As this article was prepared, the IMF board advised El Salvador against acquiring more BTC, while BTC was trading at $85,690. Recent Federal Reserve statements have provided much-needed support for the markets. Additionally, with the approach of April 2, a balance is expected against fears fueled by tariffs. All these factors may pave the way for an upward trend in cryptocurrencies. What predictions can we make for XRP, AVAX, DOGE, and FLOKI Coin?

XRP and AVAX Price Predictions

Today, Ripple  $3’s CEO announced the conclusion of the appeal process with the SEC. We will soon witness the SEC taking official steps. Therefore, while XRP Coin’s price has risen by 10% daily, we have not seen a sell-off. The good news is that this step taken by the SEC in Ripple’s case challenges the notion that all altcoins are investment contracts.

$3’s CEO announced the conclusion of the appeal process with the SEC. We will soon witness the SEC taking official steps. Therefore, while XRP Coin’s price has risen by 10% daily, we have not seen a sell-off. The good news is that this step taken by the SEC in Ripple’s case challenges the notion that all altcoins are investment contracts.

A scenario for XRP Coin’s price was anticipated. Just a few days ago, we had predicted the conclusion of the appeal process before April 16, and it has come to pass, leading to an uptick in prices. Now, XRP bulls need to reclaim the support at $2.64 to continue the rally towards $2.84.

If this threshold is surpassed, we can expect renewed demand for a new all-time high with the psychological support of $3.

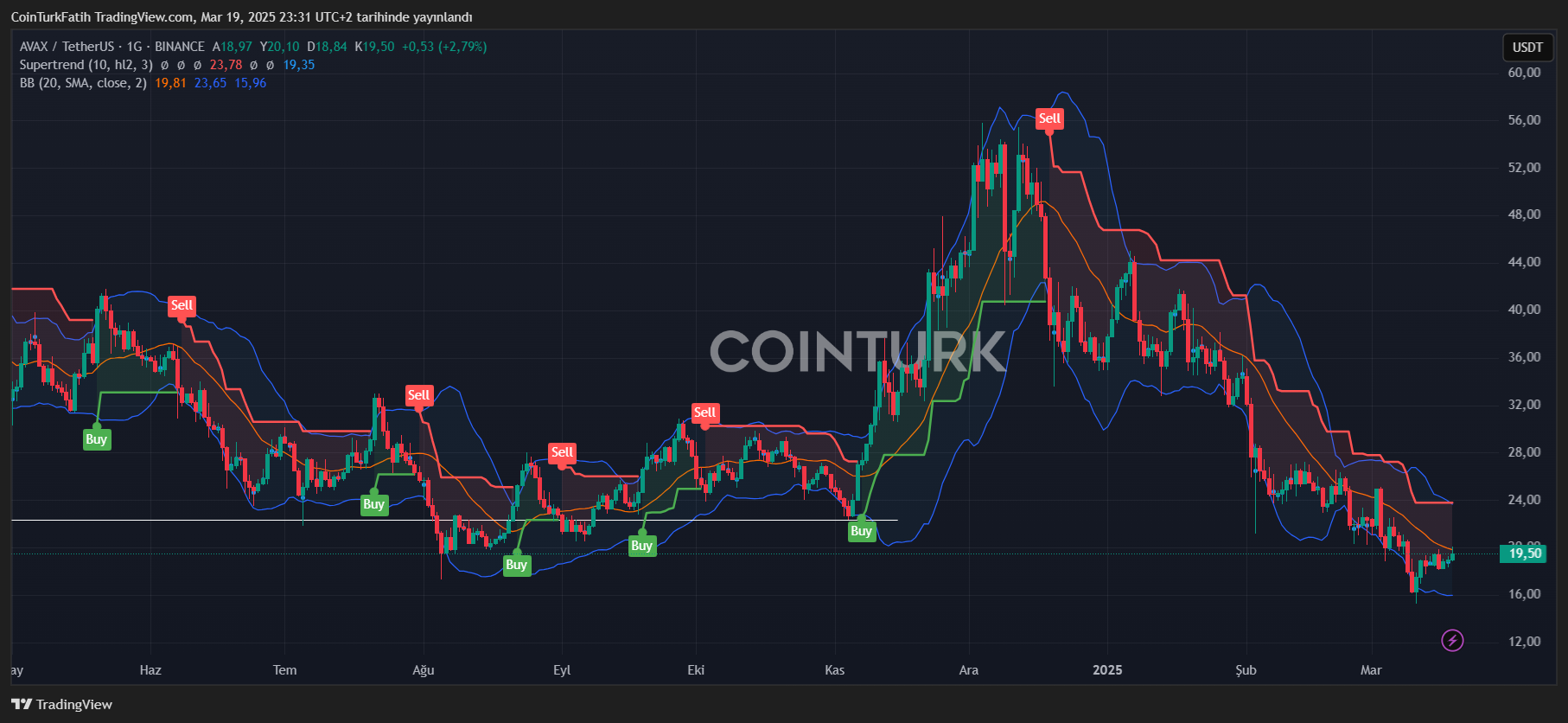

We had warned of the $15.5 level for AVAX as the decline accelerated, and after testing this area, the price began to recover. The critical point for upward momentum is $22.3, and it is essential to surpass this level soon to target the range’s peak at $33.

DOGE and FLOKI Coin

Following justified resentment triggered in recent weeks, DOGE has settled at the $0.15 support level. During this time, the SEC’s announcement that meme coins are not securities went unnoticed, which could have implications for future pricing.

If investors are becoming smarter, we should see liquidity being attracted to more established meme coins rather than gamble chips valued at a few thousand dollars. For DOGE, the goal is to close above $0.18 to reclaim $0.22.

FLOKI Coin remains indifferent, hovering close to the $0.0000543 support level, significantly lower than last year. This indicates the effects of excessive selling. With an overall market sentiment recovery, opportunistic traders may aim for a rise targeting $0.0001142.

Türkçe

Türkçe Español

Español