Cryptocurrency market is down today, with the total market value falling by 2.82% to $2.23 trillion on April 29. The largest cryptocurrency by market value, Bitcoin, decreased by 1.84% to $61,940. Meanwhile, the second largest cryptocurrency, Ethereum, underperformed compared to Bitcoin and the rest of the market, trading around $3,155 after a 3.28% drop the same day.

Reason Behind the Crypto Market Downturn

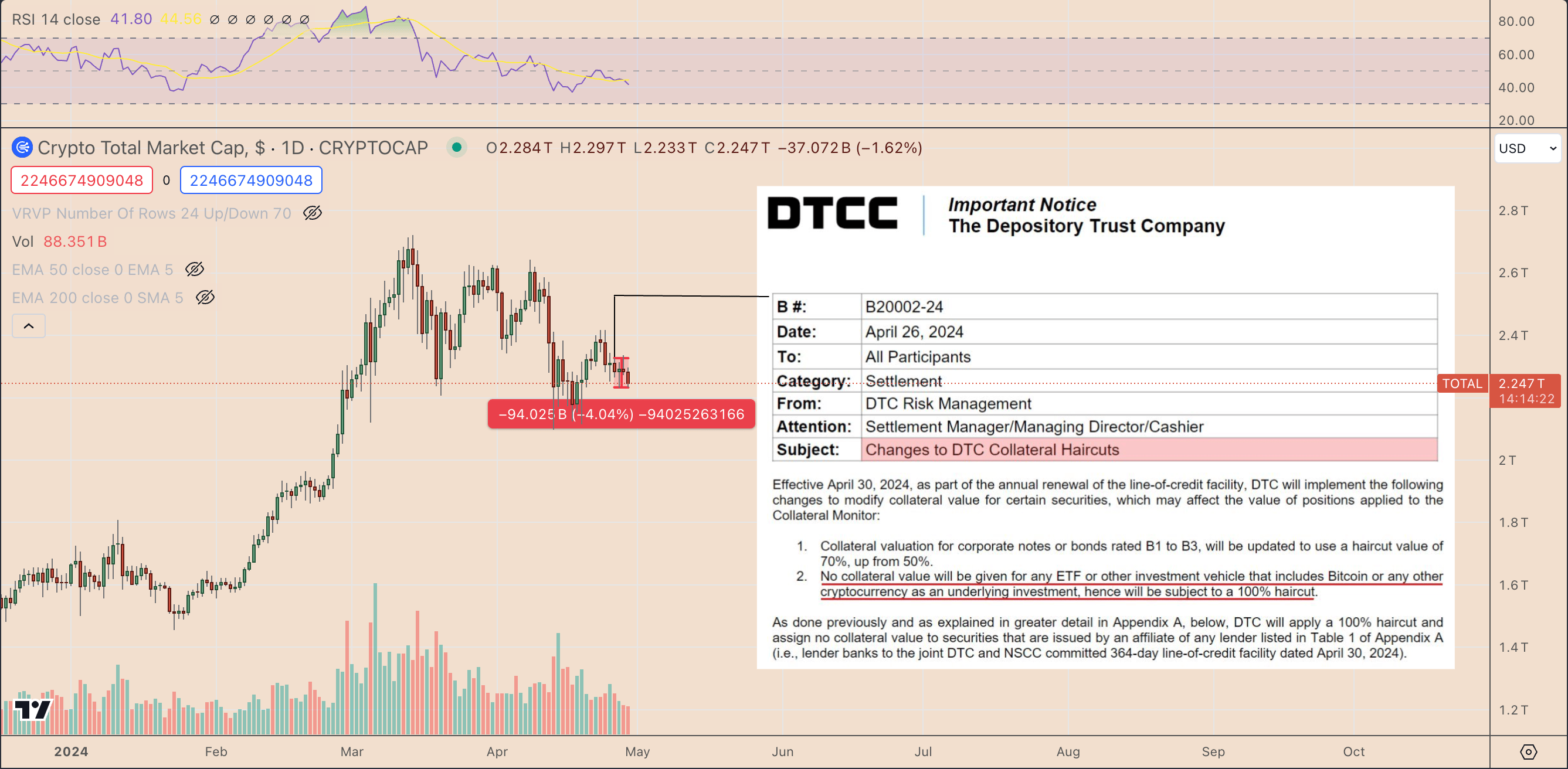

The valuation of the cryptocurrency market began to decline following the Depository Trust Company’s (DTC) decision not to recognize crypto-linked exchange-traded funds as collateral for credit limit facilities.

Credit limits are funds that financial institutions can borrow to facilitate the clearing and settlement of transactions. This financial tool helps ensure transactions are completed smoothly and efficiently, even in the presence of temporary liquidity shortages among participants.

