The cryptocurrency market experienced a downturn today, with the total market value falling by 5.20% to $2.40 trillion on April 2nd, marking the largest daily drop in the past three weeks. Bitcoin, the largest cryptocurrency by market value, led the decline with a 5.67% drop to $65,766 in the last 24 hours. Ethereum, the second-largest crypto, also fell by 6.68% to approximately $3,271 during the same period.

Why Is the Crypto Market Falling?

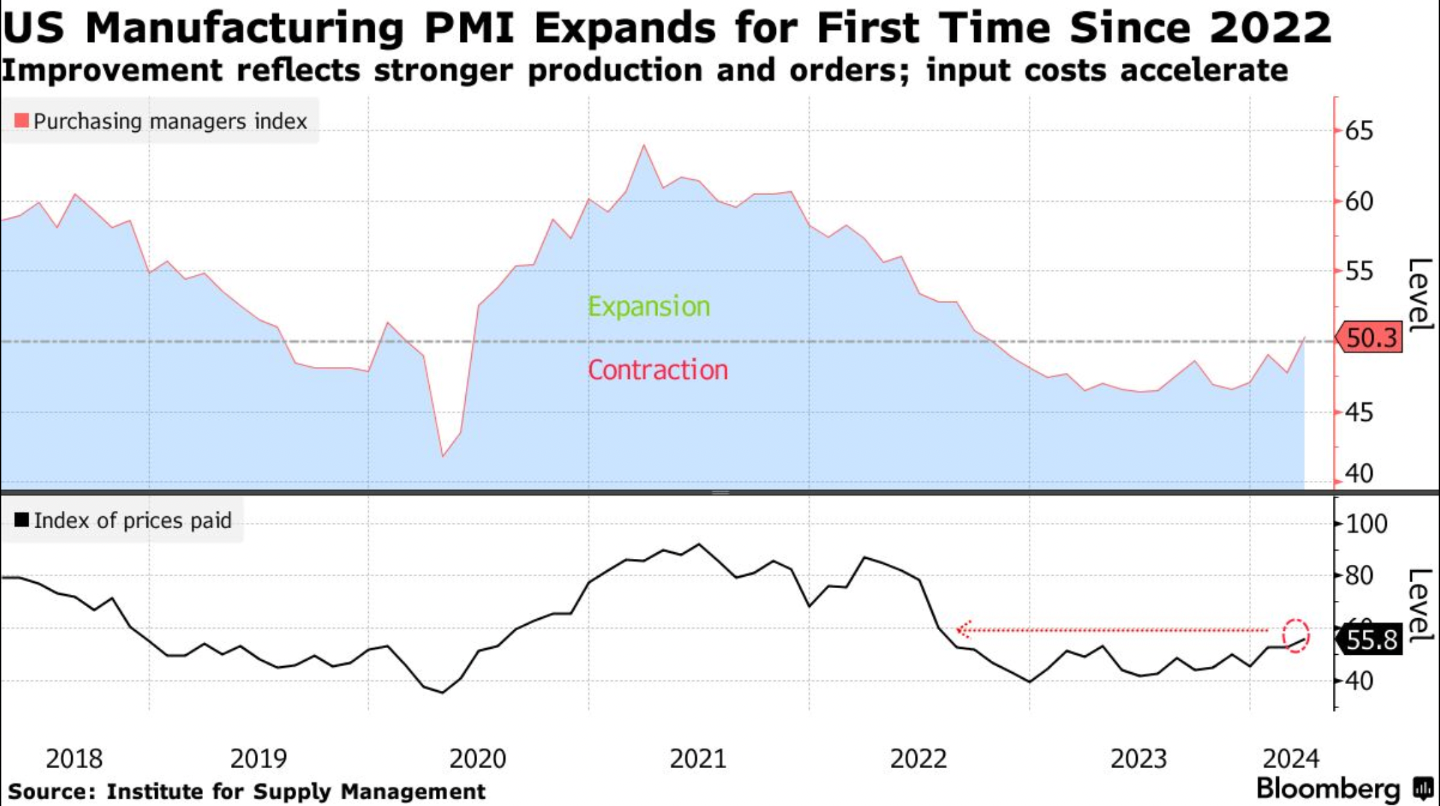

Bitcoin and the rest of the crypto market fell today following stronger-than-expected US manufacturing data, which led to reduced predictions for a looser Federal Reserve monetary policy. On April 1st, the Institute for Supply Management reported a 2.5% increase in the manufacturing index, marking the first expansion since 2022.

