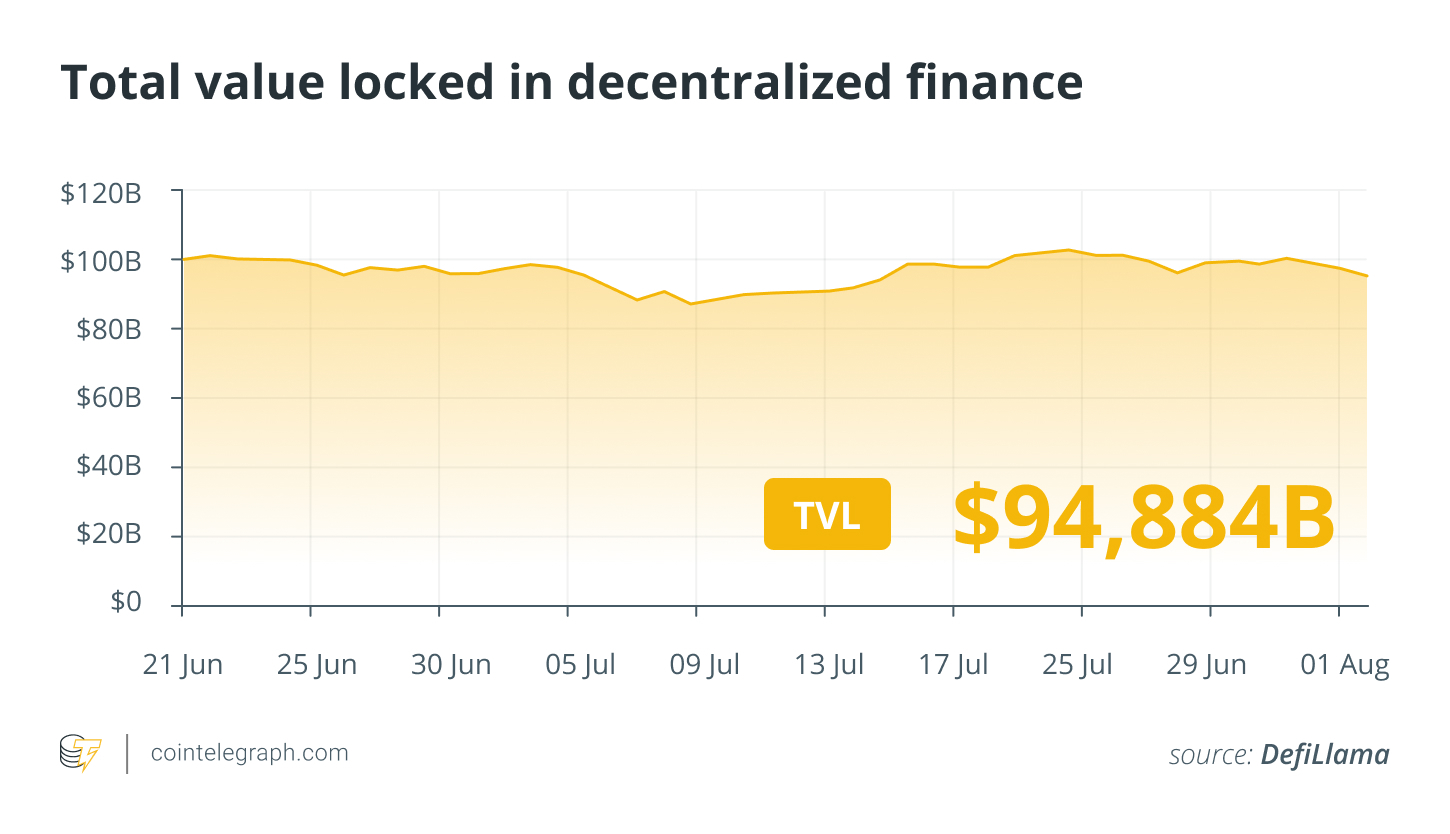

In the coming period, renewed interest in cryptocurrencies may arise from large holders or whales positioning themselves for the next potential altcoin rally through strong buy walls for the anticipated altcoin demand. The decentralized finance sector is also experiencing a revival as active DeFi loans have surpassed $13.3 billion, a level not seen since 2022.

