A popular cryptocurrency analyst has issued warnings to traders based on recent data. The cryptocurrency market remains relatively calm over the weekend, with Bitcoin  $117,837 testing the $85,000 mark before dipping below $84,000 again. This article will discuss evaluations from four different experts in the last few hours.

$117,837 testing the $85,000 mark before dipping below $84,000 again. This article will discuss evaluations from four different experts in the last few hours.

Will Cryptocurrency Prices Rise?

The rise in cryptocurrencies is contingent upon the stabilization of Ethereum  $4,557 prices. After exceeding $4,000, Ethereum’s price plummeted close to $1,500, leading to negative performance across other altcoins.

$4,557 prices. After exceeding $4,000, Ethereum’s price plummeted close to $1,500, leading to negative performance across other altcoins.

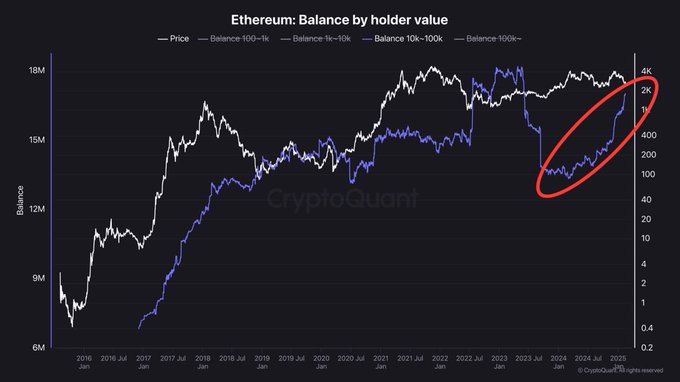

Mister Crypto noted that ETH whales have started accumulating again, suggesting a forthcoming rise. Analysts believe that this indicates an impending price increase for ETH, which could positively impact the overall altcoin market.

Moreover, a significant motivation for the anticipated rise is the shift in expectations regarding interest rate cuts at the beginning of 2025. Earlier this year, markets were predicting a single rate cut, but current data from CME indicates multiple cuts are now being priced in, with a complete end to the tight monetary policy anticipated before May.

Furthermore, recent inflation data has supported the push for lower rates, as indicated by Trump’s statements. However, the full effects of tariffs on inflation may not be seen until May.

“At the start of this year, the market was pricing in only one rate cut for 2025. Now, multiple cuts are anticipated this year, which is a highly positive development for crypto!” – Mister Crypto

ETHBTC Chart Insights

Sina_21st shared the following ETHBTC chart, illustrating a historical example for those who do not view Bitcoin as an investment. Many individuals purchase ETH and altcoins with the expectation that they will outperform Bitcoin, but this expectation often proves to be short-lived, with Bitcoin dominating in most cycles.

“ETH is the most advanced, successful, and respected altcoin. It is also the least centralized. Nonetheless, holding it has historically earned you less Bitcoin. Today, ETH/BTC has retraced all the way back over the past five years.”

Türkçe

Türkçe Español

Español