Bitcoin (BTC) and altcoins are showing signs of recovery since May 22, despite a predominant negative investor sentiment in the market. As of the time this report was compiled, BTC has seen an increase of 1.85% over the last 24 hours, trading at $27,333. Ethereum (ETH) and numerous other altcoins have been observed to have increased by 3-4% in the last 24 hours. However, the weekly trading volumes of several altcoins falling to historical lows is causing alarm.

“Volume in Altcoins has dried up”

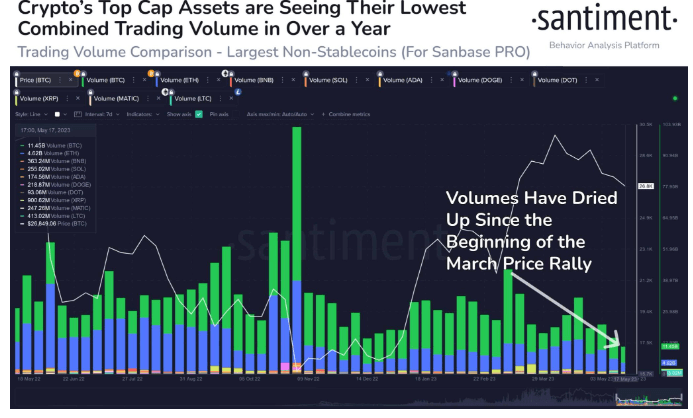

On-chain data provider Santiment has reported that the trading volume of many cryptocurrencies has fallen to historical lows. The provider warned investors to be cautious, stating this situation could potentially hinder an anticipated surge.

In its warning, Santiment stated, “Weekly trading volumes of the largest in the crypto market are at historical lows, especially in altcoins where volume has dried up. Combining just BTC and ETH volumes, we observe the second lowest threshold since September 2019.”

The price actions BTC and altcoins might take following the drop in trading volumes to historical lows are of great curiosity. Market analysts and experts suggest that for a sustainable rally, the largest cryptocurrency, BTC, needs to close its daily candle above the $27,640 level.

There has been a general negative investor sentiment in the cryptocurrency market. After a strong rally earlier this year, cryptocurrencies have been under selling pressure for a while. Bitcoin has tried to surpass the $30,000 level several times over the past few weeks, but the expected breakout above $30,000 has not materialized.

Investor Sentiment in the Crypto Market is Generally Negative

Last week was reported to be the fifth consecutive negative week in cryptocurrency investment funds, with a total outflow of $32 million observed throughout the week. Europe’s largest digital asset investment company, CoinShares, mentioned in its weekly bulletin, “Weekly volume remained 40% below this year’s average at $900 million. Volumes on reliable exchanges reached their lowest level since late 2020, at $20 billion over the week.” The total outflow of $33 million from Bitcoin funds last week represents the most negative figure in the last five weeks. Additionally, the total outflow from BTC investment funds over the past five weeks reached $235 million.

There appear to be several reasons behind the current negative market sentiment. The most prominent and primary reason is the issue of the US potentially defaulting on its debt. JPMorgan CEO Jamie Dimon recently stated that a major collapse in global markets could occur if debt limit negotiations turn out negatively.

Türkçe

Türkçe Español

Español