Whale movements are extremely important for cryptocurrency investors, as they provide valuable insights into market trends. These large investors, known as whales, are closely watched for their trading activities, which often serve as leading indicators. Institutional investors, in particular, are of great interest due to their extensive experience and significant investment volumes. Their actions are closely monitored as they have a better understanding of the current market situation.

What Smart Money is Buying and Selling in Crypto?

Most crypto investors conduct their buying and selling activities through exchanges and decentralized finance (DeFi) platforms. However, institutional investors prefer to invest in crypto investment funds, as they offer lower risks. These investors, who aim to minimize storage, fraud, and hacking risks, buy and sell funds issued by corporate asset management companies. This is why everyone is eagerly awaiting the approval of a Bitcoin ETF, as it is believed to have significant implications for the price of BTC.

Once a US-based ETF is approved, institutional investors from around the world will be able to invest in Bitcoin through various intermediaries. This will allow them to avoid risks such as cold wallets, storage risks, hacking, fraud, and high price fluctuations.

For now, instead of a Bitcoin ETF, trusts and other investment funds allow institutions to indirectly invest in cryptocurrencies.

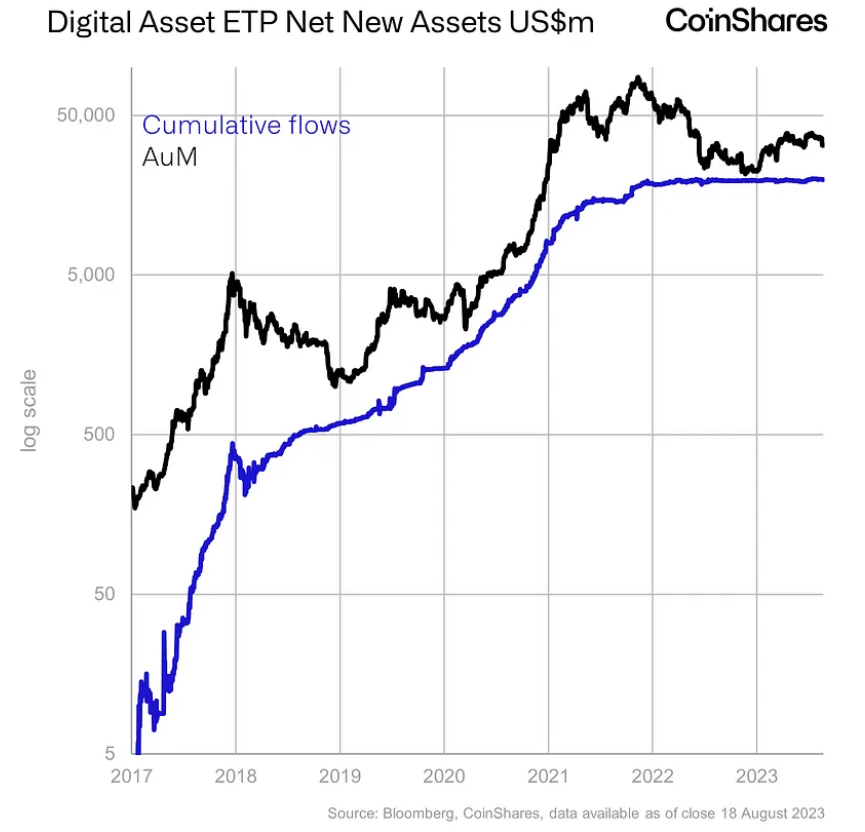

Institutional Crypto Investment Report

CoinShares released a report today, as they do every Monday, on the interest of institutional investors in crypto funds. According to the report, there was a total outflow of $55 million from crypto asset investment products last week. The disappointment caused by the SEC’s decisions on ETFs had a negative impact. The total assets under management (AuM) decreased by 10% to $2.3 billion.

“While there was a total outflow of $55 million from crypto investment products, we believe that this is related to the news emphasizing that the US Securities and Exchange Commission is not close to approving a spot ETF in the US. Market volumes remain well below average, particularly due to seasonal effects, leaving prices vulnerable to large transactions. The panic last week caused a 10% decrease in total assets under management (AuM), bringing it down to $32.3 billion by the end of the week.”

“This week, the outflows were not only focused on Bitcoin, but also seen across a wide range of altcoins. Ethereum saw an outflow of $9 million, while Polygon, Litecoin, and Polkadot saw outflows of $0.9 million, $0.6 million, and $0.5 million, respectively.”

At the time of writing, the price of Bitcoin is $26,000.

Türkçe

Türkçe Español

Español