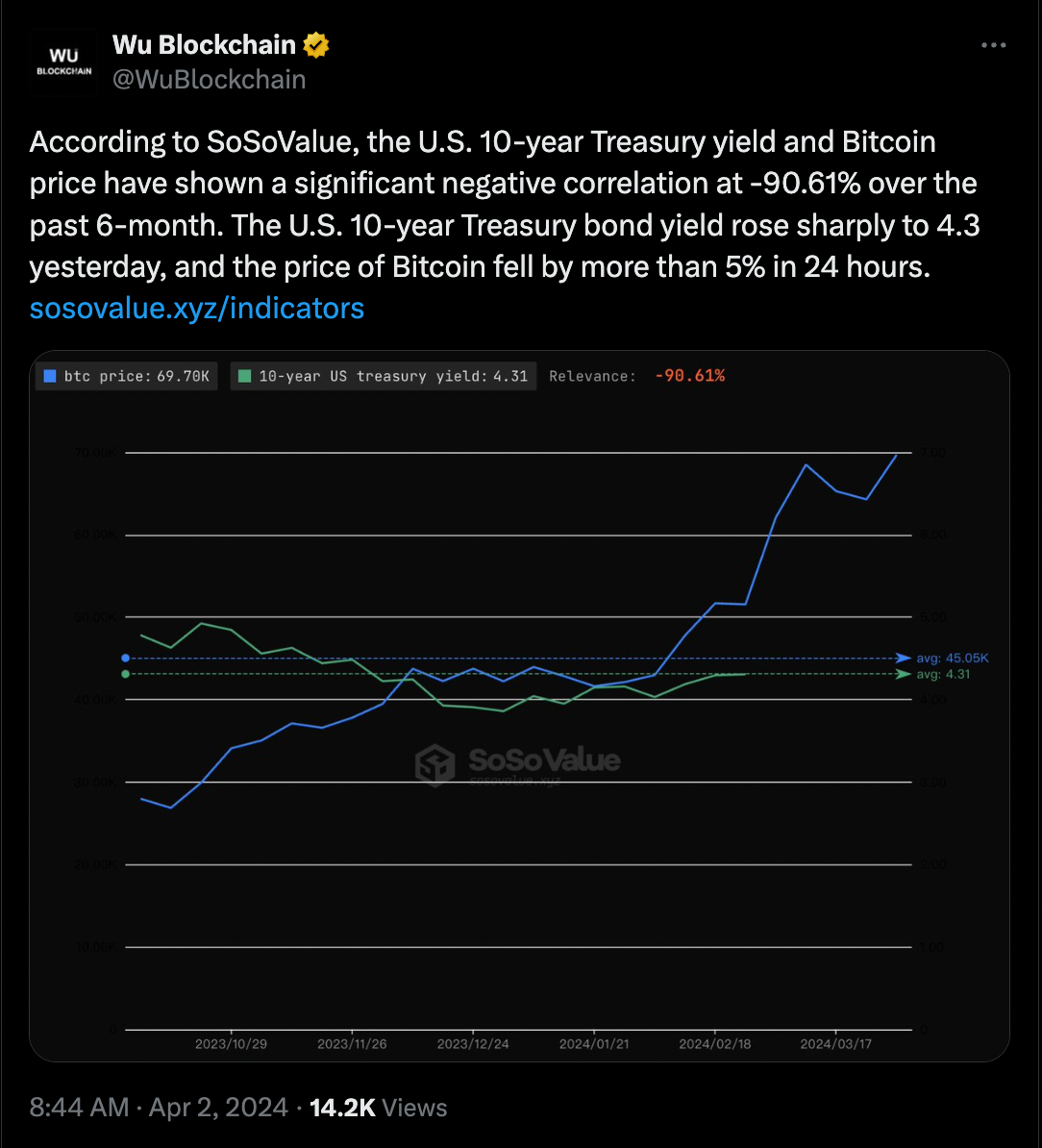

The data came after swap contract pricing reflected a drop in expectations for Federal Reserve easing to about 65 basis points this year. This decrease in easing expectations, combined with the belief that interest rates will remain high in the near future, led to a significant rise in the yield of the benchmark 10-year US Treasury bond from 4.18% to 4.33%.

When bond yields rise, investors seek higher returns due to expected inflation or interest rate increases, which often signals a strong economy or tighter monetary policy. This typically leads to a decrease in risk appetite, prompting investors to avoid riskier assets like cryptocurrencies.

