Cryptocurrency markets are closely followed by CryptoQuant CEO Ki Young Ju, who analyzed the latest situation a few hours ago. The founder and CEO of CryptoQuant, known for compiling and presenting on-chain data, is recognized for his evaluations during such critical periods. So, how does he interpret the current situation?

Crypto Analyst Commentary

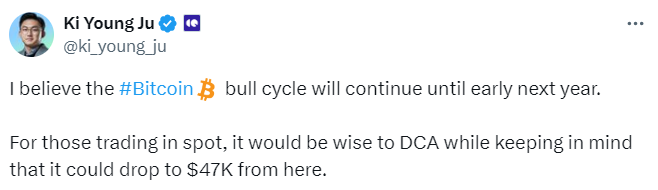

Although BTC is hovering at $56,400, the decline has not yet ended. The panic caused by high-volume BTC sales has created selling pressure beyond the supply from government and MTGOX returns. Today, volumes increased across the market, and altcoins experienced double-digit losses. CryptoQuant CEO Ki Young Ju wrote the following in his evaluation a few hours ago:

“I believe the Bitcoin bull cycle will continue until early next year.

For spot traders, it would be wise to DCA, keeping in mind that it could drop to $47,000. If you are not an experienced futures trader, do not open high-leverage long or short positions based on my tweets. Over the past month, I have indirectly warned against excessive risk, but it seems some people are still opening high-leverage long positions based on my tweets about the long-term cycle.

My tweets are from a spot trading and long-term cycle perspective. Warnings about corrections refer to risk. Always do your own research and stay safe.”

What Awaits Investors?

The latest employment and wage growth data were positive. The unemployment rate rose above 4% while wage growth slowed. Moreover, we saw that Non-Farm Payroll data were revised retroactively. Significant downward revisions confirmed the weakening in employment, albeit delayed. This situation caused the BTC price to rise to the $57,000 threshold.

Markets now predict that the Fed will make 2 rate cuts before the end of the year. Additionally, comments from Fed members indicating progress towards the 2% inflation target with new inflation data could support risk markets in the next meeting.

Will cryptocurrency investors see a decline throughout July? This will be determined by the MTGOX returns and the speed at which they are sold. For now, we do not know how much will be sold for cash returns and how much will be returned to investors as BTC.