Cryptocurrency markets have not yet seen comprehensive regulations on a global scale, but some existing laws also apply to them. Due to the complexity of the crypto space, it requires extensive and lengthy preparations for legal regulations. However, this does not mean that they are exempt from existing laws.

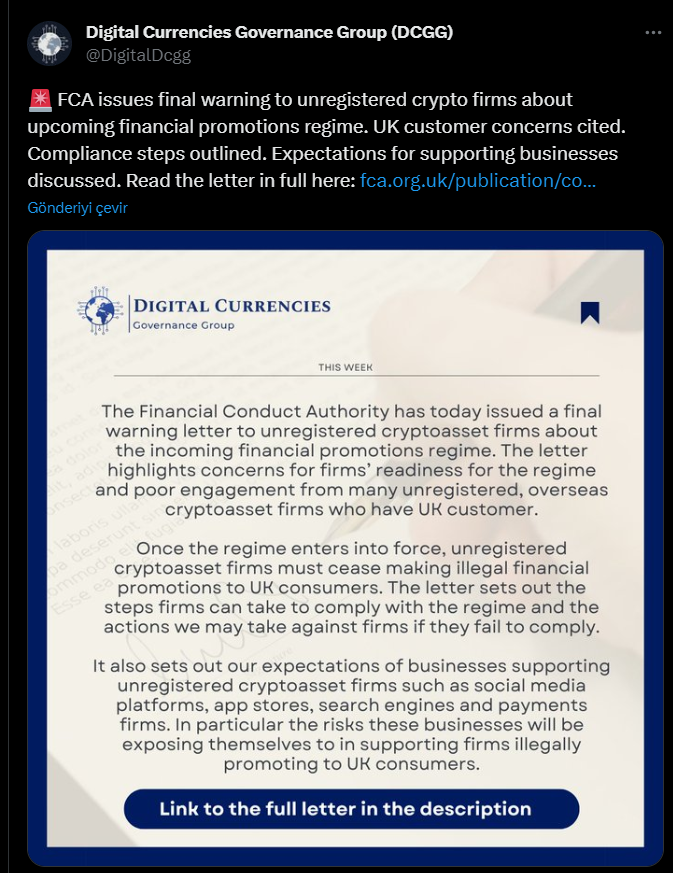

Final Warning to Cryptocurrency Companies

While UK banks are known for their extremely negative approach towards cryptocurrencies, they are starting to adapt to the industry. However, there are serious issues that need to be resolved and the UK will not compromise on them. One of these issues is crypto-focused advertisements. The Financial Conduct Authority (FCA), the financial markets regulator in the UK, warned companies for the last time today.

The FCA stated that it has issued a final warning to firms marketing crypto assets to consumers in the UK. In a four-page letter, the agency documented its efforts to reach crypto firms and urged them to take action to comply with the rules announced on June 8.

The SEC used such statements at the end of last year, and this year we have seen what happened. We will probably see some crypto companies facing the FCA in the coming months. The FCA went so far as to extend the compliance deadline from October 8 to January 8, 2024, in order to “introduce features requiring further technical development” and publish long notes about the applications.

Despite all these goodwill and efforts mentioned in today’s announcement, it is stated that crypto companies disregard the institution. Only 24 crypto companies responded to the survey sent to 150 crypto companies by the FCA.

“Once the regime comes into effect, unauthorized and unregistered crypto businesses will only be able to promote financial promotions that have been approved by an authorized person or fall within the specific exemptions in the Financial Promotions Order.”

Cryptocurrency Advertisements and Risks

At least for the UK, illegal promotion will be a criminal offense. Violators will be included in a warning list and their promotions may be blocked or removed from websites, social media, and applications.

This is good news for investors because exaggerated advertisements cause them to lose money. Even worse, “hidden advertisements” threaten investors. For years, what we have seen, especially on social media, is someone coming out and saying, “hey, this is great, use this exchange or buy this token,” and people being victimized.

The same individuals or platforms would then claim that they were only giving these recommendations to help their audience, presenting themselves as a loving character. However, their audience was unaware of the payments they received behind the scenes.

Hopefully, such advertising regulations will spread worldwide and prevent incidents that cause people to be victimized, especially hidden advertisements.

Türkçe

Türkçe Español

Español