Many crypto projects are expected to see significant rises before and after the halving event. In this context, there are rumors that some projects could reach a market value of 50 billion dollars by 2024. We recently published an article about two low-volume cryptocurrencies that are likely to reach a market value of 1 billion dollars by 2024. Let’s see which three projects have attracted attention in this regard.

Chainlink (LINK) Tops the List

Especially Chainlink (LINK) holds a leading position and may have significant upward potential during this period. As of the time of writing, it had a market value of 11.77 billion dollars. It is thought that LINK will increase real-world integration in the coming period, which will reflect on its value.

Recently, financial giant BlackRock Inc. (NYSE: BLK) stated that tokenization reflects significant value for the market.

If LINK potentially reaches a market value of 50 billion dollars, its price could see a noticeable change with a 324% increase in value. However, there is a significant obstacle in front of it. The Chainlink token stands out with its high annual supply inflation of over 15%. This characteristic could affect the price due to the potential inflation in LINK.

Toncoin’s (TON) Rise on Telegram

Meanwhile, Toncoin (TON) is one of the projects that most clearly demonstrates the increasing support of external companies to the crypto environment. This layer-1 blockchain resulted from a project carried out in conjunction with Telegram, one of the world’s leading messaging applications alongside WhatsApp.

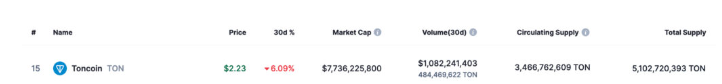

TON, serving as the native token of the Open Network, appears to have a capital of 7.36 billion dollars and a value of 2.23 dollars at the time of writing.

According to data provided by CoinCodex, if TON reaches a market value of 50 billion dollars during a bull run, it could be rewarded with a 579% increase in value. Nevertheless, the result of the investments to be made could slow down due to an astonishing inflation of about 183%.

Current Status of Bitcoin Cash (BCH)

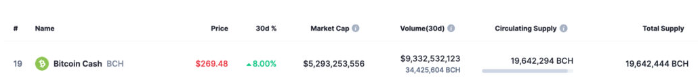

In third place on the list is Bitcoin Cash. Bitcoin Cash (BCH) has the potential to rise from its current market cap of 5.29 billion dollars to a market value of 50 billion dollars during a bull cycle. Looking back at BCH’s history, it emerged as a result of a network fork that also included the Bitcoin network in 2017, leading to a split into BHC and BTC.

During this process, BCH fell behind and became a clear loser in the market with a market value 200 times lower than BTC. Despite this loss, developments continue in the Bitcoin Cash ecosystem. It is thought to have a more efficient structure compared to Bitcoin, and the growth and innovation process in BCH does not seem to be slowing down.

If it potentially reaches a market value of 50 billion dollars, it could gain 845% from its current price. Another positive aspect is Bitcoin Cash’s low and predictable annual supply inflation of less than 1.75%.

Moreover, this supply inflation is expected to halve in 2024, similar to the Halving expected to occur next month in BTC.

Türkçe

Türkçe Español

Español