As a central securities depository, DTC manages the contract process for securities transactions. Therefore, the decision not to give collateral value to crypto-linked ETF funds indicates that participants cannot use these funds as collateral for short-term loans, which could affect the liquidity and operational flexibility of financial institutions dealing with these products. Independent market analyst Sakuzi shared the following remarks:

“There’s a risk that other major companies will follow DTC’s lead and impose similar rules. This could further impact crypto markets and make it harder for firms to use crypto as collateral.”

What to Expect in the Crypto Market?

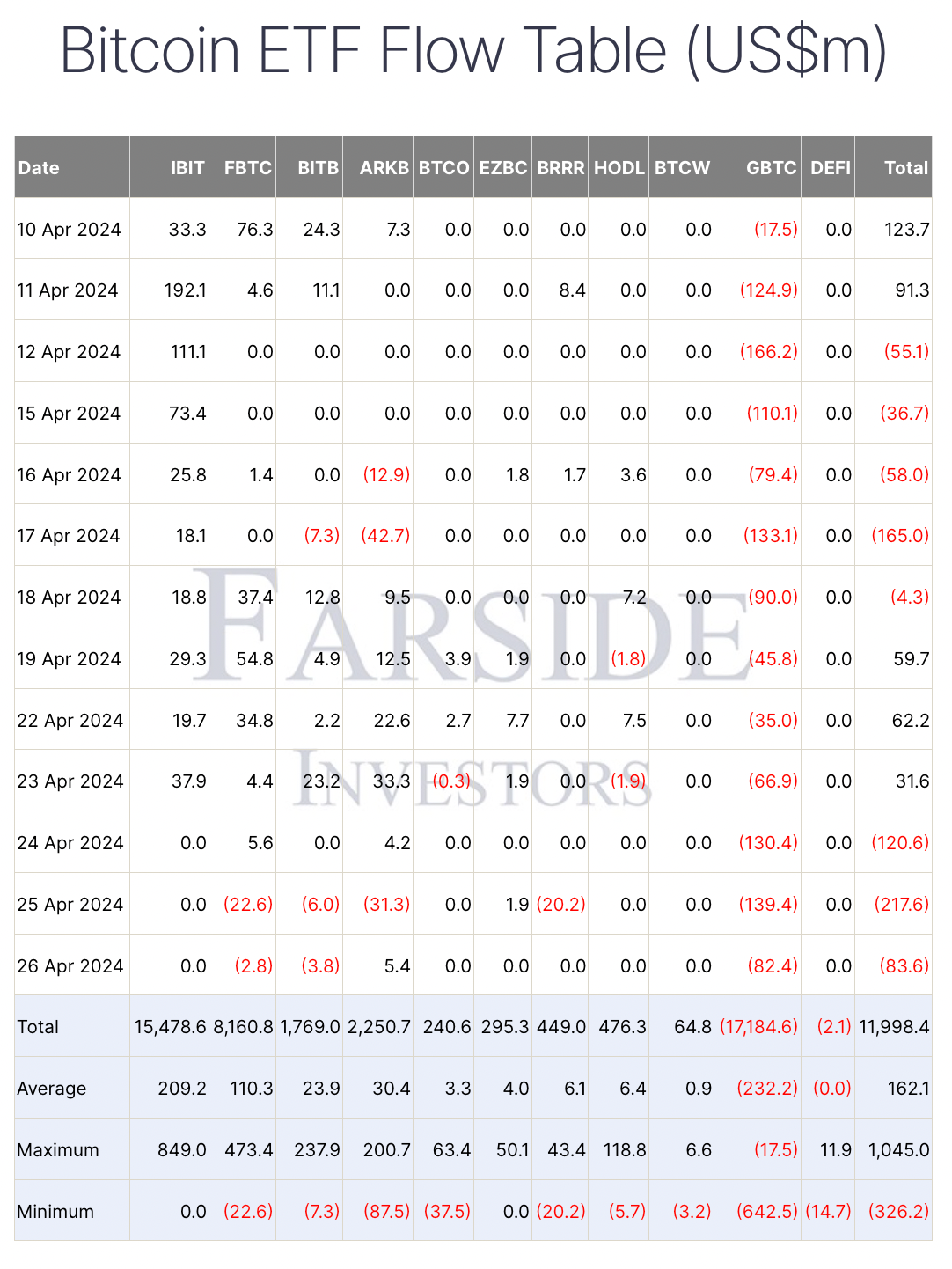

Today’s decline in the crypto market also follows days of outflows from U.S.-based spot Bitcoin ETF funds. Notably, these funds have witnessed an outflow of $421.8 million since April 24, corresponding to a 4.75% drop in the crypto market value. This indicates a period of calm as investors reduce their exposure to risk.

Cryptocurrency investors have become overly cautious following the U.S. economy’s underperformance against stable inflation in the first quarter of 2024. These disappointing data could lead the U.S. Federal Open Market Committee to pursue a higher interest rate policy at its May 1 meeting, which could cause concern for both investors and institutional investors in risky assets like crypto in the near future.

Türkçe

Türkçe Español

Español