Recent news from Iran has led to a decline in cryptocurrency prices over the past 24 hours, while Bitcoin (BTC)  $91,967 shows signs of recovery. At the time of writing, Bitcoin was attempting to reclaim the crucial level of $71,500. Although altcoins have shown weak gains, the day continues on a positive note. What are the predictions for cryptocurrencies?

$91,967 shows signs of recovery. At the time of writing, Bitcoin was attempting to reclaim the crucial level of $71,500. Although altcoins have shown weak gains, the day continues on a positive note. What are the predictions for cryptocurrencies?

Bitcoin (BTC) as a Store of Value

CarldBMenger emphasized today why Bitcoin is the best store of value. In this regard, Bitcoin must reach a greater number of cryptocurrency enthusiasts in the long run. The renowned commentator suggested memorizing 12/24 words to avoid the hassle of carrying heavy gold bars, as banks cannot seize it, and as long as you have your wallet key in mind, you can carry your money anywhere.

Consider the wars. The anticipated onset of a third world war poses significant concerns. Will people bury their wealth in safe locations to evade enemies, as they did in previous centuries? Will they hide their gold by melting it down into other utensils?

Comments on Cryptocurrencies

The recent U.S. data was not significantly beyond expectations. The Non-Farm Payrolls were announced at 12K, likely affected by disruptions in data collection due to major hurricanes impacting the country. We should see revisions in the upcoming report. Average hourly earnings came in as expected month over month.

The unemployment rate did not exceed the anticipated 4.1%. The Fed should continue to lower interest rates, as the data keeps recession concerns in check. Despite ongoing cuts for months, it is essential to ensure that recession risks do not emerge since both indicate downturn signals.

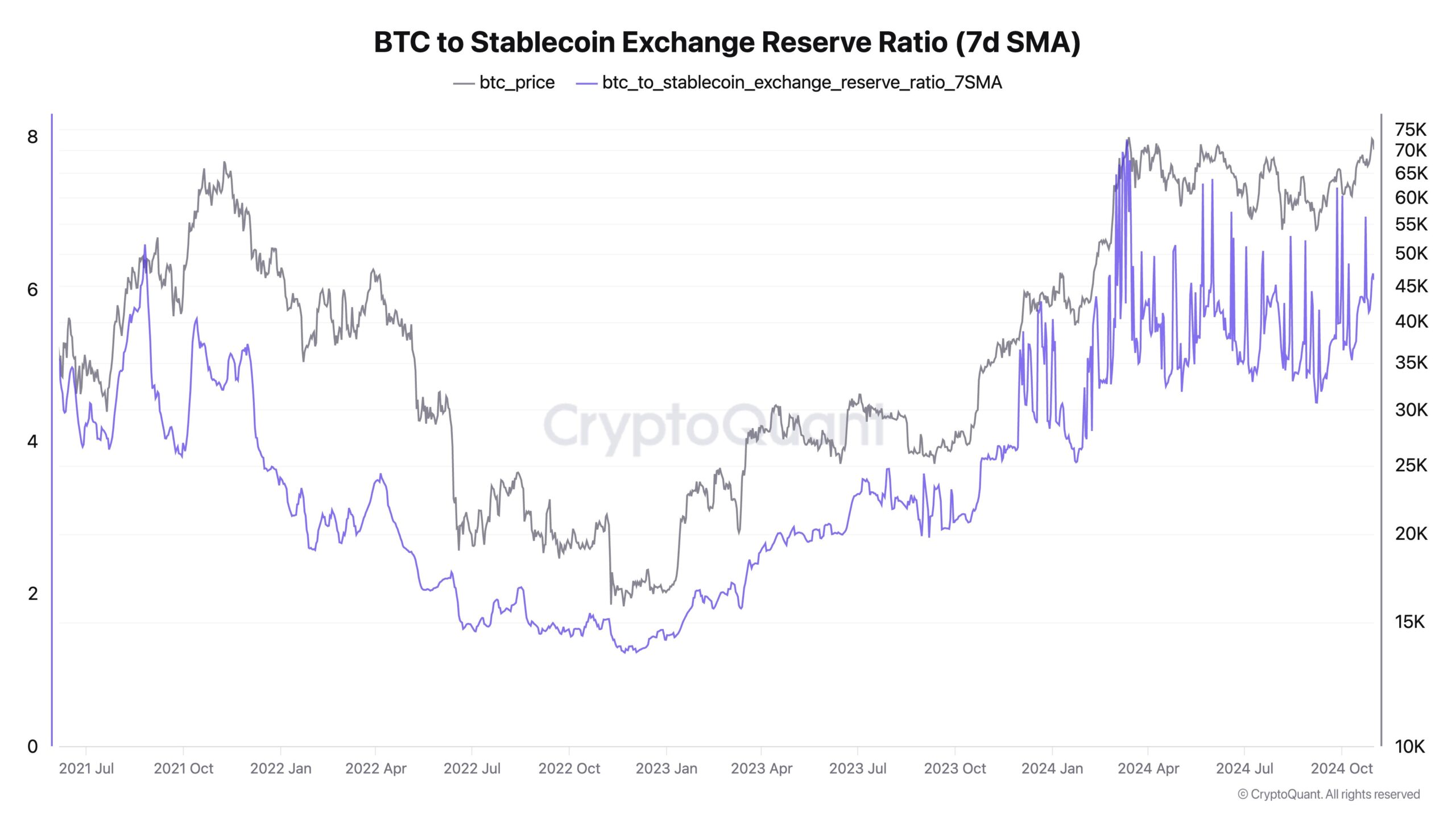

Young Ju mentioned today that the excessive focus on stablecoins is influencing Bitcoin’s rise. Unlike previous cycles, inflows from Coinbase USD and the ETF channel are becoming increasingly impactful on prices.

“Stablecoins alone cannot provide sufficient buying-side liquidity for Bitcoin. The BTC-stablecoin ratio is 6.05, meaning BTC reserves are six times higher than stablecoins compared to the last ATH. ETF flows and Coinbase USD liquidity will be crucial in the coming months.”