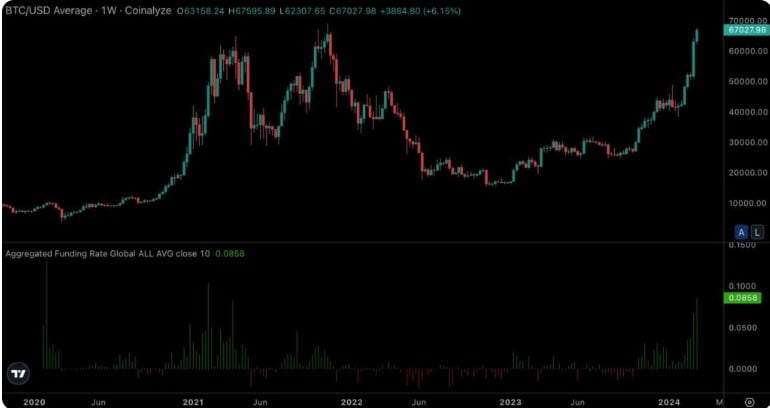

Similar funding rates to those seen in the ATH year of 2021 indicate a bullish open interest trend as Bitcoin reached its all-time high. Interestingly, a positive funding rate is emerging due to a shift in open positions towards long positions.

As of the time of writing, the total funding rate has returned to the 2021 level of 0.0858, which increasingly supports a bullish sentiment for Bitcoin.

The Future of Bitcoin

However, this imbalance, caused by the opening of long positions, has created significant liquidation zones in the lower region due to traders’ liquidation prices. Consequently, BTC and most cryptocurrencies face the threat of a near-term squeeze that could trigger a short-term decline.

This scenario could be supported by looking at CoinGlass‘s liquidation heat map, which shows a region at $50,000 with over $3 billion in estimated liquidations.

In summary, the highest open interest rate of all time brings increased capital inflow to the crypto market but also continues to come with risks and high costs. This influx, which brings long positions, could also open the door to imbalances that savvy traders and market makers can exploit.

For Bitcoin, this could mean a pullback of approximately 25% from $67,000 to $50,000, which could be a common correction seen in past bull cycles.

Türkçe

Türkçe Español

Español