Cryptocurrencies continue their volatile trend after the Fed meeting, and the current situation is favorable for the crypto market on a macro level. Today’s data was positive, with comments from Barkin of the Fed expressing satisfaction with the loosening of the labor market. As of the time of writing this article, BTC is trading at $34,600, and altcoins may be on the verge of a new rally.

Ripple (XRP) Analysis

After testing the $36,000 resistance level, the Bitcoin price dipped back to $34,000. Corrections following resistance tests are quite normal and not surprising for investors. Now, the price has started to recover from the support zone, and if it can sustain this momentum, a new bullish period for altcoins could begin.

However, the expected major rally for Ripple (XRP) did not materialize with the SEC dropping charges against top executives on October 19. Although the price briefly surpassed $0.6, it was largely triggered by the double-digit increase in BTC’s price. So, what do on-chain data say about XRP Coin?

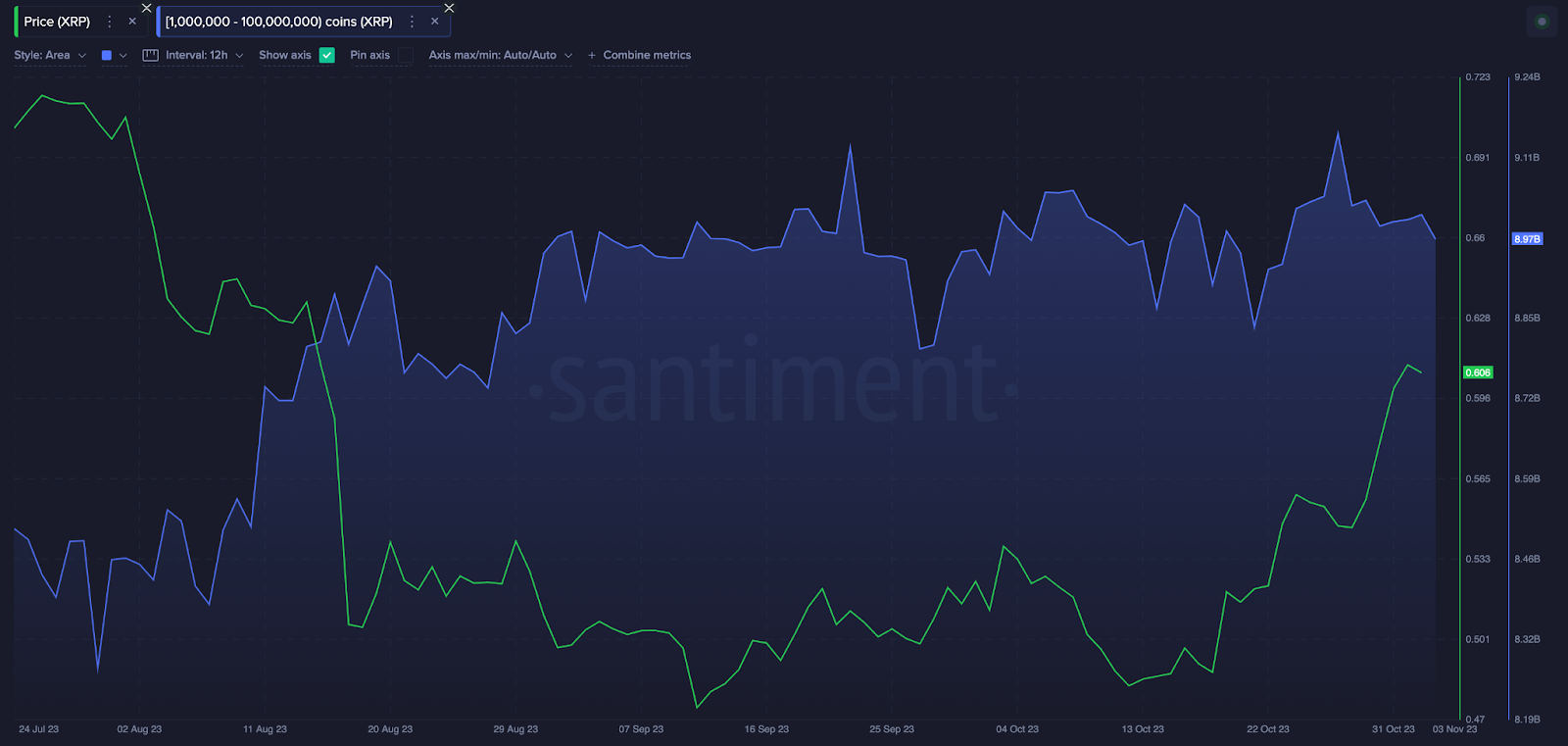

According to Santiment data, whales with balances ranging from 10 million to 100 million XRP accelerated their purchases between October 21 and November 2. During this period, the size of their purchases increased to 80 million XRP.

