The leading cryptocurrency marked a local peak last week as we warned and started to decline. How long will this correction last? It’s hard to predict, but we know that there are not always continuous rises in crypto. The price corrections that investors are accustomed to were the main motivation behind the ongoing profit sales for days.

What’s Happening in Cryptocurrencies?

Bitcoin price fell to its daily low of $38,618. The price has dropped about $10,500 from the peak, and the excitement over the ETF approval seems to have largely faded. There was a Binance hearing yesterday, and before that, Arkham Intelligence identified the wallet addresses of spot Bitcoin ETF issuers. Here’s what you need to know about the annoying levels of GBTC redemptions.

Spot Bitcoin ETFs

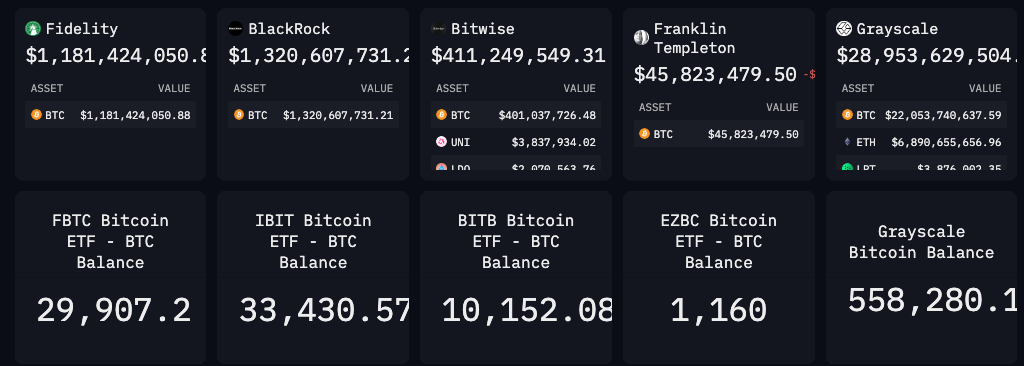

Grayscale is seeing significant outflows, and this situation has been supporting the selling motivation of crypto investors for a long time. Arkham Intelligence identified and shared the wallet addresses of many ETF issuers, providing investors with a clearer opportunity to monitor activity.

According to the data, BlackRock’s iShares Bitcoin Trust (IBIT) currently holds approximately 33,430 BTC valued at about $1.3 billion. This figure is consistent with the number reported on the company’s website. GBTC is the largest spot Bitcoin ETF among the approved funds, holding 558,280 BTC. This number was over 600,000 before approval. It can be said that there has been a sale of roughly 50,000 BTC, which seems to be above the demand of ETF issuers.

Crypto Pressure on Meta

The U.S. House Committee on Financial Services continues to pressure Meta, considering that a total of five cryptocurrency and blockchain-related trademark applications have been active since 2022. The company recently suspended NFT support. However, the Web3 vision inevitably requires Meta to work with crypto at some point.

Committee member Maxine Waters expressed concern in a letter sent to Meta’s founder and CEO Mark Zuckerberg and business chief Javier Olivan on January 22 about the ongoing applications.

Grayscale and Binance Case

Alameda Research withdrew its lawsuit against Grayscale, the largest crypto fund issuer, which sold the $1 billion GBTC ETF profitably. The Binance hearing also took place yesterday, but no conclusion has been reached yet.

Investors should pay attention to the status of altcoins stamped as securities by the SEC in the Coinbase and Binance hearings. Judges could force the SEC to clarify how altcoins are securities and may want to adopt a different method instead of the Howey test, considering them a new asset class. This should make things easier for altcoin investors compared to today.