As Bitcoin continues its efforts to stay above the $70,000 mark, major market players seem to be struggling to keep afloat. Problems with some altcoins at the top of the list may position them as cryptocurrencies that investors might want to avoid in the coming week. So, which three altcoins by market capitalization could be candidates for this?

Watch Out for Solana (SOL)

First on the list is Solana (SOL). This layer-1 project is trying to stand out with its efficiency and low costs and is also known as a popular competitor and even a killer of Ethereum (ETH).

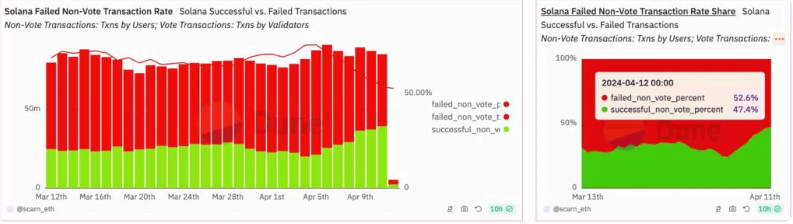

Recently, the Solana network has been notorious for an increasing number of failed transactions and is constantly facing congestion issues. In recent days, more than half of all transactions verified by Solana’s validators have not been successful.

Despite these issues, Solana continues to hold its position as the fifth-ranked cryptocurrency in the market, with a market capitalization remaining above $70 billion.

Despite its current position and price movements over the past year, SOL could be on the list of questionable cryptocurrencies for the next week due to these ongoing problems.

Ripple and XRP

On the other hand, considering the unusual delay in Ripple‘s planned standard sales for April, investors might avoid trading XRP in the coming days.

As we mentioned recently, Ripple unlocked 1 billion XRP in a standard fashion on April 1st. Subsequently, the company transferred 200 million tokens worth $120 million to Ripple’s treasury account, preparing them for this month’s sale.

However, as of the time of this report, no transactions have been made by the ‘Ripple (1)’ address. Consequently, this inactivity is unusual for Ripple, which consistently makes sales within the first 11 days of each month.

Looking back, these sales have been known to open the door to significant drops in XRP’s price. Amidst these expectations, it’s useful to note that XRP has also lost the critical $0.60 level and is trading at $0.5942.

Uniswap (UNI) and the SEC Impasse

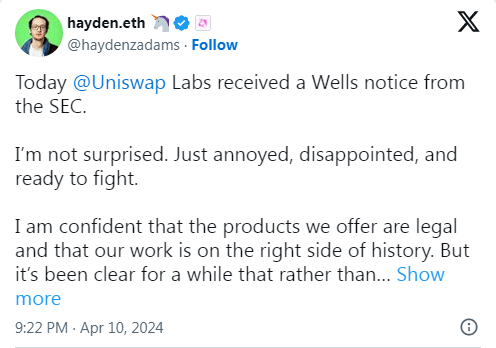

Additionally, Uniswap (UNI), the largest decentralized exchange protocol by trading volume, seems to be facing regulatory pressure from the United States Securities and Exchange Commission (SEC).

Amidst these developments, Haydenz Adams, the creator of Uniswap, has made a statement indicating the company’s willingness to fight the SEC.

Due to the SEC’s stance, UNI appears to have taken a significant hit this week. Uniswap’s native token has fallen about 20% from approximately $11.5 to $9.0 in a four-day period.

Given the potential for further action by the SEC that could put more pressure on UNI, investors may want to be more cautious with their investments.

Türkçe

Türkçe Español

Español