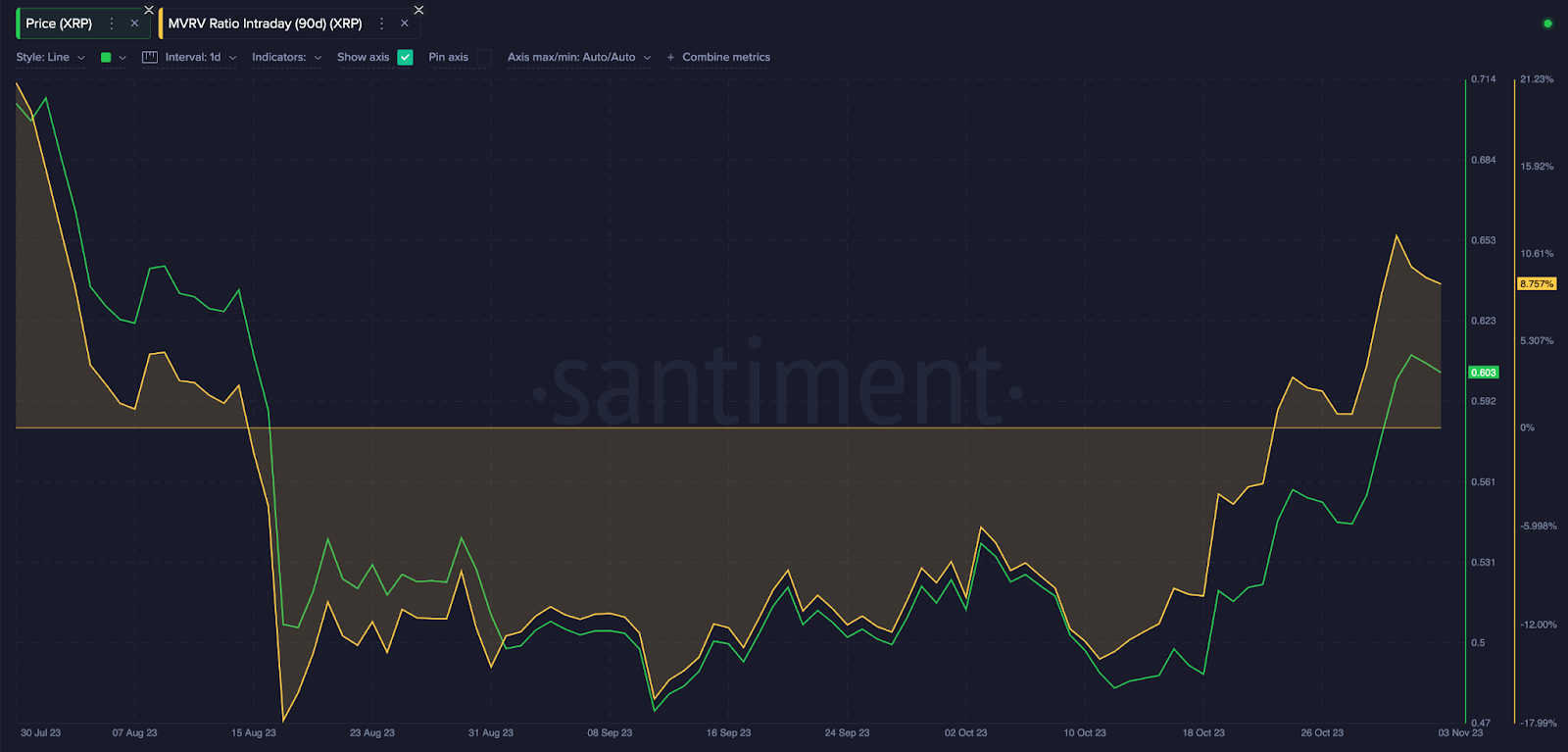

The MVRV ratio suggests that investors who bought XRP in the past 90 days could make a profit of nearly 9% if they sell at the current price. However, this is a risky move as sudden drops in BTC’s price could prompt short-term investors to rush to secure their gains.

XRP Coin Price Prediction

The RSI is in the overbought zone, and it does not seem possible for the price to break through $0.65 without strong and sustained demand. Therefore, if BTC does not enter a serious recovery phase and retest the $36,000 resistance, the current volatile trend could lead to a decline to $0.55 in the short term.

The market sentiment remains positive due to the ongoing decline in US Treasury yields. There is no significant weakening in institutional demand, and at least for BTC, the current outlook suggests further potential for growth. If the bulls of XRP Coin also come into play during this period, a rapid test of $0.732 could be seen on closes above $0.65.

As the price approaches $0.62 on the daily chart, selling pressure becomes evident. Closes above this level could indicate an early bullish signal.