Macroeconomic Data and the Crypto Market

Today’s decline in the crypto market coincides with a period of reduced inflows into US spot Bitcoin exchange-traded funds (ETFs). According to data provided by Farside Investors, these funds experienced withdrawals worth $85.7 million on April 1st.

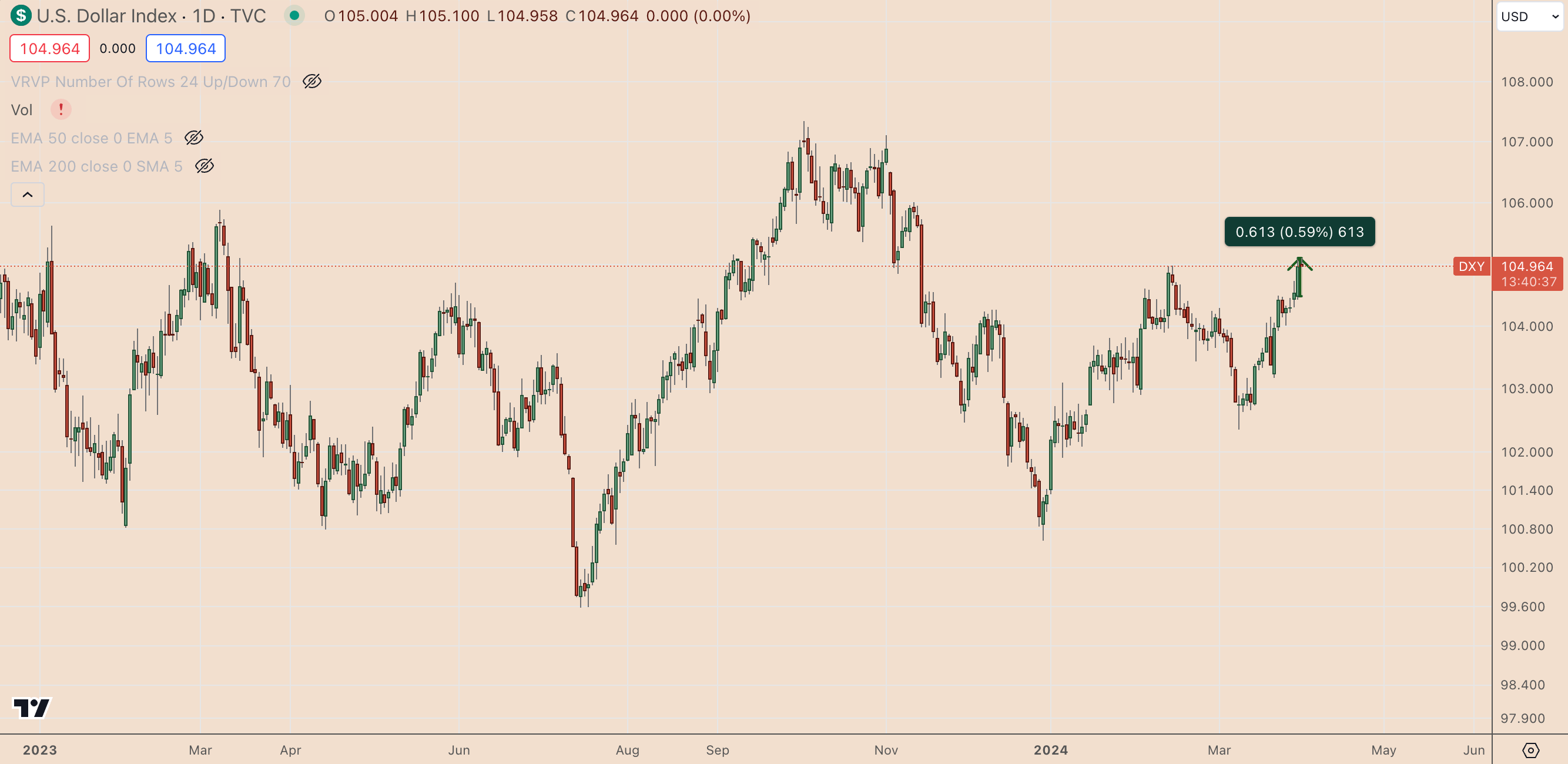

The decrease in Bitcoin ETF inflows suggests a reduction in investor risk appetite. In uncertain or bearish market conditions, investors may prefer holding cash or investing in more traditional and less volatile assets. For example, since the release of the ISM data, the DXY, which measures the strength of the dollar against a basket of major foreign currencies, has risen by 0.59%.