Cryptocurrencies have been experiencing impressive rallies for a while, with many altcoins gaining 2 to 3 times their value. However, this will not continue indefinitely. Even in bull markets, we can see a general market value drop of 30% and altcoin drops of 50% or more. This is a situation we have encountered in previous cycles.

NEAR Coin

One of the altcoins that suffered the most from the FTX collapse was NEAR Coin. Its biggest supporter, a bankrupt crypto initiative, faced rapid sales by investors who lost their long-term optimism, causing significant damage. Moreover, it did not experience a major comeback like SOL Coin. The reason is the potential for many alternatives to take its place.

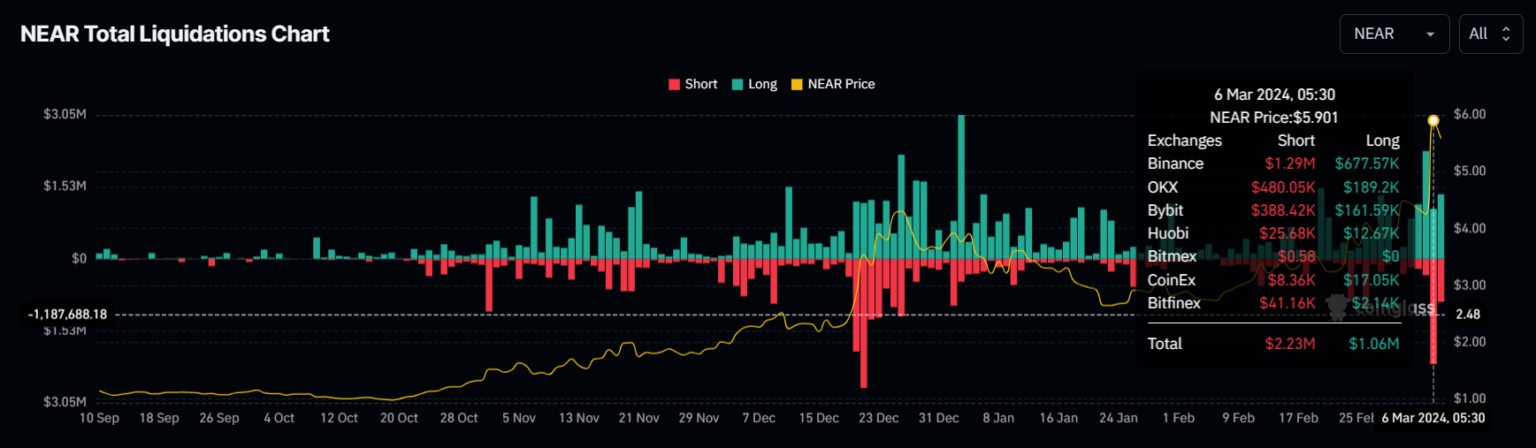

After two and a half years of struggle, NEAR Coin has seen a 38% increase in the last 24 hours. This comeback, following three days of selling candles, caught many by surprise. Bears, having confirmed a persistent decline with the third candle, were caught off guard by the subsequent rise.

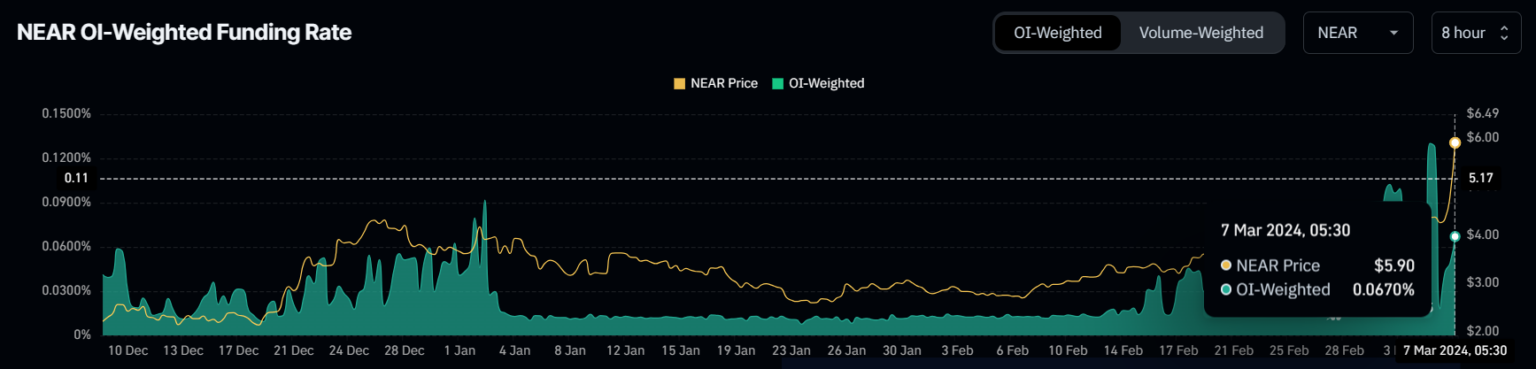

Following the liquidation of $2.23 million in short positions, the funding rate in futures markets became significantly positive, averaging 0.0670%. On the other hand, the total value locked (TVL) on the network also increased by 22.5% within 24 hours, rising from $155 million to $189 million.

NEAR Coin Price Prediction

The NEAR price has risen, but we have yet to see strong closures above the key selling wall. For now, bulls are blocked at $5.6, making it easier for bears as time passes. In an optimistic scenario, if resistance is permanently overcome, the price could climb to the next hurdle at $6.5. The outlook in futures markets suggests that bears may continue to be cautious during this rise, which could potentially accelerate the uptrend.

However, since the Relative Strength Index (RSI) is in the oversold region, investors waiting to take profits should be much more cautious. Upcoming US data or possible rapid profit-taking in the BTC channel will be highly supportive for NEAR bears.

If the RSI remains in the overbought region and NEAR Coin closes above $5.6, there is no problem. However, if the RSI declines while the price closes below $5.6, it could lead to a drop to $4.85 or lower.