As we reach the end of the first quarter, altcoin traders have yet to see the outcomes they desired. Ongoing uncertainty in cryptocurrencies has brought new lows, with hopes rising for a market recovery in the coming three months. However, if this does not happen, the “sell and go on holiday” strategy could yield negative results by May.

Significant Developments in Cryptocurrencies

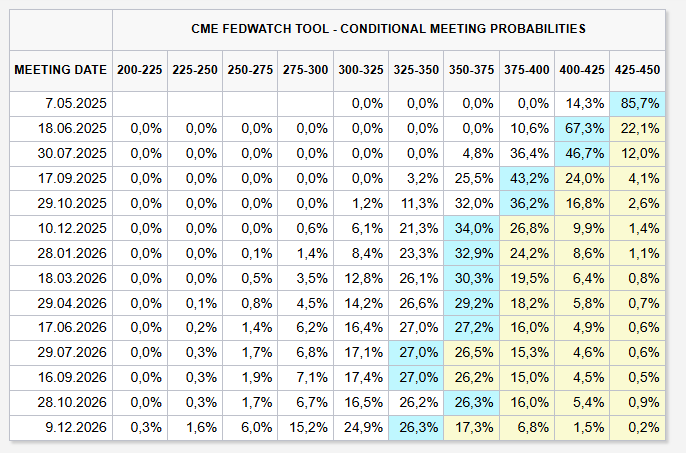

As usual, we discuss the expected significant developments in the cryptocurrency market today. Recently, we received positive signals regarding tightening during the Fed meeting. The statements suggesting a slowdown in tightening indicate that more supportive remarks could emerge in the May meeting for risk markets.

It was unexpected for cryptocurrencies to perform this way during the quarter when Trump took office, as he made a very aggressive start. His trade war against allies such as the EU and China has triggered justified fears.

As uncertainties are expected to decrease by April 2nd, we will likely see increased loosening priced into cryptocurrencies as we move into May. This is the optimistic scenario. So, what are the key developments expected in the cryptocurrency market over the next seven days?

Key Events on the Horizon

Data regarding the current situation of the U.S. economy will be revealed. The first three days of the week are expected to be relatively calm, but further volatility could arise following the data released on Thursday and Friday. With only a short time until April 2nd, it will be prudent for investors to closely monitor any last-minute developments.

The current market expectation for loosening is evident above. There are 45 days until the next Fed meeting.