Bitcoin  $119,883‘s price dipped back to around $98,700 after briefly surpassing $99,000. The recent loss of gains is disappointing, raising questions about its permanence, particularly if it closes under $98,733. So, what is causing this downturn in cryptocurrencies? What is the current situation in the crypto market?

$119,883‘s price dipped back to around $98,700 after briefly surpassing $99,000. The recent loss of gains is disappointing, raising questions about its permanence, particularly if it closes under $98,733. So, what is causing this downturn in cryptocurrencies? What is the current situation in the crypto market?

Significant Developments in Cryptocurrencies

While this article was being prepared, Trump made a statement denying reports about easing tariffs. This could lead to price increases that contribute to rising inflation in the country.

“Tariffs are meant to make US steel more profitable and valuable. I will immediately lift Biden’s oil drilling ban. I will likely get along very well with China’s Xi.”

Furthermore, Trump plans to impose additional taxes on countries beyond China. This scenario continues to create complexities for the Fed as it works through possible outcomes.

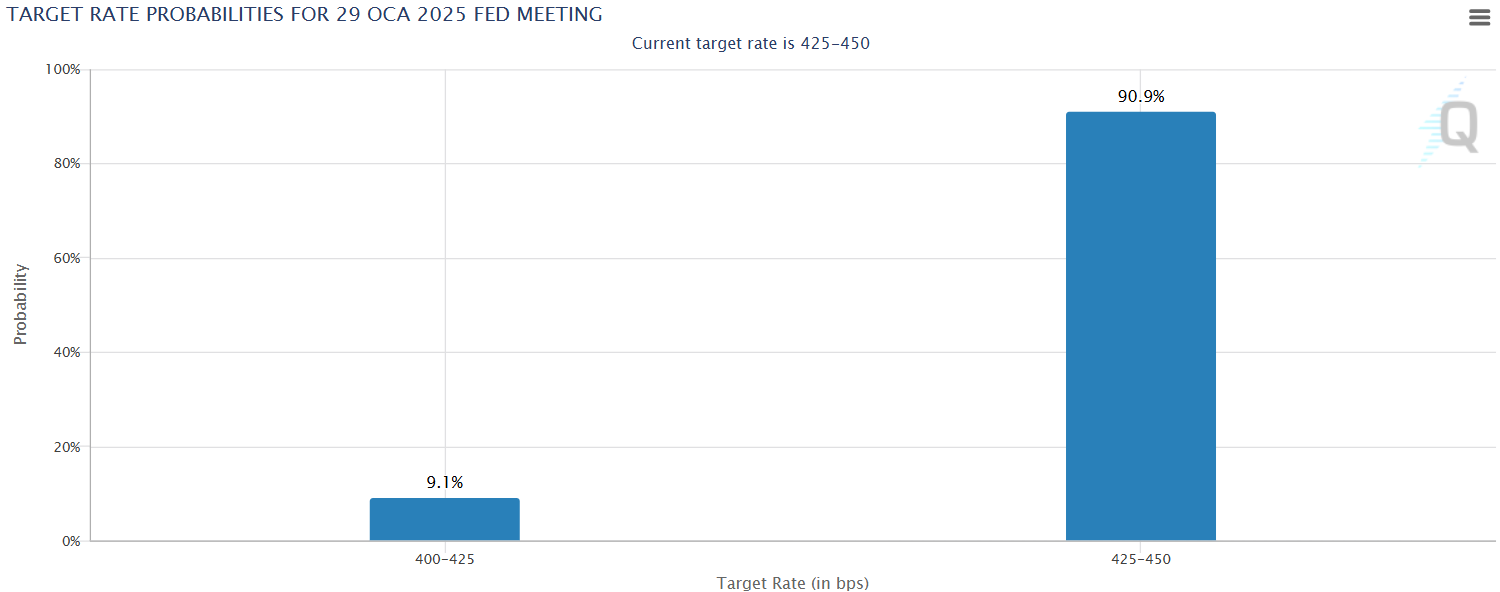

On January 20, Trump will officially take office, and the pressure on cryptocurrencies is expected to ease. This signals a pivotal moment for the crypto market, surpassing mere good news. Currently, market expectations suggest that any interest rate cuts may pause during the upcoming Fed meeting.

Amid all this, Fed member Cook commented on the current situation:

“Inflation and employment risks are roughly balanced. It will be appropriate to gradually reduce rates over time. I see private credit and artificial intelligence as risks to financial stability. The Fed may proceed more cautiously with interest rate cuts. The labor market is more balanced and is not a source of inflation. Although the labor market cooled last year, it remains solid.”

Türkçe

Türkçe Español

Español