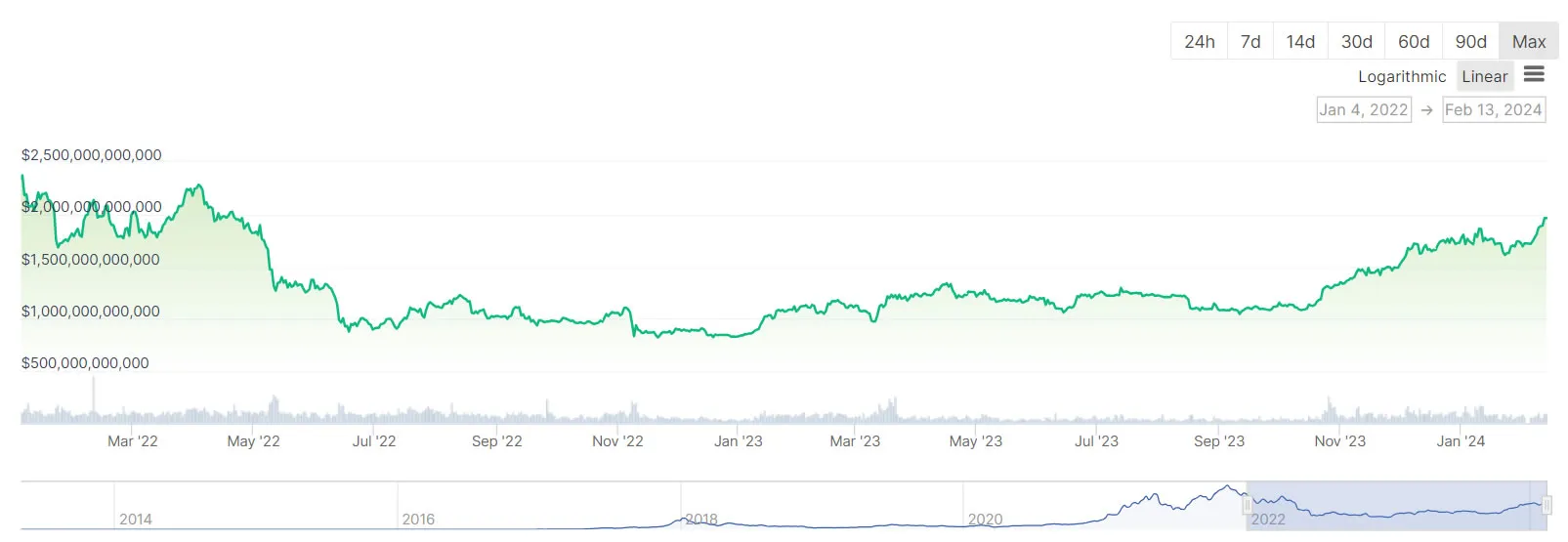

Crypto markets have reached nearly two-year highs as total capitalization approaches $2 trillion. Bitcoin‘s surge past $50,000 this week has bolstered them, providing analysts with ample material to speculate why this bull run scenario might be different.

Peak Performance in Crypto Markets

The crypto market’s capitalization has reached its highest level since April 2022, which is $1.97 trillion. During the mentioned period, crypto markets were falling from their November 2021 peak of $3 trillion and entering a bear market territory. This time, they are emerging from a two-year crypto winter and possess many fundamental factors not seen in previous cycles. On February 12, Daniel Cheung, co-founder of Syncracy Capital, stated that there is a high probability that this bull cycle could result in:

The largest market value creation and lasting longer than expected.

Potential Effects of the Fed on Bitcoin

The expert also noted that for the first time, the bull market is aligning with the beginning of the Fed’s expansion cycle. The US central bank is struggling to keep inflation low and reduce interest rates after two years of aggressive hikes.

Crypto markets remain in a “buy the dip” mentality unless there is a serious macro shock. There is also a lack of individual interest, which could mean that things are still early. This year, numerous narratives and sub-sectors are emerging in crypto. These include artificial intelligence technology, real-world asset tokenization, re-democratization, and more. The expert also anticipated a more positive regulatory approach considering BlackRock’s entry into the ecosystem. Cheung mentioned that these factors could help:

Assist in creating sustainable wealth among investors in the asset class.

Türkçe

Türkçe Español

Español