Important Statements from the Founder of CryptoQuant

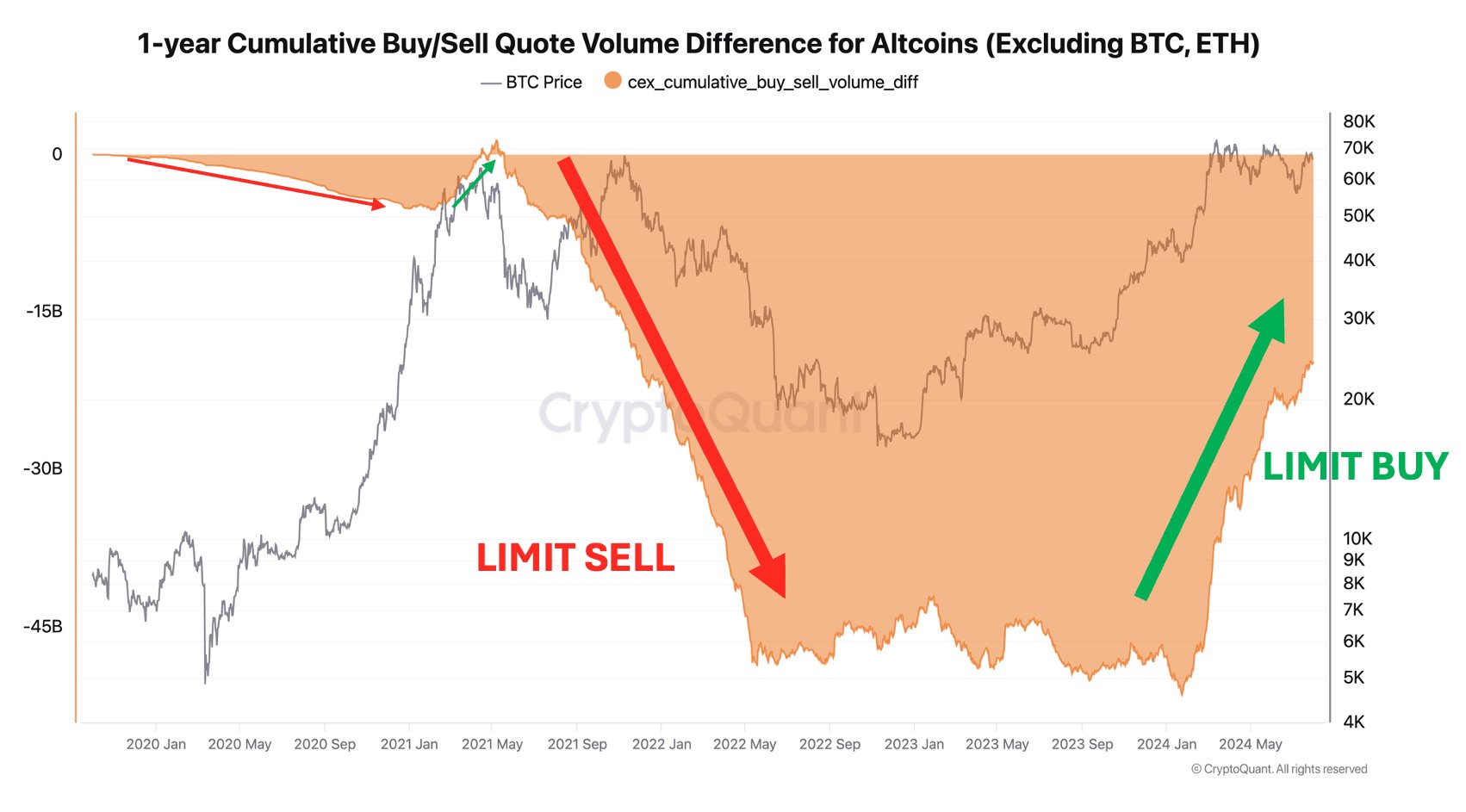

CryptoQuant founder Ki Young Ju believes that crypto whales are positioning themselves in anticipation of the next altcoin rally during a period when investors are having heated discussions about when the altcoin season will start. Ju’s analysis focused on the one-year cumulative buy/sell bid volume difference for altcoins, a data metric that measures the difference between buy and sell limit orders over a one-year time frame.

The analyst explained that whales prefer limit orders to avoid slippage, and the rise in the metric level indicates an increasing number of buy limit orders among large crypto investors and institutions, representing strong buy walls for future demand for altcoin projects.

Significant Step from the Morpho Labs Team

The decentralized finance protocol Morpho Labs recently raised $50 million following a revamp in its operations. The round was led by Ribbit Capital with participation from a16z Crypto, Coinbase Ventures, Variant, Pantera Capital, Kraken Ventures, and other investors. Previously, Morpho Labs had raised $23.6 million in multiple funding rounds, including an $18 million Series B funding round led by a16z and Variant in 2022.

The funds will be used to support the recently launched Morpho Blue, a permissionless lending protocol that allows organizations to create and manage their markets without the need for prior approval from any central authority. The solution also offers vaults that can be customized with specific risk management parameters.

Decline Continues in Memecoin Projects

According to data obtained from TradingView, most of the top 100 cryptocurrencies by market cap closed the past week with significant declines.

Among the top 100 projects, the local memecoin project Brett (BRETT) of the Layer-2 network Base saw the largest weekly decline of over 55%, followed by the Solana-based memecoin Dogwifhat (WIF), which fell by over 54%.